Bharat Forge is leveraging both the ‘Make in India’ and the government’s decision to hike the FDI cap in the defence sector for its benefit

What would a company and its management do when it is the world’s largest manufacturer of its kind, its shares are trading at all-time highs and profits have never been higher? Sit back and relax? Maybe. But Bharat Forge – the world’s largest forging company – is using all of these to step on the gas and diversify into areas that lie beyond what you imagine when you hear the word “forging”

Shakti Shankar Patra | The Dollar Business

On March 31, 2010, shares of Bharat Forge closed at Rs.254.3 on National Stock Exchange (NSE). The Pune-based company had just ended the fiscal year, with a loss of Rs.76.6 crore, as compared to a profit of Rs.290.9 crore just two years back. This, on the back of a 30.2% (y-o-y) decline in sales that was led by a slump in exports; flat (y-o-y) EBITDA margins and an all-time low interest coverage ratio.

Exactly five years hence, shares of the company are trading 5x higher. It ended FY2014 with a 72.6% (y-o-y) jump in profits to an all-time high of Rs.518.7 crore (the market is betting on another 30% jump in FY2015). This, on the back of a 30% rise in sales; all-time high exports, stable EBITDA margins and an interest coverage ratio at a nine-year high.

The question then is simple. Just what caused this turnaround?

Never say die

In his annual letter to shareholders after the drubbing of FY2010, the charismatic Chairman and Managing Director of the company, Baba Kalyani wrote, “Those with character and resolve confront the difficulties and solve them.” Reading the 1,700-word letter five years later, one cannot but feel that these were not empty words. Kalyani meant every bit of it. The letter is also an indication that he had already envisioned the future of the company and its transformation from a global leader in forging to a manufacturing powerhouse. For, the letter spoke about his plans to “ramp up new non-auto facilities,” “commencement of capital goods business,” securing the company’s “maiden contract for a 450 MW power plant” and “significant opportunities” in railways.

That in FY2014, Bharat Forge earned 37% of its consolidated revenue from the industrial segment, as compared to just 20% during the FY2010 drubbing, is testimony to the fact that its renaissance had begun well before Kalyani sat down to write that letter.

One stone, two birds

While Prime Minister Narendra Modi’s ‘Make in India’ campaign got approval from all and sundry, Bharat Forge is probably one of the few companies that has tried to make it a part of its DNA. For, since the day Modi first spoke about the campaign, every presentation Bharat Forge has made; every media interaction its management has done; and every other press release it has issued, has been about ‘Make in India’ and the company’s plans around it. The culmination of this and the Modi government’s decision to allow up to 49% foreign direct investment (FDI) in defence is the Kalyani Group’s joint venture (JV) with Israel’s Rafael Advanced Defense Systems.

In a freewheeling interaction with The Dollar Business, Bharat Forge’s Executive Director, and the new face of the company, Amit Kalyani said, “It (the JV) will help us develop and produce a wide range of high-end technology systems such as Missile Technology, Remote Weapon Systems and Advanced Armour Solutions etc.” He also said, “Currently, the contribution of defence to our portfolio is zero, but soon it will become a significant part of our portfolio.”

Probably, the diversification away from forging, which Baba Kalyani had envisioned a few years back, is in full throttle and leading from the front is the younger Kalyani.

Role Model

There are largely three categories of listed Indian companies that earn more than 50% of their revenue from overseas markets – services exporters, generic pharmaceutical exporters and those, which earn it via foreign subsidiaries. And then there’s Bharat Forge, whose FOB value of exports, as a percentage of standalone sales, crossed the 50% threshold in FY2014. Thanks to this, 23.5% of the company’s standalone profit of Rs.399.9 crore came from just export incentives. But the sad part about Bharat Forge’s export incentives is the fact that its export incentive rate (export incentives as a percentage of FOB value of exports) is, today, less than half of what it was a decade back. For, while the company had earned export incentives of Rs.51.8 crore on FOB value of exports of Rs.499.6 in FY2005 – 10.4% – it earned just Rs.93.9 crore of export incentives on FOB value of exports of Rs.1,826.9 crore – 5.1%. As a result, although export incentives still accounted for, as discussed, 23.5% of its profit in FY2014, it’s a far cry from the 32.1% they had accounted for in FY2005. And herein lies one of the biggest challenges for Prime Minister Modi and the ‘Make in India’ campaign. Just where do we draw the line when it comes to export incentives? Do current rates provide enough incentive to manufacture in India?

No peers

There are a few more things that are absolutely fantastic about Bharat Forge. Firstly, at a time when corporate India is saddled with massive amounts of debt, Bharat Forge’s total debt is reducing by the year and, in FY2014, stood at a six-year-low of just Rs.2,007.4 crore. That during these six years, its revenue has jumped almost 50%, exports and profits have almost doubled and EBITDA has more than doubled, makes the debt reduction much more sweet.

Secondly, prudent use of tax havens and the fact that it earns a big chunk of its revenue from exports, which are in any case not taxed, means that in FY2014 Bharat Forge’s Tax Rate, at 28.8%, was the lowest in a decade! Thirdly, in a decade, when commodity prices and the rupee have been all over the place, Bharat Forge’s EBITDA margins (consolidated) have been stable in the mid-teens, with a fall into single digits only once – in the drubbing year of FY2010.

The surge ahead

In an investor presentation made in November, 2014, Bharat Forge has clearly laid down its plan for the future. It wants to double its sales by FY2018, build capacity and focus on cash flows, other than getting the industrial segment going even more. Speaking about the company’s capex plans, which are set to begin from FY2016, Amit Kalyani said, “We have plans to invest about Rs.1,000 crore over the next three years. So, we will be investing a little more than Rs.300 crore a year across all our industry verticals.”

He also said that all of this investment is going to be in India, and not at its facilities in Germany and Sweden. Clearly, it is gearing up for ‘Make in India’ like nobody else. In Amit Kalyani’s words, “We are in the best position for ‘Make in India’. We have the base technologies and we have the domain knowledge. Moreover, we have a global customer base and have the R&D capability to serve the purpose. Now, we are going to deploy our manufacturing capabilities across more and more sectors, so that we can grow our business as well as take advantage of the ‘Make in India’ phenomenon.” No wonder, shares of the company have trebled since the day the Modi government assumed power.

“I want the new FTP to be a fair trade policy” - Amit Kalyani, Executive Director, Kalyani Group

Having established Bharat Forge as the world’s largest forging company, its Chairman and Managing Director Baba Kalyani has now passed on the mantle to his son Amit Kalyani, with whom The Dollar Business caught up on the sidelines of Aero India 2015, to understand what the company’s diversification plans are

Sisir Pradhan | The Dollar Business

TDB: Many find it hard to believe, but in FY2014 India actually became a net exporter of aircraft and aircraft components? Since we believe you have high expectations from this sector, tell us about your plans when it comes to aerospace.

Amit Kalyani (AK): I don’t think that’s the fact. India has become strong in export of aircraft and aircraft components, but I have still my doubt that the country has become a net exporter. The country has made a lot of progress in exports and hopefully in the next two years, it will grow a lot. In the aerospace industry, all aircraft have lot of forgings in them and have lot of forged metal parts and components. These are very high technology, high precision, high safety and critical components. Hence, this is a natural extension to our existing capability. Since we have been working with global companies in the non-automotive area, we have expanded the reach to the aerospace field.

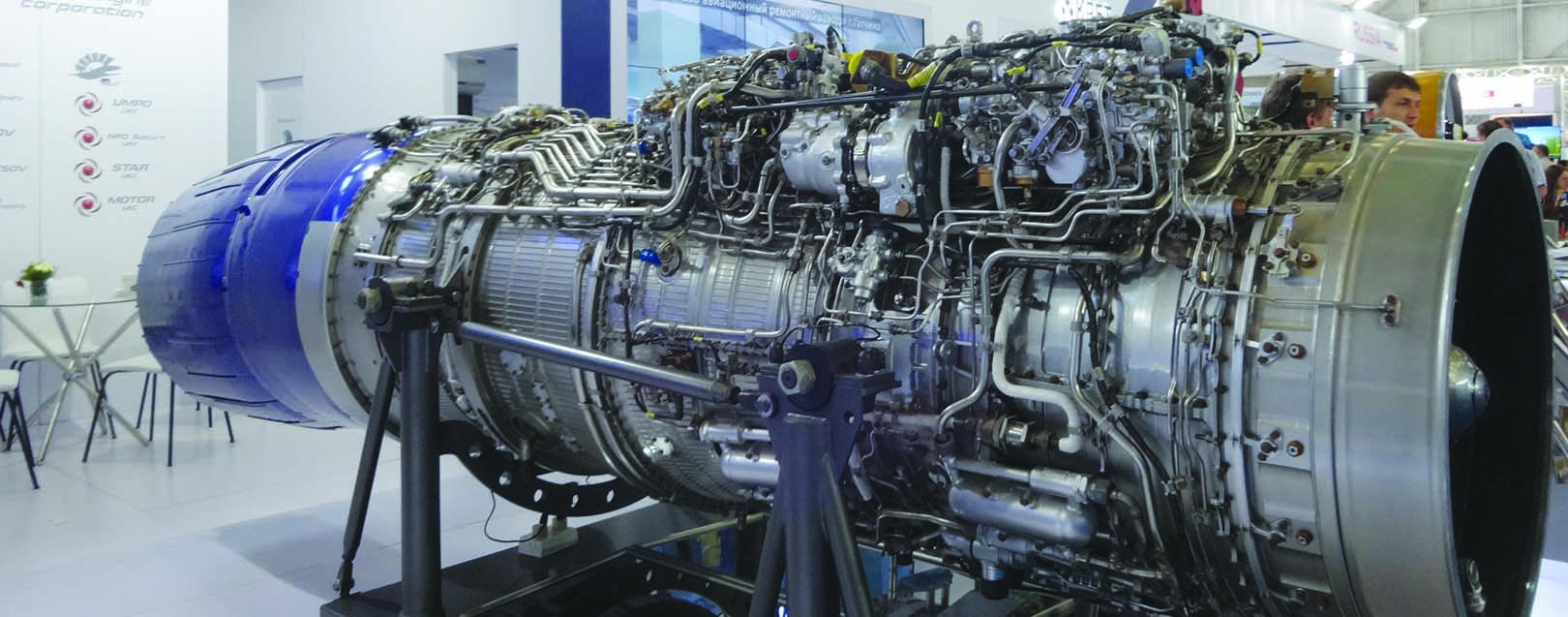

About four years ago, we made an announcement that we are entering the aerospace sector. In this sector, one needs to invest a lot in the training of personnel, development and approvals, which are industry and company-specific. So, we went through all that and our efforts are now starting to pay off as we have started getting orders. An example of such an order is the one we got from Boeing on February 18, during Aero India 2015. It is a multi-year contract to supply titanium forgings for wing components of the next generation 737 and 737 MAX. Under the agreement, Bharat Forge will begin supplying pre-machined forgings to Boeing from its facilities in Pune and Baramati starting the first quarter of FY2016.

TDB: Going forward, will you largely focus on the supply of components or are there plans to manufacture full-fledged aircraft? Moreover, how would you like Bharat Forge to be labeled five years from now – still as the world’s largest forging company or a manufacturing powerhouse in multiple sectors?

AK: We are certainly not going into producing full-fledged aircraft, but we are going to make systems and sub-systems from components. First it is components, then sub-systems and then systems. In the longer run, we definitely would like to be a major player in manufacturing of products in multiple industries. We are certainly looking beyond just forging.

TDB: Recently, you unveiled Bharat-52 long-range 155mm/52 caliber gun, which shows your big plans in the defence sector. Now that private investment is allowed in the sector, what are your plans in this area?

AK: We have plans in the artillery field, as well as in the land-systems field. Now, we are getting into developing and manufacturing other high-technology systems. To make this possible, we have formed a joint venture with Israel’s Rafael Advanced Defense Systems Limited. It will help us develop and produce a wide range of high-end technology systems such as Missile Technology, Remote Weapon Systems and Advanced Armour Solutions etc. The government has recently increased the FDI cap in defence to 49% and we hope that our partnership with Rafael will be among the first new ventures under the new FDI limits in the country. Currently, the contribution of defence to our group revenues is zero, but soon it will become a significant part of our portfolio.

TDB: Tell us in brief about your capex plans. What size of capex are you planning? Which sectors are you targeting? And how much of it are you planning for India, and how much for Germany and Sweden?

AK: We have plans to invest about Rs.1,000 crore over the next three years. So, we will be investing a little more than Rs.300 crore a year across all our industry verticals. And all this is in India.

TDB: What is there in your business model that has kept you immune from the economic slowdown in Europe, particularly in Germany?

AK: No one has been immune to the economic slowdown in the last few years. However, we have a fairly well-diversified business model, which has somehow helped us sail through the adverse economic conditions and helped us in a certain amount of de-risking.

Coming back to the economic conditions in Europe, everybody is working towards bringing the region’s economy back on track. But that is something a little outside our area of expertise and let’s say, that is somebody else’s problem. However, I think, the economy in Europe is stabilising and Germany, which is our main market, is doing well. Weakening of the euro is also making Germany more competitive.

TDB: At a standalone level, export incentives account for about a quarter of your PAT. However, they have been falling consistently for the last few years. Do you expect the government to further rationalise incentives in the upcoming Foreign Trade Policy (FTP)?

AK: Export incentives are less than 2% of our sales. We have lot of tailwinds as an economy. Oil is at its lowest in years. So, we must use this opportunity to start investing in creating the infrastructure and getting the economy kick started.

I want the new Foreign Trade Policy to be a fair trade policy. There are certain areas where we have inverted duty structures and those need to be corrected. And we are on track.

TDB: At 8.4%, your cost of debt in FY2014 was the highest in the last 10 years. What caused this? How do you intend to keep it under check as you restart capex in FY2016?

AK: I don’t believe our cost of debt is that high. I don’t remember each figure like that.

TDB: Prime Minister Narendra Modi’s ‘Make in India’ has high expectations from manufacturing companies like yours. How are you gearing up to shoulder the responsibilities, particularly since in FY2014, even at a standalone level, you earned over 50% of your revenue from abroad?

AK: I believe, we are in the best position for ‘Make in India’. We have the base technologies and we have the domain knowledge. Moreover, we have a global customer base and have the R&D capability to serve the purpose. Now, we are going to deploy our manufacturing capabilities across more and more sectors, so that we can grow our business as well as take advantage of the ‘Make in India’ phenomenon. The ‘Make in India’ campaign is also giving us an opportunity to manufacture and supply to a lot of Indian companies, including PSUs, who used to import many of their products.

TDB: Over the last 10 years, Bharat Forge’s standalone numbers have been much bumpier than its consolidated numbers. What has the company learned from this?

AK: Earlier, we used to depend on one industry. Now, we are more diversified than ever before. Earlier, due to our dependence on one industry, we couldn’t do much more than what our customers were doing.

TDB: Railways is a sector where you have started supplying components. Now, as the sector is likely to open up for private players in a much bigger way, what kind of opportunities do you actually see there?

AK: Railway is the lifeline of India. It is a big sector and offers big opportunities for private players like us. India can’t grow if railways can’t grow. So, railways need to grow at double the country’s growth. But in the last many years there have been no investment, due to which our railway system is way behind. I hope under the new railway ministry something good is going to come out for this sector.

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.