In terms of value, bumpers have been among the front-runners when it comes to exports of auto components from India. Last fiscal, Indian manufacturers exported bumpers in various shapes and sizes, worth $179 million. And industry experts expect its exports to only rise further going forward. So, what makes this product a hot favourite amongst foreign buyers? The Dollar Business analyses.

Ahmad Shariq Khan | September 2016 Issue | The Dollar Business

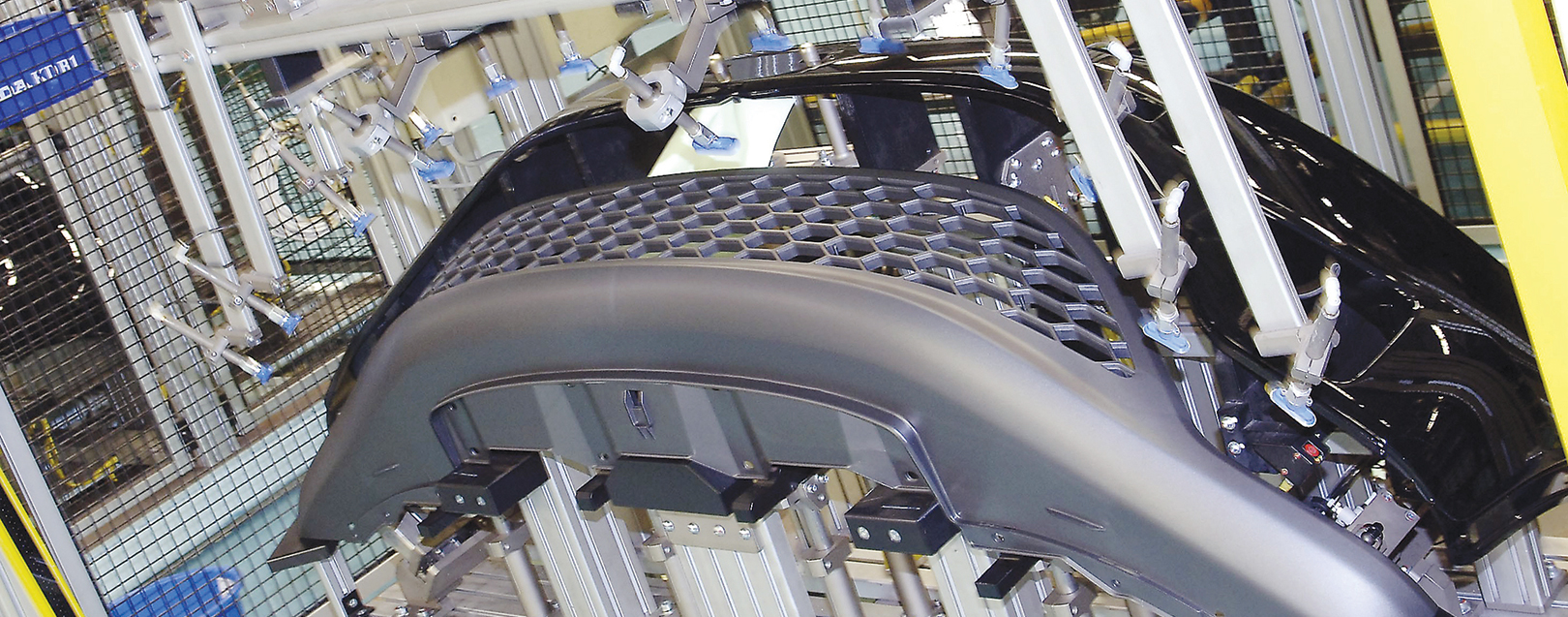

Anyone, well almost everyone, who has driven on India's chaotic roads knows the value of bumpers! Not very surprising it is therefore that a huge aftermarket for bumpers and its parts exists in India. Interestingly, that's not only the case with India, but in many countries across the globe. Well, the good news is that Indian manufacturers are already exporting in significant numbers. So chances are, if you see a Ford Escape on the roads in Texas (US), its bumpers may have actually been shipped all the way from India!

Over the years, the Indian automotive industry has shown significant progress in engineering as well as in various allied segments. In fact, the industry has today emerged as one of the largest in the world with an annual production of 23.96 million vehicles in FY2016, registering a growth of 2.58% over FY2015.

Similarly, the auto component industry has also shown a healthy growth. According to the Automotive Component Manufacturers Association of India (ACMA), the turnover of the auto component industry stood at $39 billion in FY2016, registering a growth of 8.8% in rupee term over the previous year, and a CAGR of 6% over the last six years.

What's more? According to FY2016 Industry Performance Review by ACMA, exports of auto components has grown by 3.5% in FY2016 to Rs.70,900 crore from Rs.68,500 crore in FY2015. In fact, the segment has registered a CAGR of 18% over the last six years. When it comes to export markets for India-made auto components, Europe accounts for 36% of the total exports followed by Asia and North America, each taking up 25% share of the exports pie. The key exported auto components include engine parts, transmission parts, brake systems and components, bumpers, exhaust systems, turbochargers, etc. Did we say bumpers?

'BUMPER' EXPORTS

Bumpers and its parts for motor vehicles is one category where India is emerging as a strong competitor to China in global export markets. Having said that, in CY2015, while India exported bumpers and its parts for motor vehicles worth $196 million, China's exports of the products stood at $369 million for the same period. But that's not a bad number for a country where the automotive aftermarket is dominated by unorganised segment. Further, although exports of bumpers has seen a decline in line with the general decline in exports over the last two years (exports of bumpers declined from $213 million in FY2015 to S179 million in FY2016), exporters expect a decent growth in the near future based on the strengths of the industry. “Indian suppliers are up-to-date with the latest trends and demands across the globe and that always sets us apart,” says Ashok Oberoi, Director, Yaduvanshi Polymers Pvt. Ltd., an automotive aftermarkets manufacturer and exporter based out of Kondli in East Delhi.

Cost-effective and diversified product offerings of global standard, ranging from aftermarkets for the entry level segments to parts of the much-touted premier vehicle brands across the globe, is yet another factor that makes India a preferred sourcing destination for auto components. “We upgrade our facilities at regular intervals. I think, the diversified product portfolio of Indian suppliers has many takers in the international market due to its quality material, durability, latest designs, perfect finish and supreme reliability,” adds Oberoi.

Rajneesh Kumar, Managing Director of KMC Enterprises, another auto components exporter from Delhi, is of the view that clients nowadays demand products that are compact, made of high-quality materials, easy-to-install, designed for longer service life and are light-weight. Kumar is, at present, witnessing significant demand for bumpers specifically designed for BMW 3-Series, 5-Series, 7-Series, BMW X5 and BMW Z3/Z-Coupe. For Ford, he is exporting bumpers for models such as Contour, Crown Victoria, Econoline Van and Escape. When it comes to Honda, he is manufacturing and exporting bumpers for hot-selling Accord and Civic models.

GOOD TIMES AHEAD

As demand for passenger cars is likely to grow at a faster pace with the economy picking up in both domestic and global markets, a higher growth is expected in times to come. According to ACMA, the Indian auto components industry is expected to post a turnover of $100 billion by 2020 and exports are expected to clock between $80-100 billion by 2026, up ten-fold from the current $11.2 billion. The industry body also believes that Indian auto components industry is set to become the third largest in the world by 2025.

ICRA, the premier credit rating agency, also expects the auto components industry to continue sustaining growth and clock 8-10% growth in FY2017. “Indian auto component makers are well positioned to benefit from globalisation as exports potential could go up by up to four times to $40 billion by 2020”, states the report.

CENTRE OF GRAVITY

The car manufacturing industry and the allied components manufacturing hubs, the mainstay of the growth, seem to be evenly divided into three clusters. Southernmost (and the largest auto hub) is located in and around Chennai. It contributes 35% of total revenue and accounts for 60% of the country’s total automotive exports. The city is home to many auto majors such as Ford, Hyundai, Renault, Mitsubishi, Nissan, BMW, etc.

Closer to Mumbai, in Maharashtra, along the Chakan corridor near Pune, is the western cluster, with 33% of the market share. The cluster has manufacturing facilities of companies like Audi, Volkswagen and Skoda. In addition, General Motors, Tata Motors, Mercedes Benz, Land Rover, Jaguar Cars, Fiat and Force Motors have set up assembly plants in the area.

The northern cluster, which is around the National Capital Region has two big manufacturing hubs, in Gurgaon and Manesar, in Haryana. “These manufacturing hotspots, along with many Tier 2 and Tier 3 suppliers to original equipment manufacturer (OEM), have in a way contributed in kick-starting a sort of engineering manufacturing revolution across the country,” says Vinnie Mehta, Director General, ACMA.

speed breaker

The Indian auto components industry has carved a niche for itself globally with deep forward and backward linkages with several key segments of the economy. However, manufacturers are grappling with some issues, which if addressed can catapult the industry's growth to next level. For instance, high cost of die casting machine, used for manufacturing bumpers, is acting as a deterrent in the growth of the product's exports from India making it uncompetitive in global markets. “Today the cost of a die for bumpers for a specific auto brand costs a few lakhs. So, if we manufacture a bumper here for one particular car variant using a particular die, we cannot use that die for newer variants with different bumper specifications. Hence, for us, in some cases, importing bumpers from Malaysia is a cost-effective proposition,” says Oberoi. This is due to inverted duty structure prevailing in the country where raw materials are taxed at a higher rate than finished goods.

safety FIRST

According to some industry experts, India presently lacks mandatory safety standards for a large number of aftermarket products. Consequently, it has become impossible not only to check the import of counterfeit products, but also to accurately gauge the standard of domestic production. The same also causes a lack of trust among importers and hampers export prospects of the industry. It’s high time both policymakers and industry work in collaboration to eradicate this menace by strengthening the legislative framework.

smooth ride ahead

With rapid strides recently made by Indian exporters in this segment, it looks like Indian aftermarket manufacturers including that of bumpers will soon be a leading force to reckon with globally. Further, with exports showing signs of revival and some major markets for bumpers like US and Europe starting to pick up steam, it's quite plausible to assume that Indian manufacturers with their inherent frugal manufacturing strengths are on course to emerge as a preferred suppliers in all major auto hotspots across the globe. As far as margins in this trade are concerned, exporters of bumpers enjoy double-digit profit margins, anywhere between 15% and 25%. However, supplies to OEMs, because of higher volumes, garner slightly lesser percentage returns.

With product standardisation, pro-manufacturing policy, a fairly attractive margin, and hopefully a more rational duty structure soon, it seems, Indian bumper manufacturers and exporters are in for a smooth ride.

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.