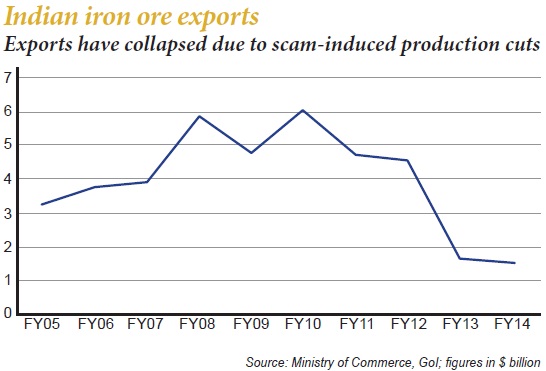

News, leads and analysis related to India’s trade and all that’s happened on the policy front during the month of December 2014 India–Russia Trade Putin’s India Visit A friend in need is a friend indeed Given the ongoing tensions between Russia and the West over the former’s annexation of Crimea, Russian President Vladimir Putin’s India visit, just a few weeks before that of US President Barrack Obama this Republic Day, seems to have raised a lot of eyebrows, particularly in US. This, more so, after Indian Prime Minister Narendra Modi, following a meeting with Putin, tweeted, “India’s partnership with Russia is incomparable.” However, putting aside fears, the US State Department has clarified that Putin’s India visit will, in no way, jeopardise US President Barrack Obama’s Republic Day visit to India. But unwilling to buy the argument that all’s hunky dory between India and Russia, a US State Department Spokesperson, Jen Psaki, said,“I’d remind you, India doesn’t support the actions of Russia and the actions – their intervention into Ukraine. They’ve been pretty outspoken about that as well.” It’s worth noting that following its annexation of Crimea, several sanctions have been put on Russia by US and other Western nations, which has seen the ruble sink to an all-time low against the US dollar and a sell-off in Russian bonds, with the benchmark 10-year yield more than doubling this year. The recent crash in crude oil prices (Russia is the world’ second biggest crude oil exporter, with exports of $173 billion in CY2013) has also exacerbated Russia’s economic woes, which has forced the former superpower to lookout for non-Western trading partners. India-ASEAN Pepper Imports Too spicy for the palate India has expressed concerns over pepper imports from South-East Asian countries, claiming it is affecting small farmers in southern states. Speaking about the issue while addressing business delegates of CLMV (Cambodia, Laos, Myanmar and Vietnam), Commerce and Industry Minister Nirmala Sitharaman said,“There are voices of anxiety that if there are other than legitimate trade coming in, may be some where some kind of rules/country of origin of rules being bypassed.” She went on to add, “I have provinces within India, particularly the southern provinces, which probably climatically have lot of commonness with these four countries (CLMV), were already expressing concern about agricultural products which are very unique to us also coming in a very big way into India and as producers, particularly the small producers, find it difficult to compete.” It’s worth noting that several Indian farmers’ associations have been very critical of India signing a free trade agreement with ASEAN, which they claim has been detrimental to the growth of exports of several spices, in which India has a dominant position in the world. USTR Intellectual Property Thumbs up from Uncle Sam As a testimony of Indian adherence of global trade and intellectual property best practices, the United States Trade Representative (USTR) has announced that it has closed an Out-of-Cycle Review (OCR) of India. In a statement, USTR said,“India has made useful commitments in recent months, including to institutionalise high-level engagement on IP issues, to pursue a specific work programme and to deepen cooperation and information exchange with the United States on IP-related issues under the US-India Trade Policy Forum.” However, keeping up the pressure, the statement noted, “As this OCR comes to a close, the United States looks forward to the 2015 Special 301 Review process, which will provide the next formal opportunity for a thorough review of India’s environment for IP protection and enforcement, including progress made on recent IP-related commitments and on engagement through the agreed work plan.” It’s worth noting that in April 2014, the USTR had announced that it “would initiate an Out-of-Cycle Review (OCR) of India in the fall of 2014.” Sugar Export Incentives A sweet and sour story In what could be the outcome of a veto by Ministry of Food, the Indian government has delayed the announcement of export incentives for raw sugar exports, which are expected at Rs.4,000/MT. Industry insiders feel Ministry of Food wants sugar mills to first pay up arrears to farmers before export incentives are announced for the next year. On the other hand, thanks to depressed domestic prices, arising out of massive stockpiles, it’s very difficult for sugar mills to pay farmers, unless they are allowed to sell in international markets. While this chicken and egg story continues in India, international observers feel if the Indian government approves export incentives, international sugar prices would come under pressure, particularly since the next Asian harvest is expected to be a fairly good one. It’s worth noting that last year, the Indian government had provided raw sugar export incentives in the range of Rs.2,277/MT and Rs.3,371/MT. Make in India RBI Forget page...not even on the same book! If one thought the friction between the Centre and RBI couldn’t get any worse, particularly after RBI Governor Raghuram Rajan completely ignored Finance Minister Arun Jaitley’s open plea for a rate cut, one was in for a surprise. For, speaking at a FICCI event, Rajan not only snubbed Arun Jaitley’s rate cut plea by stating, “Growth cannot be met just by undertaking monetary measures,” but also rejected Prime Minister Narendra Modi’s initiative ‘Make in India’ project, claiming the Chinese model is unlikely to succeed today. “Export led growth strategy will not pay for India as it did for the Asian economies, including China, due to the tepid global economic recovery, especially in the industrial countries. The world is unlikely to be able to accommodate another export-oriented China,” Rajan said.Going into specifics, Rajan added, “I am counseling against an export-led strategy that involves subsidising exporters with cheap inputs as well as an undervalued exchange rate, simply because it is unlikely to be as effective this time. I am also cautioning against picking a particular sector such as manufacturing for encouragement, simply because it has worked well for China.” While Rajan has become the first prominent rejecter of ‘Make in India’, what remains to be seen is for how long can he delay an interest rate cut, given November WPI inflation has come in at zero. India–EU FTA It doesn’t happen, until it happens While an India-EU FTA has long been cooking, if you believe EU Ambassador Joao Cravinho, the much awaited agreement is, now, just a few months away. Speaking on this, the Ambassador told an Indian news agency, “We are actually not very far from the agreement but we are not there yet. I am quite positive that next year or so it would be possible to finalise the free trade agreement.” Cravinho feels the delay in the unveiling of the new FTP by India has played a role in the FTA not seeing the light of day. “The Indian government has been a little slow; slower than we wanted to, in producing the new trade policy,” he said and added, “We expect that in the New Year we will see a new trade policy. Once that happens, we will be able to sit down again and resume our negotiations.” It’s worth noting that India-EU trade is largely balanced. Hence, there’re no fears of EU goods flooding the Indian market because of the FTA. Iron Ore Exports No to Ban What’s the secret fiscal measure? Putting aside fears that India might limit or completely ban the export of iron ore, Indian Minister of State for Mines, Steel, Labour and Employment, Vishnu Deo Sai has said the government has no such intentions. In a statement, Sai said, “The government has decided that although conservation of iron ore resources is of paramount importance, the same may not be achieved by banning or capping export of iron ore but by taking recourse to appropriate fiscal measures.” While what exactly those fiscal measures are have not been made clear, the statement has definitely come as a boost to India’s mining sector. It’s worth noting that once the world’s third largest iron ore exporter, India has been grappling with a series of mining scams that have ensured a massive drop in production. This has also seen a 70% drop in exports from $5.8 billion FY2008 to just $1.6 billion in FY2014. Duty Elimination RCEP For freer, flatter & fairer trades In a bit of a climb down, India has made an initial offer to eliminate duties on just 40% of product lines originating from the other 15 members of Regional Comprehensive Economic Partnership (RCEP). While China and South Korea have, unexpectedly, supported India’s offer, other members of RCEP – a mega FTA between the 10 ASEAN nations, India, China, South Korea, Japan, Australia and New Zealand – want India to offer freeing up 80% duty lines. While those urging India to do more, point at India-ASEAN FTA, wherein India has freed up 80% tariff lines, many others think that’s too much to ask, given that India runs massive deficits against China and doesn’t have any deal with even Australia and New Zealand. It’s worth noting that with an ambitious target of concluding negotiations by December 2015, RCEP has the potential of being a game changer in world trade.

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.