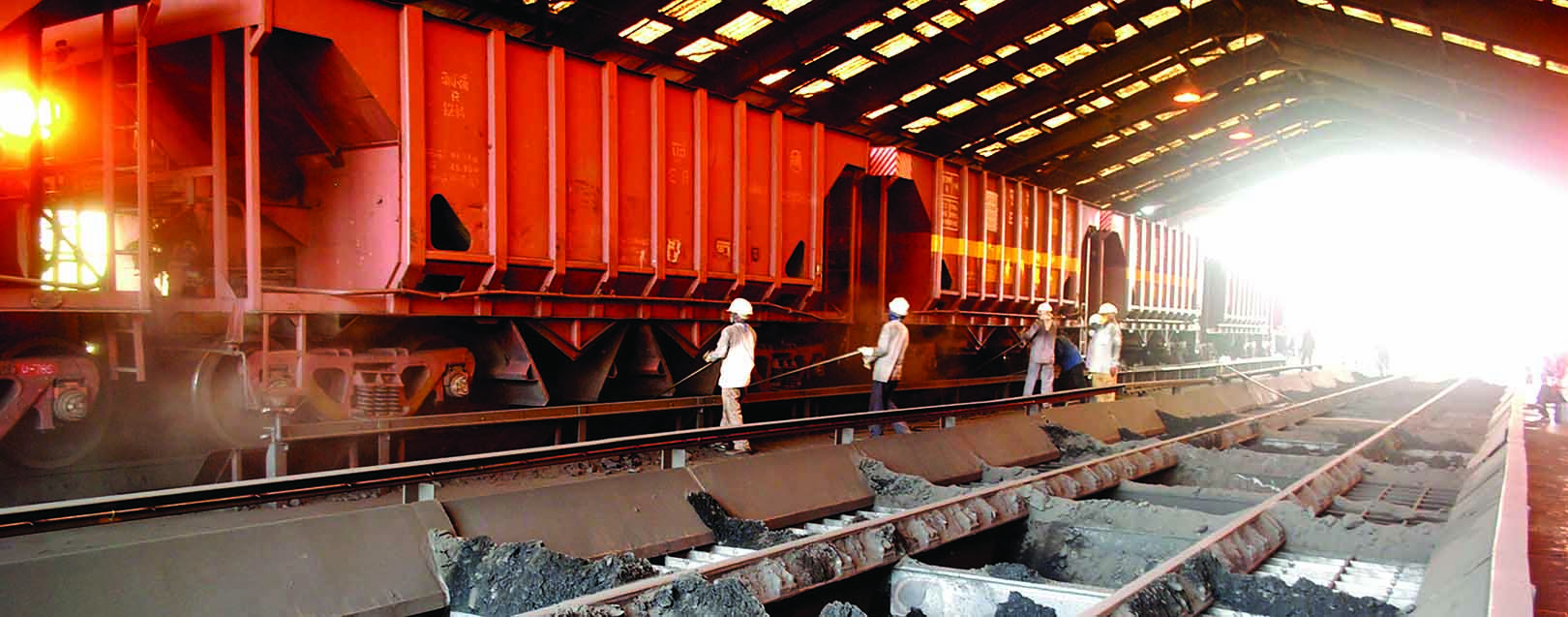

Workers pushing the hydraulic system to release cargo from a BOBR (bottom open bottom release) wagon. Paradip Port has a capacity of evacuating as many as 25 rakes in a day

In FY2014, when most Indian major ports failed to meet their targets set by the Ministry of Shipping, one of them not only managed to meet but also beat its target by a handsome margin, registering a 20.25% year-on-year growth in traffic. To ascertain the reasons behind this stellar performance and if or not FY2014 was a pure stroke of luck, we decided to travel to the East Coast and conduct a check of India’s 2nd biggest major port – Paradip Port in Odisha

Sisir Pradhan | @TheDollarBiz

The turbulent weather while landing at the Bhubaneswar Airport, which is located 105 km away from Paradip, brought back memories of 1999 when the Port town was ravaged by the strongest ever tropical cyclone in the North Indian Ocean. Over 10,000 people had lost their lives. Port officials revealed that the 1999 Super Cyclone, as it is generally referred to as, had sank several tugs and trawlers off the coast. They also pointed out that although a cargo conveyor belt, power transmission lines, roads, railway lines and warehouses at the Port had been severely damaged due to the storm, its core infrastructure was not much affected. In fact, the Port had promptly berthed a vessel just a couple of days after the storm in order to send across a message to all stakeholders that ‘all’s well’ and they were very much in business. In one-and-a-half decade since the cyclone, a lot has changed at Paradip and nearby areas. Infrastructure is much better and one can see a lot of prosperity around. The Port’s cargo traffic has also increased five-fold and many large and small port-based industries have come up in the vicinity. One of the most visible improvements is, without doubt, the condition of roads. Being the only major port in the state of Odisha, one of the most mineral rich states of the country, massive quantities of minerals and ores are exported via it, something that had led to nightmarish traffic congestions.

However, the then Vajpayee-led NDA government’s decision to extend the Golden Quadrilateral project to include major ports has benefited Paradip a lot. Today, a 76-km-long four lane bituminous road (NH-5A) connects the Port to National Highway No.5. The completion of the much-delayed State Highway, which connects the port to Odisha’s main trading center Cuttack, has further improved road connectivity. The Port also has good broad-gauge electric railway connectivity, thanks to the East-Coast Railway. However, lack of air connectivity is an issue. Although the Bhubaneswar Airport has got international status, it is yet to start international flights. So, the nearest airport that caters to international flights is at Kolkata – located more than 450 km from Paradip.

Safety last

I was welcomed to the Port town by a very foul smell. On enquiring, my driver-cum-guide Ajay said, “The smell is because of untreated waste dumped by seafood processing plants.” Being a major fish landing center, Paradip is home to several seafood processing units. While they have contributed a lot to the town economically, what stands out though is the stench! “Anyone who has grown up in this town, will find other places hard to live in,” Ajay quipped sarcastically. Standing near the gates of the Port, one can see massive chimneys of several factories – another sign of the growing economic activity in the region and one of the reasons for Paradip Port Trust’s (PPT) stellar performance last year. Fertiliser plants of IFFCO, Paradeep Phosphates Ltd. (PPL) and Goa Carbon Ltd.; a pelletisation plant of Essar Steel and oil terminals of PSU oil majors dot the town. An IOC oil refinery is also in the final stages of completion. But what really struck me as I entered the town and made my way towards the Port’s administrative office was the utter madness on the roads. With absolutely no sign of traffic management, all sorts of vehicles were zipping around in all directions. Locals said the entire 2-3 km stretch has witnessed several fatal accidents, most of them involving cargo trailers and oil tankers. “Many-a-time, ill-trained drivers throw caution to the wind in their attempt to make more number of trips.

Careless pedestrians also aggravate the situation,” a local said. Having narrowly escaped being run over by a speeding trailer, I could not help but think that the entire stretch badly needs serious attention and a scientific traffic control mechanism. Locals also added that despite being home to several large industries, including a major port, the town doesn’t have a single super-specialty hospital or a hospital with intensive care facilities. The nearest hospital, capable of treating critical injuries is at Cuttack, almost 80 km away from Paradip. My views on the poor and unsafe road conditions inside the Port area were also shared by S. C. Samal, Manager, Boxco Logistics India, a logistics solutions provider that has its office near the Port. “Condition of roads inside the Port area is not the safest. The Port also needs to expand its storage area. Many times exporters and importers don’t vacate their storage area, which further deteriorates the situation,” Samal told The Dollar Business. For the record, around 14 accidents occurred inside the Port area in FY2013, resulting in six deaths.

Port town to the T

The Port notified area is spread over 6,382 acres, of which a small portion has been leased out for cargo related activities and construction of offices, residential buildings and commercial establishments. The sudden spurt in industrial activity in the town has also led to exorbitant real estate prices. Traders feel in the absence of a real estate tariff fixation mechanism, finding office and/or residential space in the town is becoming impossible. Since most of the developed land in Paradip belongs to the Port, most Port users often find themselves at the mercy of Port authorities for allocation of Port quarters. “I couldn’t find office space inside the town. Hence, I took a 500 sq. ft. room outside the city limits, for which I am coughing up Rs.20,000/month,” Avinash Sahoo, owner of a small fleet of dumpers plying between berths and storage area at the Port, told The Dollar Business. With real estate prices in the area continuously heading north – despite the absence of basic drainage and sewage facilities – many port users have started moving out to small hamlets, 20-30 km away from the Port area. PPT’s woes don’t just end with poor road conditions and rising real estate prices. According to Subhakant Dash, Senior Manager (Port Operations), TM International Logistics Ltd. (a Tata Group Company that provides port logistics support to Tata’s plants in Odisha and neighbouring states), “Many Port users flaunt safety rules inside the Port area.

Sometimes, they don’t wear even basic safety equipment like helmets and safety shoes. On the other hand, when it comes to cargo handling infrastructure, the Port doesn’t have enough mechanised berths. They still depend on cranes to load and unload cargo. Although private players operate harbour mobile cranes, break downs are frequent.” Comparing PPT with the Dhamra Port (owned by Adani Ports & Special Economic Zone and located 216 km away from Paradip), Dash added, “Although port charges at Paradip are lower as compared to Dhamra, cargo loading, unloading and berthing related delays increases the overall per tonne cost at Paradip Port. Infrastructure and productivity are the two major issues at the Port.”

Straight from Bollywood

A cartel of unscrupulous elements having an iron grip over labourers in and around the Port is another issue that PPT should address urgently, if it’s serious about the future. And if you believe certain stakeholders, it’s PPT that is facilitating such a situation. “All over India, with only one (Stevedoring) licence, stevedores can load and unload cargo inside a port. But here, another licence called CFH (Clearing, Forwarding, Handling) licence is required. And although PPT is issuing stevedoring licenses to everyone, it is issuing CFH licenses to only a few. As a result, many are sitting idle. Despite agreeing to fulfill all requirements, we are not getting the licence,” Mahendra Kumar Swain Assistant Manager (Operations), Seaways Shipping, told The Dollar Business. This has meant that only a handful, which have the CFH licence, arm twist exporters and importers to cough up extra money. In fact, the situation has gone so out of control that Jindal Steel & Power Ltd. (JSPL), which uses the Port to import coking coal and limestone, has written a letter to the Ministry of Shipping complaining how the lack of competition has led to drop in efficiency at PPT. Among other things, the letter, sent by Kapil Rawat, Executive Director (Logistics), JSPL, mentions, “The concept of management committee must be abolished, which controls the labour deployment for port operation.

This is the main reason for not allowing competition at the port and only handful of old stevedores are controlling the operation. Out of more than 35 registered stevedores, only nine old members of this committee can draw labour operation. Rest 26 are dependent on these nine. So through this system, 25% of the stevedores are controlling the rest 75%. Until, the (Shipping) Ministry looks into this aspect and make this at par with all other major ports under its jurisdiction, it will be difficult to improve the efficiency level at Paradip Port.”

In the closet Hiding behind glossy numbers is PPT’s lack of infrastructure and inefficiency. Citing a live example, Dash of TM International Logistics Ltd. told The Dollar Business, “Our vessels MV Ocean Wind and MV Sher-E-Punjab arrived at Paradip on the 19th and the 24th of August 2014 respectively. Although it’s almost been 15 days and more than a week respectively (I met Subhakant Dash on September 3, 2014), both are in mid-sea waiting for berthing permission. The performance of Dhamra Port with just two berths (one for imports and one for exports) is certainly much better than Paradip’s 16 berths.” However, PPT’s Senior Deputy Traffic Manager K. K. Sahu denies all such allegations. “The Port has two mechanised berths to export thermal coal. PPL and IFFCO have two captive berths as well. One mechanised berth is being operated by Essar Steel for its pellet plant. We have floated tenders for mechanisation, but even for development of infrastructure, we have to take the approval of many ministries. This delays the process,” he told The Dollar Business. Sahu also mentioned one peculiar reason that slows down things at PPT. “Although we charge 2-3 times of regular tariff for the use of storage area after the free usage period of 60 days, some users don’t vacate plots on time,” he said expressing helplessness. “We also need 20-25 rakes/day but get only 12 rakes/day,” he added. At the same time, some users, on the condition of anonymity, said that the Port has only one berth (Central Quay – I) with 14.5 meter draft, which can handle gearless Panamax and MiniCape vessels (60,000-95,000 DWT). The other berths can only handle Handymax vessels (less than 60,000 DWT).

At a time when most international ports are moving towards handling Capesize vessels, which needs draft of more than 18 meters, it is surprising to know that India’s second biggest major port is still a long way off from acquiring such capabilities. In fact, the practice at PPT is that whenever a priority vessel comes in, it first gets berthing at CQ-I and after discharging some cargo, it’s moved to lower draft berths. In the meantime, if someone else wants to use CQ-I, it has to fork out money for moving the berthed vessel. Similarly, the Port has only two wharf cranes and five mobile harbour cranes operated by private players, which is a far cry from the facilities at other major ports in the country.

The puzzle

After spending three days meeting PPT’s stakeholders and learning about all that’s wrong with it, the obvious question in my mind was, “How on earth is PPT managing such stellar figures despite such inefficiencies?” The answer was hidden in the breakup of cargo handled by PPT. In the last 10 years, while traffic handled by PPT has grown at a CAGR of 10.39%, that of POL (Petroleum, Oil and Lubricants) has grown at an astounding CAGR of 29.21%. This means while POL accounted for just 2.79% of the total traffic handled by PPT in FY2005, it accounted for over 26% of the total traffic in FY2014. And since POL imports are largely done through Single Point Mooring and Oil Jetty operated by oil importers, PPT can’t and shouldn’t claim credit for the growth in traffic. And putting his seal on my hypothesis that the growth in traffic at Paradip Port is not because of PPT but despite PPT’s inefficiencies was K. T. Parashar, Assistant Commissioner of Customs, PPT. Parashar said the Port urgently needs to upgrade its infrastructure for faster clearing of cargo. “After the introduction of the EDI system, customs clearance has improved a lot. Moreover, the Port majorly handles bulk cargo, hence there is no real delay in customs,” he told The Dollar Business, confirming that the delay at PPT is of its own doing.

Can't always be lucky

Paradip is mineral-rich Odisha’s only and India’s East Coast’s leading major port and hence, has a very important role to play. Until now, its inefficiencies have been masked by lack of competition, rise in POL imports and several such reasons. The demand for it has continued to rise because of the lack of options available on the East Coast. But the powers that be should realise that they can’t take good fortune for granted. It doesn’t take much for the tide to turn. Isn’t it?

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.