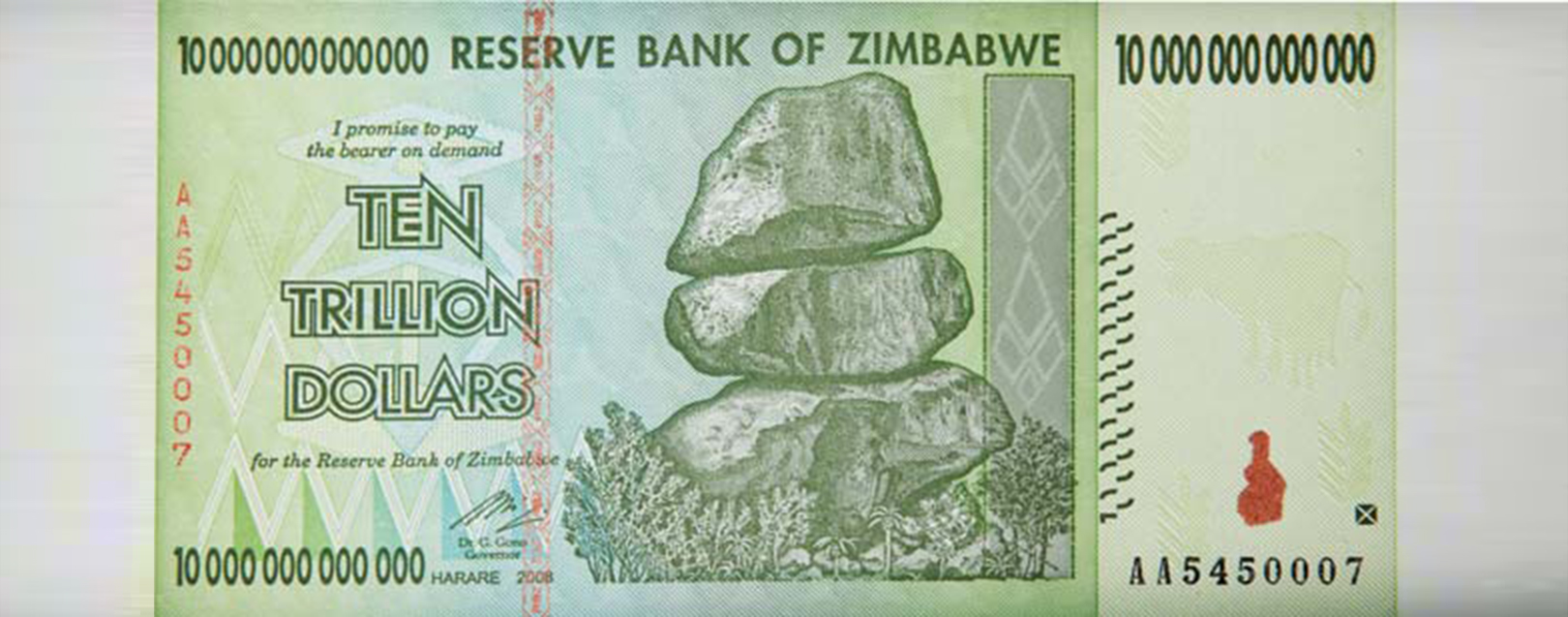

While comparing major economies with Zimbabwe doesn’t make sense, Fed critics often point at the African nation’s money printing binge (which led to annual inflation in the country shooting up to close to 80 billion percent forcing it to print even t

If one goes by the monetary policies that central banks have adopted in the last few years, one really wonders what could be the reason for them trying to decimate their own currencies (SNB), seeking inflation (BoJ), punishing savers (ECB) and of course, monetising every single piece of government debt (BoJ again). Is it plain stupidity, a currency war or something that doesn’t meet the eye?

Shakti Shankar Patra | The Dollar Business

Sitting in a television studio in New York about a year back, billionaire investor Stanley Druckenmiller said, “I don’t think the academics at the Fed understand the unintended consequences of the exit.” Although not so much in words, what Druckenmiller essentially meant was that the all-powerful Federal Reserve, the only entity with the right to print as much of the world’s reserve currency as it wants, is headed by academicians without any practical knowledge, most of whom don’t understand the dangerous road they have pushed the world economy down, with their expansionary monetary policies. And Druckenmiller is no Tom, Dick, or Harry. If there’s one man in the world you would expect to understand central banks and their way of functioning, it’s Druckenmiller. After all, he was a core member of George Soros’ coterie that broke the Bank of England (BoE) in 1992. In fact, Druckenmiller is supposedly the person, who picked up a quote from the then Bundesbank President Helmut Schlesinger, which had made Soros go for the ‘jugular’.

On a wing and a prayer

While small and regular increases in the monetary base are necessary as an economy expands, recent years have seen them increasing at a never-before-seen rate, with central banks trying to inflate their way out the Great Financial Crisis (GFC), which rocked the world in 2008. Let’s take the example of the Federal Reserve’s balance sheet. In the 12 months between August 2007 and July 2008, the Fed’s balance sheet expanded from $870.3 billion to $918.6 billion – a growth of just $48.3 billion or 5.5%. But in the 12 months between September 2008 and August 2009, it exploded by 119.8% to over $2 trillion! Yes, trillion with a T. And this was just the beginning.

Bidding everything up

Except for Laissez-faire fundamentalists, most agree that Fed Balance Sheet expansion was necessary during the GFC, particularly since most of the expansion happened to provide liquidity to the market. This stemmed from the belief that the Lehman’s bankruptcy had created a liquidity crisis and not a solvency crisis for banks and other financial institutions and it made absolute sense for the Fed to support the market with short-term liquidity, which was easily reversible. And even the Fed did exactly this, as after peaking at just over $1.5 trillion in December 2008, its liquidity facilities collapsed to less than $50 billion in a matter of just 18 months.

What continued, however, was outright purchases of all kinds of debt, primarily US treasuries, via programmes like QE I, QE II, Operation Twist and QE III. As a result, by the time QE III ended this October, Fed’s Balance Sheet had expanded to over $4.4 trillion – $38 billion average/month increase in the US’ monetary base for 72 straight months!

Split wide open

Ever since the Fed started out on its asset purchase programmes, the world has got divided into two camps – Fed critics and Fed supporters. While the former call the latter Fed apologists, the latter call the former conspiracy theorists. Without taking any sides, which is easier said than done, let’s look at the facts. The Federal Reserve has two set mandates – maximum employment and stable prices. It also need to ensure moderate long-term interest rates. However, if one thinks it shouldn’t be too difficult to objectively judge how Fed policies, since 2008, have fared on these parameters, one is in for a surprise.

Let’s talk about the first mandate – maximum employment. While Fed supporters point out that the US economy has added over 1.4 million non-farm jobs since December 2007 and unemployment rate is now down to just 5.8%, which is close to the long-run normal rate of unemployment, Fed critics point out that the number of people not in the labour force has increased by about 13.1 million during the same period and that the labour force participation is at a 36-year low!

When it comes to stable prices, while Fed supporters point out to the fact that consumer price inflation in United States is at just 1.7% – lower than the 2% that the Fed considers consistent with its mandate – Fed critics say that inflation numbers are simply white lies, thanks to the usage of hedonic adjustments, substitutions, geometric pricing and other such complex stuff.

Even when it comes to interest rates, there’s no consensus. So, while Fed supporters point at the US 10-year bond yield at sub 2.5% and claim Fed policies have worked, Fed critics ask what’s the point of looking at yields when the Fed itself is buying up massive chunks of bonds that the government is issuing, thereby ensuring yields never rise?

Richie Rich

When it comes to the motivation behind such expansionary Fed policies, the world is even more divided. While ‘Fed apologists’ point at stock indices at all-time highs as proof of how Fed policies have ensured growth and confidence, ‘conspiracy theorists’ claim pushing stocks and other assets ever higher has always been the primary goal of the Fed, which is not what its job is. Druckenmiller, during the same interaction mentioned above, also seemed to agree with the ‘conspiracy theorists’. He said, “This (Quantitative Easing) has been the biggest ever redistribution of wealth from the middle class and the poor to the rich.” His logic was that such expansionary policies have inflated asset prices like stocks and bonds and real estate, which are not held majorly by the 99%, but mostly by the 1%, leading to widening of the wealth gap.

All in

The interesting aspect of today’s free-floating currencies is that they are always valued against other currencies, although some think a currency should only be valued against gold. And even if there is no consensus on the consequences of or motivation behind central banks resorting to expansionary policies, there is absolute unanimity that, ceteris paribus, higher the monetary base, weaker the currency. And the only reason the dollar hasn’t collapsed following the Fed’s policies is the US’ superpower status and more importantly, similar monetary expansion by other central banks, which have managed to maintain an illusionary status quo. For example, in seven years between June 2007 and June 2014, despite a $3.5 trillion expansion, Fed’s balance sheet has actually expanded lesser than that of Bank of England (BoE). So, logically GBPUSD is, today, lower than where it was seven years back.

Similarly, thanks to its decision to peg Swiss franc to euro, in order to weaken the former, which can, probably, be considered as the biggest currency war in recent years, Swiss National Bank’s (SNB) balance sheet has also expanded by 4.6x (slightly less than that of Fed’s and BoE’s) in these seven years. At the time of announcing the peg, SNB had said, “The current massive overvaluation of the Swiss franc poses an acute threat to the Swiss economy and carries the risk of a deflationary development.” In other words, SNB deliberately debased the Swiss franc by expanding its balance sheet, in order to foster growth and create inflation. But unlike most other central banks, it, at least, accepted this openly. Not that it had a lot of choice, when it went for a peg.

On the other hand, when the Bank of Japan (BoJ) started its current round of balance sheet expansion, in right earnest, after Shinz? Abe took over as the Prime Minister of Japan in 2012 (BoJ has been unsuccessfully trying to foster growth via QE since 2001), it said its primary goal was to fight deflation and create at least 2% inflation. It never said a word about weakening the yen, which, let’s face it, was the ultimate goal (the yen has lost over 50% in value against the dollar in the last two years).

The question then is, if currency devaluation via monetary expansion is a panacea (there’s no point talking about devaluation via rate cuts since the entire developed world – US, Eurozone, Japan, UK and Switzerland – already have interest rates at zero or near zero), shouldn’t all central banks retaliate against each other? And if they are not, why not?

War or peace

When BoJ, a couple of days after the Fed wound up QE III, announced that it is increasing the quantum of its asset purchases to ¥80 trillion/annum, the belief of those who thought there was a currency war going on, got a setback. For, why would BoJ make this mega announcement right after the end of Fed’s QE III? And why hasn’t any other central bank, say European Central Bank (ECB)or People’s Bank of China (PBoC), retaliated to this with its own QE? Aren’t they afraid of their exports getting affected by the resultant sharp weakness in the yen? And since none, even those like South Korea, who compete for Japan’s export pie, have retaliated or even criticised it, doesn’t this smell more of coordination and less of war? To find the answer to this multi-trillion dollar question, we spoke to three leading global voices – Jim Rogers, Peter Schiff and Surjit Bhalla. And as you will find out, the verdict is anything but unanimous.

“The only way to win a currency war is by losing it” Peter Schiff, Founder CEO, Euro Pacific Capital

In financial markets Peter Schiff has a bit of a cult status. Those who love him, adore him; those who hate him, call him a loose cannon. So, The Dollar Business caught up with him in Puerto Rico to understand what he thinks of currency wars

Interview by Shakti Shankar Patra | @TheDollarBiz

TDB: What do you think will the longer term repercussion of Bank of Japan’s recent decision to expand its balance sheet by ¥80 trillion/annum be?

Peter Schiff (PS): I wasn’t surprised by Bank of Japan’s (BoJ) decision to expand its balance sheet further. I think it’s very foolish for Japan to do this. One would think Japan would have recognised that the Quantitative Easing (QE) that they have done in the past hasn’t worked, in fact it has backfired. The Japanese economy is in a worse shape now as a result of the bond buying that the BoJ has done in the past. So, by buying even more bonds in the future, it’s going to do even more damage. As long as the Japanese are trying to stimulate their economy with QE, they are going to do it forever. For, more they try to stimulate the economy with QE, the more they end up sedating the economy. The only thing that Japan is achieving by doing QE is delaying the day of reckoning on its debt.

TDB: Theoretically (since a currency is always valued against another currency) if both the central banks in charge of a currency pair keep expanding their monetary base, the currency pair can continue at the same levels. Isn’t it?

PS: If you and I jump off the top of a 100-storey building at the same time and we look at each other, neither of us will realise that both of us are moving, right? But that doesn’t change the fact that we are both going to die. So, if all the central banks debase their currencies in uniform, it doesn’t mean they are spared from the consequences of their actions. It just means they are all going to meet the same fate.

TDB: Central banks across the globe, at least in the developed world, are telling us that the reason they are expanding their monetary bases is because of the threat of deflation. Where do you stand on this issue?

PS: If deflation is about falling consumer prices, then there is absolutely no deflation, anywhere. Deflation is not even on the horizon. The only deflation that would be there, without the central banks, is asset bubble deflation – stock markets coming down, real estate markets coming down and debt bubbles bursting. This is what central bankers are worried about. But they don’t want to come out and say they want to print a lot of money to prop up the stock market. That’s not a politically viable strategy since a lot of voters, worldwide, don’t own stocks. So, they say we need to save the economy and we need to save consumers by making sure prices go up. But this is sheer idiocy. For, from a consumer’s point of view, the best thing that can happen is prices going down. Then you also have politicians claiming higher prices encourage demand. No, they don’t! Lower prices encourage demand. The theory that countries need inflation is nonsense. They don’t. Only highly indebted governments, trying to prop up asset bubbles and wipe out their liabilities in a dishonest way, need inflation.

TDB: What do you think could be the tipping point for the end of such policies?

PS: I think why a lot of people believe money printing works is because US printed a lot of money and everyone is now convinced that it worked and we are having a recovery as a result of all the QE. But we are not. We just inflated another bubble that is in the process of bursting. So, probably by next year, as the US economy, once again, will be teetering on the brink of a recession, and the Fed is forced to launch QE IV or some version of it, more people might figure out if it hasn’t worked after five or six years, it’s never going to work. They’ll ask, if the Fed couldn’t end QE now, when can they end it? They’ll ask, if the economy went through the entire business cycle of recession to recovery and back to recession and rates were zero the entire time, when can the Fed ever raise rates?

This is the problem with QE. Once you start it and zero percent interest rates, you can never end it. QE breeds dependency. It makes the economy more dependent on such policies. So, the moment you end the policy, the collapse is greater. The longer you wait to end QE, the worse it’s going to be when you end it; the longer you do it, the worse it’s going to be and the more you do it, the worse it’s going to be. Ending it would mean embracing the consequences and admitting what the central banks have done, all this while, was a mistake. What might happen, though, is that when everyone figures out that this was all bu!!sh*t, the dollar might start to really fall, affecting US’ long-term ratings. That’s when I think, things will start to fall apart.

TDB: But if the dollar fails, what’s the alternative? We might as well go back to the gold standard…

PS: We need to go back to a gold standard. Gold standards work. That’s why they were so successful for a long time. But governments don’t like gold standard because it stands in the way of big government. It protects people from the government. And it protects markets from government manipulation. You always have had a much sounder financial system under a gold standard and you have shared prosperity and you have had rising standards of living. But politicians want to play favourites and they want to have winners and losers because they want to wield power and then be able to sell that power to the highest bidder. All this is much easier under a fiat currency environment. The only way to escape the sufferings of all this is to go back to a gold standard and I believe that’s where the world is headed.

TDB: Do you seriously believe we will go back to some kind of a gold standard in the next 5-10 years?

PS: I don’t know the time horizon because governments will, obviously, resist it. But if you look at modern history, over the last few hundred years, we were on a gold standard most of the time. We’ve been off the gold standard for only 40 odd years. So, this is not the historic norm. In fact, when Richard Nixon took us off the gold standard in 1971, he had said it was just temporary. I think he was right, just that it’s been a lot more temporary than he thought.

TDB: How would you react to the theory that via all this money printing, US and the developed world have managed to export inflation to the developing world, to countries like India?

PS: Exactly! In fact, when we were doing our QE and a lot of the new money was fleeing the dollar, many markets (especially emerging markets in South-East Asia and Latin America) made the mistake of adopting our cheap money policy and fighting this currency war. They should have allowed their currencies to appreciate. Instead, they printed alongside the dollar to absorb all the inflows and that’s been the root of the problem.

TDB: In that case, do you think we need a world body like the WTO to stop individual countries from deliberately debasing their currencies?

PS: I don’t think there should be some kind of a global entity. I think, countries on their own will figure out what they are doing is wrong. It’s all based on a universally held belief, which will hopefully be completely discredited and all economic theories written by Keynesian experts would be put in the fiction section of libraries, that in order to export you need to weaken your currency and need inflation. It’s not true. Everybody wants to protect their exports, however the real goal is imports. But to pay for your imports, you need to export. So, if your currency goes up, it means you don’t have to export as much to pay for your imports. It means you are richer, it means you don’t have to work very hard and it means your standard of living is very high. Being able to import cheap should be the ultimate goal.

“Governments, especially American & British governments, always lie about inflation” Jim Rogers, Chairman, Rogers Holdings

While many saw the GFC coming, not many had the courage to sell their mansion in New York City at the peak of the housing boom and relocate. But then, not everyone is Jim Rogers. To figure out if he expects something similar, this time in the forex market, we caught up with the maverick, investing genius

Interview by Shakti Shankar Patra | @TheDollarBiz

TDB: What’s your take on the Bank of Japan’s (BoJ) decision to increase its monetary base by ¥80 trillion/annum?

Jim Rogers (JR): Obviously, this will lead to a gigantic force of liquidity flooding the market. I own Japanese shares and I bought more when the decision was made. It’s not good for Japan, it’s not good for the world. But it’s certainly very good for Japanese stocks, stock brokers and investors.

TDB: The BoJ must be very happy with the resulting weakness in the yen. But do you think if this continues there will be reactions from other central banks, which can lead to a phase of competitive devaluations across the world?

JR: No country has ever saved itself by debasing its currency. It works in the short term, but never works in the medium to long term. The Japanese yen is down 45%-50% against the US dollar in just 2-3 years, which is a staggering amount for a major currency. Of course, this will eventually lead to other countries feeling the effect of it, and then, they would start doing something about it.

TDB: What do you think could be the tipping point for the end of such policies by central banks?

JR: This can, actually, go on for a while as other central banks will try to follow Japan. The English have already done this, the European Central Bank (ECB) is going to start very soon. It should stop now, but it’s not going to. Eventually, either the bankers will come to their senses or the market will say it’s not going to take this stuff anymore. And then, we are going to have a very bad bear market.

War could also be a tipping point. May be markets will go too high and people will realise it’s all a bubble and hence, will start taking money out of the market, irrespective of what the central banks do. I suspect that with all this money, we will have higher stock markets in Japan, US and other places, and then they will go too high and that would be the tipping point. But with a bubble, you never know what or when the tipping point is.

On the other hand, if such deliberate devaluations turn into a gigantic currency turmoil and we have more and more currencies collapsing, people, in desperation, will start looking for something to save them. It will start with US dollar, but that too will come under suspicion and hence, in desperation, people will get into gold or silver or a basket of currencies. I think this will be the scenario, if we have a major currency collapsing in the next 2-3 years. However, if it takes longer, I suspect the renminbi will come along to compete with the US dollar.

TDB: Since a currency is always valued against another currency (theoretically), if both sides of a currency pair continue to devalue at the same rate, this can continue forever. Isn’t it?

JR: It cannot continue forever because eventually the whole system will collapse. Such policies will lead to trade wars and import controls. We have seen this happening in the 1920s and 1930s, which eventually led to World War II.

I would also point out that even if currencies devalue at the same rate, something else would be rising against the currencies, whether it is inflation or gold or other assets.

TDB: Ever since the US Federal Reserve started QE II, there has been a big surge in the number of trade disputes at World Trade Organisation (WTO). Do you think this is an unintended consequence of such currency wars?

JR: Whenever you have economic turmoil or hard times, people start complaining and look for some kind of an explanation. History tells us that such situations culminate in a war. And this is happening again. I don’t expect a major war any time soon, but in a decade or so it’s not unlikely. The more economic turmoil we see in the world, the more will it lead to such currency fighting and eventually to wars.

TDB: The WTO takes a stance on trade barriers. Do you think it’s about time it took a stance on such deliberate currency devaluations as well?

JR: Unfortunately, since almost every country is indulging in such practices, it would be very difficult for the WTO to have any power or authority to stop countries from devaluing their currencies.

TDB: Most central banks, in the developed world, have been talking about deflation as the biggest threat to their respective economies and have used it to justify monetary expansion. Where do you stand on this issue?

JR: There is no deflation in Japan. If you go there you will see there is no deflation. If you go to United States, you will see no deflation. Many countries like China, India, Italy, Norway, Australia etc. admit and acknowledge there is inflation, some others just lie about it. Deflation is a myth that central banks and governments have sold to the world. Governments like to lie about inflation because it hurts people, especially the American and British governments always lie about it. But, eventually, they can’t get away with it because everybody knows there is inflation.

TDB: USDJPY has moved from about 76 to 115 in a matter of just two years. Why is it that despite this, Japan’s exports haven’t really benefitted much?

JR: These things take time. I am sure, eventually, a weak yen will lead to higher exports and lower imports by Japan, which is not a good thing as it will ensure a much lower standard of living. But Mr. Abe doesn’t seem to know or care about this. All he wants is higher stocks and a lower yen.

TDB: Do you think if things go really out of hand, RBI will join such a race and deliberately weaken the rupee?

JR: RBI has been ‘less bad’ than most other central banks in the last few years. But if this spreads and more and more countries try to knock their currencies down, India will get into the game as well. The RBI is smarter than that and knows that it can’t be good and will only make inflation worse. I hope the RBI stays out of this because it’s not good for anybody.

“There’s no currency war, Central Banks are actually in bed with each other” Dr. Surjit Bhalla, Chairman, Oxus Investments

Economists, generally, don’t call a spade a spade. While some call it a shovel, some wait for more data to confirm it’s a spade! But not Dr. Surjit Bhalla, the most outspoken of India’s leading economists, with whom The Dollar Business caught up for a freewheeling talk on currency wars on a chilly Delhi evening

Interview by Shakti Shankar Patra | @TheDollarBiz

TDB: You don’t belong to the camp which believes the ongoing monetary expansion by central banks around the world is leading us towards a disaster. Do you?

Surjit Bhalla (SB): No, I don’t belong to that camp at all. Basically, what we know – for which there is a considerable amount of evidence – is that monetary policy, whether conventional or unconventional, is not at all affecting inflation. In other words, we have very loose monetary policy – by almost any definition – and yet we have a case that in country after country, it’s not affecting inflation. The reason it is not affecting inflation is, I think, the extremely intertwined nature of globalisation. This means what I do doesn’t affect price levels in my country.

However, there is some evidence that it does affect growth. The best evidence of this is US, which was the first country to loosen its monetary policy and we have seen the results. The answer to why it doesn’t affect inflation but does help growth is exchange rate.

TDB: If monetary policy doesn’t affect inflation, do you think the Bank of Japan, which is seeking 2% inflation, can achieve it through monetary policy?

SB: I don’t think the Bank of Japan is really seeking inflation. It is using that as an excuse to depreciate the yen. And I happen to think, and evidence will bear me out, that ever since Abe started on this expansionary path, the Japanese economy is looking better. Now, 0.5% GDP growth might not be great, but it’s definitely better than 0% GDP growth. The second piece of evidence that supports my view and really supports devaluing is what’s happening in Europe. So, while everyone talks about this monetary expansion as monetary policy, in reality, it is exchange rate policy.

TDB: Doesn’t this mean every central bank has all the more reason(s) to retaliate against another central bank’s attempt to debase its currency?

SB: Don’t think that this hasn’t happened. However, there are checks and balances. For example, when China very successively kept its currency weak for years, the whole world piled up on it, correctly in my view, to start appreciating its currency. So, if I were a part of the G3 and I was US, and there was Japan and Europe, I would say it indeed makes a lot of sense for the yen to be cheaper, it makes a lot of sense for the euro to be cheaper and it makes a lot of sense, at the moment, for the dollar to be stronger. My view is this is all very coordinated. It’s not a coincidence that the day US ended its QE, Japan expanded its own.

TDB: Do you think the Fed critics suffer from ‘fear of the unknown’ because such coordination is obviously something very new?

SB: It’s not fear of the unknown. It’s pure ideology and, in fact, worse than pure ideology. It’s the “don’t confuse me with facts, my mind is made up” mindset. For example, the latest CPI numbers in India came at just 5.5%. But when some ‘respectable’ economists were asked if inflation in India was trending down, the answer was, “We won’t know till next summer.” Inflation in India has come down from over 12%, and these guys are saying we won’t know if it’s trending down until next summer!

This is pure ideology. These are just bears, caught in a trap. They should just admit they are wrong.

TDB: But when money supply increases, ceteris paribus, prices should rise. In’t it? How is it that with all this monetary expansion, inflation is not rising?

SB: The answer is exchange rate. One has to recognise that the world has changed. People read text books and take examples from the 1980s and 1990s, some go back even to the Great Depression era and think currency depreciation will cause inflation. But look at Japan. USDJPY has moved from about 76 to over 115 in just 2-3 years, but has it caused any inflation? No. The basic model we had, i.e., MV = PT (M for Money Supply, V for Velocity, P for Price Level and T for Transactions) has broken down completely. For, it’s all in V, which is constantly changing. Hence, there is no effect on prices.

TDB: You have been very vocal in your criticism of the Reserve Bank of India’s (RBI) interest rate policy. But how would you rate its forex policy?

SB: I have been a strong advocate of the exchange rate policy that the Reserve Bank of India (RBI) has followed. I have no disagreement with it. I have always argued that you should devalue only from a position of strength, never weakness. So, with inflation coming down, the rupee should have appreciated, which the RBI has prevented by intervening. And I think they’ll continue to do that. For years, the rupee traded between 44 and 46 to a dollar. Then we made a mistake of allowing it to go to 39, which, interestingly, might have more to do with Chidambaram than the guy we were waiting for. Since then, it’s been depreciating from 46 onwards because of our misguided inflation policy.

TDB: Do you think India should strive for a strong currency so that imports are cheaper and standards of living improve or should we strive for a weak currency, which might help growth?

SB: Firstly, a developing country should always target a competitive exchange rate, which means you should err on the side of undervaluation rather than overvaluation. But, when you are coming off an unusual experience that we have had in India – of high domestic inflation but low inflation everywhere else – it makes sense to have a stronger currency, particularly since inflation is trending down and confidence is high. An appreciating currency will attract more investment. So, at this stage, it makes sense to let the rupee gradually appreciate.

TDB: Till the 1990s, governments used to put in all their might to have a strong currency. What has changed the psyche so much in the last 15-20 years?

SB: One great lesson that everyone learnt from Black Wednesday, and later from the East Asian crisis (which probably was the first currency war), was to not let one’s currency become too overvalued. After that there hasn’t really been any example of an exchange rate getting severely overvalued, except for the euro and even that has been corrected.

TDB: So, the bottom line is that you don’t think there’s a currency war going on right now.

SB: I don’t think there’s a currency war going on in the developed world. In other words, US knows really well what the impact of the Japanese policy will be and fully appreciates that the eurozone needs a more competitive exchange rate. In fact, after the GFC, currency movements in the developed world are all very coordinated and there also is a lot more understanding among developing countries. Today, we are all in the same boat. There’s no place to hide and there’s no place to exploit. So, forget about a war, all central banks and governments are actually in bed with each other!

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.