AU’s strategy relies on the prior creation of monetary unions in several existing regional economic communities. These unions would be an intermediate stage, leading ultimately to a merger, creating a single African central bank and currency.

Manish K. Pandey | August 2016 Issue | The Dollar Business

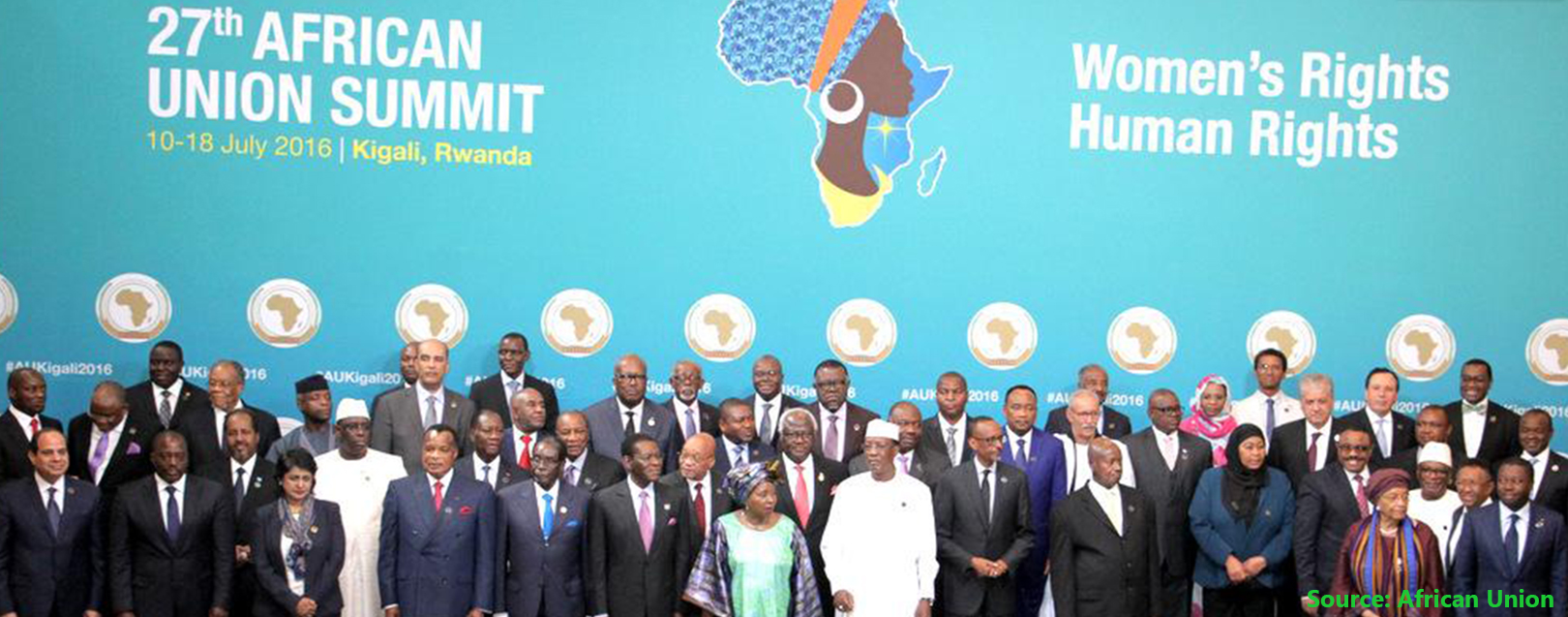

The 27th Ordinary Session of the African Union Assembly of Heads of State and Government, which was held on July 17, 2016 in Kigali (the capital city of Rwanda), was not so ordinary by any means. After all, it was the start of the Pan-Africanism – an African Union on the lines of European Union (well, not literally if you consider Brexit!). The event was marked by the launch of the African Union (AU) passport aimed at facilitating the free movement of people within the continent. Idriss Deby Itno, Chairperson, African Union and President of the Republic of Chad, and Paul Kagame, President of the Republic of Rwanda became the first two African nationals to receive an All-Africa passport.

The launch of African Union passport can be seen as yet another step towards Agenda 2063, both a vision and an action plan to build a prosperous and united Africa. But then how many more such steps would be required to live the dream that only time can tell. And, of course, it all depends on the success of the initiative that aims at facilitating the free movement of people on the continent with as many as 53 countries accounting for about 15% of the world’s human population and over 20% of the earth’s total land area. Not to say, the continent comprises thousands of distinct ethnic groups, several divergent economies, and varied social and political beliefs.

No doubt, free movement within the continent has been a long-established priority among member states (as manifested in the 1991 Abuja Treaty), and is already being practiced in a few regions, such as the Economic Community of West African States (ECOWAS), Southern African Development Community (SADC), and East African Community (EAC). But then, we should not forget that these regional groups comprise just a handful of countries – 15, 15 and 5 respectively, numbers which don’t match with the figure the African Union is targeting. Moreover, these inter-governmental organisations represent countries with similar geographic, demographic and economic profiles, and as such it’s been easier for them to manage the show.

Even if we consider that the free movement within the 53-nation bloc can somehow become a reality (may be in distant future), it would be being over-optimistic to think of Africa as a single-currency area or a monetary union. Further, how African policymakers plan to achieve the objective also remains to be seen. An IMF paper by Paul Masson and Catherine Pattillo states that “the African Union’s strategy relies on the prior creation of monetary unions in several existing regional economic communities. These regional unions would be an intermediate stage, leading ultimately to their merger, creating a single African central bank and currency.”

Sounds great on paper. But it’s not an easy goal to achieve in reality. Well, the reasons are simple and almost same for which the European Union (EU) now seem to be a thing of the past. While UK has already announced its divorce from EU, there are several more that want to part ways from the 28-nation (27 soon!) bloc. Post Brexit now eight more countries – France, Holland, Italy, Austria, Finland, Hungary, Portugal, and Slovakia – want to hold referendums to exit EU. And the malaise is only spreading further.

If 28 countries, which are much smaller in size but way bigger in terms of GDP than most African nations, cannot stay together for long, then how can one expect a group of 53 divergent economies to keep aside their political and economic interests and commit to a monetary union. What’s even more puzzling is that the African Union aims to have a common currency by 2021! Isn’t it a little bit of an ideal to achieve?

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.