News, leads and analysis related to India’s trade and all that’s happened on the policy front during the month of July 2016

India

World bank REPORT

The World Bank Global Economic Prospects June report, predicts a gloomier 2016. The report expects the world economy to grow at 2.4% in 2016 and 2.8% in 2017, at a lower pace than its previous forecast of 2.9% and 3.1% for the corresponding two years respectively. The report further predicts Indian economy to witness 7.6% growth in 2016, 0.2% slower than what the Bank had predicted earlier. However, the prediction for the next two fiscals is 7.7%.

Interestingly, China is likely to grow as expected, at 6.7% and 6.5% in 2016 and 2017 respectively. Russia and Brazil are projected to be reeling in recession, while advanced economies will be recording weaker-than-expected growth. But then, amidst the gloom, India has a reason to cheer as it retains the crown of being the world’s fastest growing economy, leaving behind its large emerging market peers as well as advanced economies.

“Relative to other large emerging economies, purchasing manager indices for India reflect more buoyant sentiment. Business start-ups are on the rise, particularly in the e-commerce and financial services sector. Furthermore, increased public investment in infrastructure development is contributing to an improved business environment and reduced supply-side constraints,” states the report. Also fueling this growth is the ongoing liberalisation of India’s foreign direct investment (FDI) regime. “FDI to India surged 37% from the launch of the ‘Make in India’ campaign in October 2014 to February 2016, with computer software and automotive sectors attracting the bulk of this investment.” The Bank however indicates that India’s expansion is likely to decelerate in the next three years as growth is slowing sharply in commodity-exporting countries.

“Relative to other large emerging economies, purchasing manager indices for India reflect more buoyant sentiment. Business start-ups are on the rise, particularly in the e-commerce and financial services sector. Furthermore, increased public investment in infrastructure development is contributing to an improved business environment and reduced supply-side constraints,” states the report. Also fueling this growth is the ongoing liberalisation of India’s foreign direct investment (FDI) regime. “FDI to India surged 37% from the launch of the ‘Make in India’ campaign in October 2014 to February 2016, with computer software and automotive sectors attracting the bulk of this investment.” The Bank however indicates that India’s expansion is likely to decelerate in the next three years as growth is slowing sharply in commodity-exporting countries.

As of December 2015, about $45.7 billion (2.2% of GDP), had been pledged under the Make in India campaign. The World Bank also predicts that the global growth will stabilise and pick up to 3%, but only by 2018. If these predictions come true and India settles its domestic concerns, then nothing can stop India’s rise in the global economy.

Banking and drama seldom go hand in hand. But when it comes to the country’s most loved banker’s resignation, sparks are bound to fly. RBI Governor Raghuram Rajan wrote a letter to his colleagues at the central bank deciding not to extend his term once it ends in September 2016, sending shock waves across financial markets.

Rajan said that he was an “academician” and “(his) ultimate home (was) in the realm of ideas”. Rajan was amongst the “few good men” who had played a very positive role in handling inflation, reforming the financial system and cleaning up the books of the public sector banks. His departure could prove to be a major setback to the fight against crony capitalism and the clearance of stressed assets. Experts predict that the volatility of the rupee will increase in the light of this development. This dramatic exit of Rajan from the stage has left the Indian economy starved for credible actors to fill his space. But then the gentleman has himself stated that the RBI is bigger than any governor. “I will, of course, always be available to serve my country when needed,” states his letter.

India-Qatar

Bilateral trade

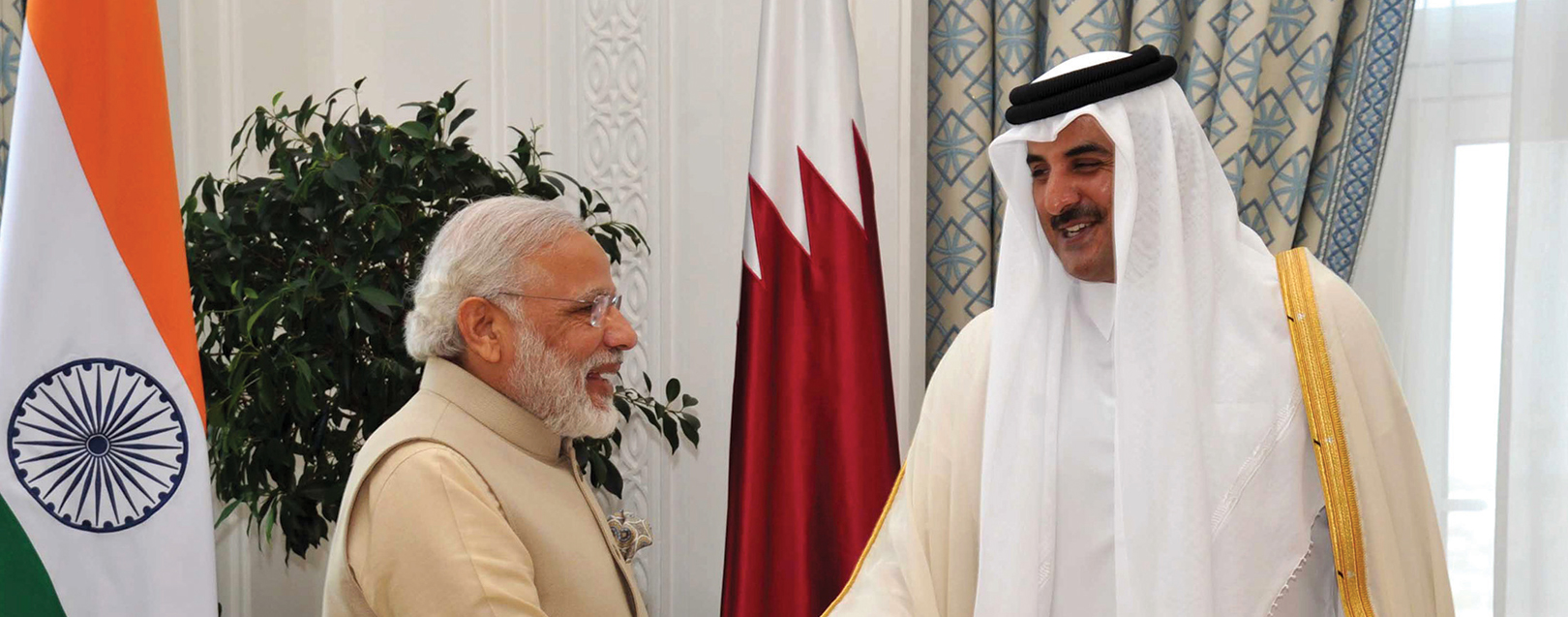

It seems that PM Narendra Modi’s visit to Qatar has started “a new era of friendship.” The Indian Prime Minister, during his two-day visit to Qatar, earlier this month, met Emir of the State of Qatar, Tamim bin Hamad Al-Thani, and signed seven memorandum of understandings (MoUs), including one to open up Indian market to Qatar’s Sovereign wealth fund. India is now looking forward to tap Qatar’s sovereign wealth fund, estimated at $300 billion, for infrastructure development projects across the country.

Qatar is an important trading partner for India in the Gulf region, with bilateral trade between the two countries touching $15.66 billion in FY2015, before declining to 9.92 billion in FY2016. It is also one of India’s key sources of crude oil – India imported petroleum gases and other gaseous hydrocarbons worth $6,317 million in FY2016. However, the duo decided that it’s time to look beyond just trading relationship and make headway into strategic investments.

There is a vast potential for augmenting Qatar’s investment in India. Qatar’s investment in Indian sectors, such as construction, infrastructure will earn India the much needed FDI. Even Qatar has extensive infrastructural development requirements, a market Indian infrastructure companies could look at. Now that’s what you call a win-win situation!

FDI

Economic reforms

When the news of RBI Governor Raghuram Rajan’s exit (Rexit) was staring us in the face, we knew that the Government of India needed to pull a rabbit out from the hat to stem the impact. The PM’s office managed to do more by announcing the easing of the FDI norms – allowing 100% FDI in sectors such as air transport, food processing, defence manufacturing, information and broadcasting, single brand retail, and pharmaceuticals. PM Modi said that the change in FDI norms will provide a “major impetus to employment and job creation” and would make “India the most open economy in the world”. The news also mitigated the panic, which Rexit had brought with itself, by assuring investors of the government’s will to fast track reforms that were essential for the growth of economy. These reforms are expected to improve the ease of doing business in India and boost the “Make in India” initiative, bringing India closer to its dream of being the global manufacturing hub. As the government keeps opening up the remaining sectors of the economy, we can expect more MNCs making a beeline for India.

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.