Indian boiler manufacturers have been capitalising on opportunities in their traditional export markets for long now. It’s about time they look beyond these markets and focus on new markets that have the potential to take India up the global industry value chain.

Vanita Peter D’Souza | November 2015 issue | The Dolloar Business

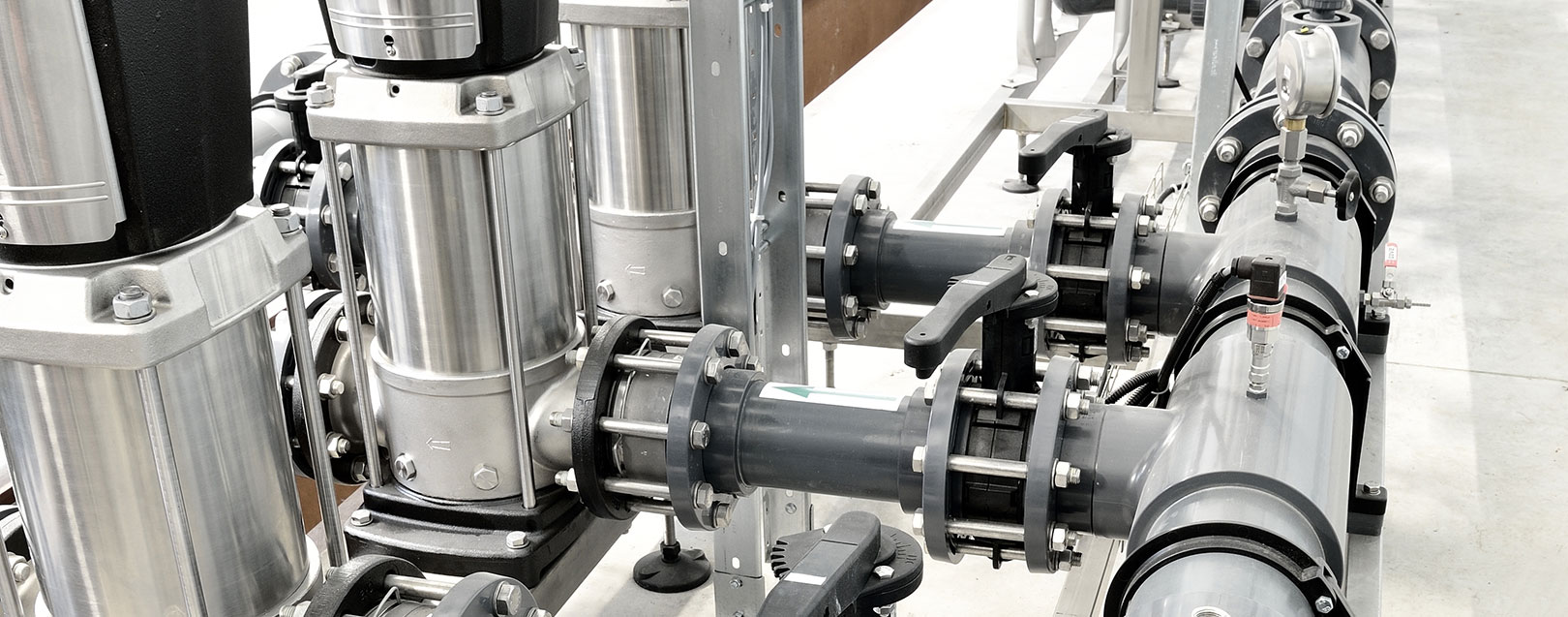

From fueling the industrial revolution over the centuries across the globe to energising the growth engines of our economy, boiler technologies have evolved (as per changing requirements) to become a crucial component of Indian manufacturing, complementing and supplementing production dynamics. India’s expertise in the water tube boilers industry is evident from the footprint it has established in different parts of the world.

Steamed Up

Boiler being an engineering product has complex dynamics and risks attached to its production, which may not be easy to fathom for an outsider. To understand the function of a water tube boiler, The Dollar Business caught up with Manmohan Sabharwal, Director, Tecor, a New Delhi-based manufacturer and exporter of boilers. According to him, water tube boilers are used in plants requiring tonnes of steam at high pressure, specifically sugar mills, agro industries, textile industries, etc. It is also used for power generation and co-generation. “In co-generation, electricity and heat is produced at the same time,” Sabarwal explains and adds that a unit or plant may not need an installation of water tube boiler always. “We first look at the use the boiler will be put to in the industry, such as the amount of steam it requires, and then decide what type of boiler needs to be installed. Water tube boilers are large and the steam requirement is round the clock,” he tells The Dollar Business. Pointing out the difference between smoke tube boilers and water tube boilers to The Dollar Business Ashwani Sethia, CEO, Thermodyne Engineering Systems, says: “In case, if the requirement of steam is up to 10 tonnes (T), one should invest in a smoke tube boiler. A smoke tube boiler has a threshold of 10 T but it has the capacity of up to 15T. However, plants which need above 10T of steam should prefer water tube boilers.”

Heat Exchange

Water tube boilers are exported under two different HS codes, the code being determined by the capacity of the boiler to produce steam per hour. Water tube boilers with a steam production exceeding 45T per hour are listed under HS Code: 840211 while those which do not exceed 45T per hour are exported under HS Code: 840212. Though small, the quantum of exports of water tube boilers with a steam production exceeding 45T per hour (HS code 840211) from India assumes significance, considering the fact that it is positioned 4th among the very few countries having sizeable global presence.

With a total global export market size valued at around $765 million, India should focus on consolidating on its exports valued at about 10% of the market size during FY2014-15 by making forays into uncharted and sparsely tapped terrain. For instance, the size of the top exporter, South Korea, is three times bigger than India’s, with the latter’s share being around 33%. United Arab Emirates is the largest importer from South Korea with procurements valued at $154 million. Interestingly, exports from Korea to its two top markets – UAE and USA – witnessed a big jump during CY2014 over that of the previous year. While USA emerged as a new market for Korea with imports valued at $83.5 million, procurements by UAE increased by over 50 times from a little over $3 million in CY2013 to over $154 million in CY2014.

On the other hand, India’s exports to UAE and USA were $4.5 million and $14,000 respectively in CY2014. Though the quantum is miniscule, but from a positive point of view, India’s very presence itself in USA and UAE can be translated into making forays and capturing the existing export market size in these countries. An analysis of the four year-long exports pattern from FY2011 to FY2014 of both South Korea and India should prove to be a revelation to the Indian exporters because it points to some parallels between the two countries in terms of market gains. During FY2012 India’s exports were valued at a little over $50 million was double than that of South Korea’s, valued $23.5 million. During FY2013, India’s exports came down to around $32 million, while South Korea gained ground to achieve $63 million. The next fiscal witnessed India moving ahead with exports valued at about $68 million compared to South Korea’s valued at $41.1 million. But, 2014 witnessed South Korea breaking away from the fluctuating trends and leap frogging by an amazing 500% to $253 million and carving out around 33% of the market size. While India did record an increase over the previous fiscal, it was left far behind in the race.

Although the gap had widened between the two countries in the last fiscal, one very important factor that has emerged from the analysis of the patterns and rallying market shares during the three fiscals, before South Korea surged ahead, indicates that India can make further inroads into top exporter’s domain, specifically US and UAE. When it comes to export destinations for Indian boliers, Indonesia is the largest market for the Indian water tube boilers that produce steam in excess of 45T per hour. Almost 60% of these boilers are exported to Indonesia, 13.7% to UAE and a little over 7% to Thailand and Nigeria. Indonesia is an agro and allied industry based nation and a lot of sugar mills, distilleries and extraction plants are situated in the country. Hence, they are the top importers of Indian boilers as Indian products are cheaper compared to those of other exporters. For boilers that produce less than 45T of steam per hour, Bangladesh is one of the major markets (22.40%), followed by Kenya (11%) and Ukraine (8%).

BOILER EXPORTS FROM SOUTH KOREA TO DEVELOPED NATIONS HAVE GROWN MANIFOLD NOVEMBER

It’s complicated

Increased market size could result in more players emerging in the boilers segment. But fickle and knee-jerk policies related to the steel sector is impacting the economies of scale in the boilers segment, specifically when it comes to imports. The reason is simple. Raw materials account for more than 50% of the boiler cost and steel happens to be the most important raw material for a boiler. “Now, imagine how difficult it is for the industry to buy a raw material which attracts a safeguard duty of 20%, an anti- dumping duty and a basic custom duty which was hiked twice in the last three months,” avers Setia. The Indian boiler industry, including the water tube boilers are regulated by the Central Boiler Board (CBB) under India Boiler Regulation (IBR), 1950. IBR includes the manufacturing guidelines, usage and inspection provisions in the boiler industry. The CBB has appointed either a Chief Inspector or Director General or an equivalent authority to inspect the boilers in each and every state. A manufacturer cannot introduce the boiler in the market without getting a clearance from them. “We have to manufacture a boiler under the IBR guidelines,” says Sabharwal.

There are many risks associated with boilers both during production and usage, and boiler explosions were a common occurrence across the globe until standards and regulatory authorities were legislated. Regulation and standardised rules and processes are good for the exporters, as they not only ensure the quality of the product, but also create barriers for less quality-conscious manufacturers and protect the country’s reputation.

THE NEXT STEP

While, as per exporters, margins in water tube boilers remain lower than other manufactured goods, exports from India are growing significantly and the country is well on its way to become a major player in the global market. Not to say, exporters have already made forays into developed markets and the trade there is gaining momentum. If we can ensure the right quality product at a competitive price, no one can stop India from becoming the global leader in the trade!

“INDONESIA IS A LARGE MARKET FOR INDIAN BOILERS”

TDB: What is the difference between smoke tube boilers and water tube boilers? Could you also give us a detailed mechanism of these boilers?

Ashwani Setia (AS): The boiler is basically a device that can produce steam. Steam is produced when we convert the chemical energy of fuel into heat energy. Then, the heat energy has to be transferred into water to produce steam. For such kind of a transfer, you pass some smoke tubes into the water, then the water gets heated and gets converted into steam. Alternatively, you can make a wall of water tubes and put fire inside that. So, if water is in the tubes, it is a water tube boiler, and if there is smoke inside the tube, it becomes a smoke tube boiler. Ideally, the customer should not be concerned about what kind of design it is. He should know how much steam and pressure he needs. This is called process application. If the requirement is small, the customer can use a smoke tube boiler, which can be manufactured at an affordable price. In case of a bigger requirement, the smoke tube boiler is not a viable option. For higher capacity or higher working pressure range, a water tube boiler is the best choice.

TDB: Which major industries demand water tube boilers?

AS: Any process industry, which includes any heating process, uses these boilers. It could be sugar, chemical, food process, plywood, or even the textile industry. In a heating process, you need steam and it is a media which can heat evenly. Heat is also needed for power generation. Generally, the requirement of these power generation companies is huge, as steam has to be generated at a much higher working pressure. In these cases, the only option is to invest in a water tube boiler.

TDB: In your opinion, why is Indonesia the top importer of water tube boilers?

AS: Indonesia is a growing economy and has lots of wood industry. Additionally, with climate change and the protocols of developing nations, all process industries have started to move out of them. As a result, the polluting industries are moving to countries like Indonesia, which is why they require a lot of boilers. But since they do not produce their own boilers, they are the net importers.

TDB: What is the average margin of an exporter of boilers?

AS: The margins have squeezed over the last few years. In the last 20 years, the price of boilers has remained the same, more or less. Earlier, people could make up to 100% profit; today the average margin is 10%, which can go up to 30%, or even slip to 5%. In countries like China, commodity prices are much lower. In these kinds of engineering products, we have very little of what we call as engineering and more of raw material cost. In the case of boilers, more than 50% is raw material cost. So if the cost of this 50% material gets cheaper by, say 10-15%, our margins might increase.

TDB: How efficient is the Central Boiler Board?AS: The Central Boiler Board is the regulatory body for the manufacture and usage of boilers in India. So, in a way, it controls or rather gives protection to the Indian boiler industry from foreign competitors. Their regulation is good for the industry. Otherwise, everyone would start making boilers, further deteriorating the quality of India boilers, domestically and internationally, and then there would be explosions every day.

TDB: What are the risks involved in manufacturing a boiler? Is it easy to find skilled labours?

AS: Since it is a boiler, it includes a lot of risks, so you have to check your boiler with radiography. That means you have to check each and every welding joint through an X-ray. Even if there is a pinsized hole, we say that the bonding of the metal is not done properly and it has to be repaired right there. Getting skilled welders is a little difficult. So yes, there is a shortfall. Although there is abundant labour, their skills are not always up to the mark.

TDB: There is so much noise about PM Modi’s ‘Make in India’ scheme. How do you think the boiler industry could benefit from it?

AS: There are many activities that promote ‘Make in India’, but at the ground level results are yet to come. Broadly, the scheme is for every industry. If other industries grow, the boiler industry will automatically grow, as it is a capital equipment required in many industries.

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.