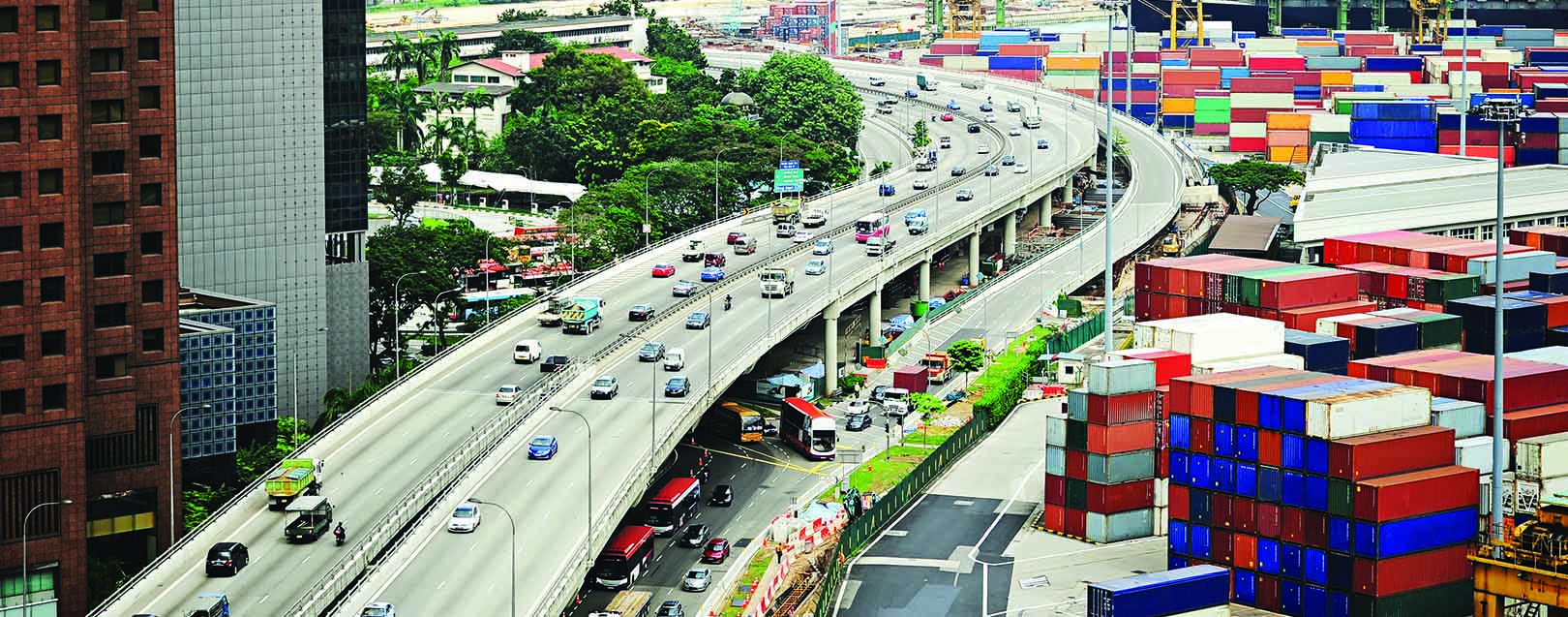

A highway near Singapore's commercial port. Singapore is one of the world's busiest ports in terms of shipping tonnage and transships a fifth of global shipping containers

Upon hearing the word ‘export’, odds are high that the first proper noun that comes to one’s mind is China. And why not? With exports of over $2 trillion for each of the last two years, China has been the world’s top exporter for five straight years. But then China is the world’s most populous nation and the world’s second biggest country in terms of land mass. So, how about a country that exports almost 20% of what China does but has a population that is less than 0.4% of China’s, spread over less than 0.01% as that of China. Sounds impossible? Then you haven’t heard of Singapore – which sits pretty on top of the list of countries when it comes to per capita exports. But being a small country means it imports in massive quantities to facilitate these exports. And herein lies a great opportunity for Indian exporters. The modern history of Singapore began in 1819 when Sir Thomas Stamford Raffles established a British trading port on the island, the primary objective being keeping the Dutch at bay. Under British colonial rule, Singapore grew in importance as a center for India-China trade and the entrepôt in Southeast Asia.

During World War II, Singapore was conquered and occupied by the Japanese Empire from 1942 to 1945. When the War ended, Singapore reverted to British control, with increasing levels of self-governance, which culminated in Singapore’s merger with the Federation of Malaya to form Malaysia in 1963. However, social unrest between Singapore’s ruling People’s Action Party and Malaysia’s Alliance Party resulted in Singapore’s separation from Malaysia. As a result, Singapore became an independent republic on August 9, 1965. Since then, the island nation has developed rapidly.

Asian pride

Rapid economic growth after independence meant that by the 1990s, Singapore had become one of the world’s most prosperous nations, with a highly developed free market economy and strong international links. Today, Singapore is the 13th largest merchandise exporter and the 15th largest merchandise importer in the world. According to WTO, Singapore has the highest trade/GDP ratio in the world – 407.9%. Due to its geostrategic location and developed port facilities, a large volume of Singapore’s merchandise exports involve entrepôt trade. Being a strong advocate of free trade, Singapore has very few trade barriers. Trade partners with Most Favoured Nation (MFN) status enjoy zero tariff. There are, however, some import restrictions based mainly on environmental, health and public security concerns. Exports, particularly that of electronics, chemicals and services – including the fact that Singapore is a regional hub for wealth management – are the main sources of revenue for the economy, which allow it to purchase natural resources and raw goods which the country lacks. Singapore also has limited arable land. Hence, it relies on Agro-Technology for agricultural production.

Since Raffles' times

Trade relations between India and Singapore have been very strong since the days of the British Empire. Economic and commercial ties have only expanded in recent years, particularly after the conclusion of the Comprehensive Economic Cooperation Agreement (CECA) in 2005. Today, Singapore is India’s largest trade and investment partner in ASEAN and accounted for 25.9% of India’s total trade with the group of nations in FY2014. With it being a regional hub for financial services, Indian companies are also increasingly using Singapore for raising funds, particularly for their global operations. The India-Singapore CECA includes components like a free trade agreement (FTA) in goods; an arrangement for boosting trade in services, including financial services; a package to promote investment flows and provide mutual investment protection; a new agreement to avoid double taxation; mutual recognition agreements on quality certification of goods and services; liberalised visa rules for professionals; and undertakings to cooperate on several sectors like customs, dispute settlement, intellectual property rights, education and e-commerce. Bilateral trade between India and Singapore has grown from just $6.65 billion in FY2005 to $19.3 billion in FY2014 making it India’s 10th largest trading partner in the world.

With the signing of DTAA (Double Taxation Avoidance Agreement), which provides for certain benefits for investments coming from Singapore, the country has emerged as the second largest investor in India, accounting for about 11.6% of the total FDI received by India till date. Given Singapore’s location and the growing Asia-Pacific market, Indian companies often use Singapore as a spring board to tap growth opportunities in the region.

In addition, incentives provided by Singapore and its competitive tax regime have encouraged Indian companies to set up both manufacturing and servicing operations in Singapore. Currently, more than 4,000 registered Indian companies are estimated to be present in Singapore. Nine Indian banks such as Bank of India, Indian Overseas Bank, UCO Bank, Indian Bank, Axis Bank, State Bank of India, ICICI Bank, EXIM Bank and Bank of Baroda have operations in Singapore. Some of the leading Indian companies that have invested in Singapore are Glenmark, Ranbaxy, Bharat Electronics, Polaris Software and India International Insurance Co. Similarly, some of the leading Singaporean companies that have invested in India include PSA International, NOL Shipping, DBS Holding, Keppel Land, Temasek Capital, SingTel, USEL and Accendas Technologies.

...and today

The Indian business community is the largest foreign business community in Singapore. Singapore is also a foreign exchange hub and the fourth largest forex trading centre in the world. Moreover, a common legal system, a neutral location for arbitration, a strong IP protection regime and convenient air connectivity are some of its other advantages. Singapore is also the top destination for outbound investment. It has traditionally been an IT & Telecom hub with good infrastructure such as data centres, sub-marine cable capacity, strong talent pool and strong competence in areas such as mobility and analytics. Indian companies like Tata Communications, TCS, Mahindra Satyam, Tech Mahindra, Infosys and Wipro have established significant presence in Singapore. Other than technology, Singapore is also a hub for FMCG. Global FMCG giants like P&G and Unilever have a very strong presence in Singapore. Pharmaceuticals and biotechnology are other areas of interest in Singapore.

Its track record of manufacturing high quality medicines, world-class research infrastructure and a strong IP regime to protect key R&D outcomes, provide corporations with enough reasons to establish global links via Singapore. With India trying to fix its infrastructure problems, many Indian companies have started venturing overseas to secure upstream resources such as coal mines and plantations. And given Singapore’s double taxation avoidance agreements with many resource-rich Asian countries, it inevitably ends up becoming a base for Indian companies to invest and manage these upstream resources from.

Low-hanging fruits

Despite strong historical and current economic ties and the fact that India’s exports to Singapore have grown at a CAGR of 19.42% over the last decade, a detailed The Dollar Business Intelligence Unit analysis reveals that there are still 13 multi-billion export opportunities for the taking. To arrive at a list of products in which Indian exporters have missed out on billion dollar opportunities, we took into account only those products (at 4 Digit HS Code) where Singaporean imports were worth over $1 billion in CY2013 and Indian exports were worth over $1 billion in CY2013, but still offered at least $1 billion of opportunities. Right on top of this list is petroleum oils (HS Code 2710). Being the ‘undisputed oil hub in Asia’, Singapore imported mineral fuels worth $117 billion in CY2013. Of this, while $35.57 billion was accounted for by crude oil, refined/processed petroleum oils were worth over $74.65 billion. And although India did manage to cater a bit to this demand, we missed out on about $68.7 billion worth of opportunities – roughly equal to India’s total export of petroleum oils in CY2013. Another standout product in this list is electric apparatus for line telephony (HS Code 8517). While Singapore imported goods worth over $9.3 billion under this category ($5.8 billion worth of mobile phones) and India exported over $3.4 billion worth of goods under this category ($2.2 billion worth of mobile phones), India’s exports to Singapore were worth just $51.9 million. The third biggest opportunity for Indian exporters is aircraft parts (HS Code 8803). While Singapore imported over $5.2 billion worth of aircraft parts and India exported over $1.5 billion worth of the same in CY2013, India’s aircraft parts exports to Singapore were worth just $10.6 million. Other prominent goods that offer such multi-billion dollar opportunities include auto parts (HS Code 8708), electric transformers and static converters (HS Code 8504) and unwrought gold (HS Code 7108). In fact, if you add the potential export opportunities for Indian exporters in just these 13 categories, you arrive at a number which is just below $100 billion – nearly 31.5% of India’s total exports in FY2014.

Blast from the past It was Calcutta (now Kolkata) from where Sir Thomas Stamford Raffles set sail in 1818 and established British rule in Singapore. In fact, it was Calcutta from where Singapore was governed for 44 long years between 1823 and 1867. Given such strong historical ties and despite the presence of a large Indian community in Singapore, it actually is a surprise that India’s exports to Singapore have grown at a CAGR that is just two percentage points more than its overall exports. So, isn’t it time to ‘Look East’ more?

Dr. A. K. Sengupta Chief Consulting Editor, The Dollar Business; Former Dean of The Indian Institute of Foreign Trade (IIFT), New Delhi

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.