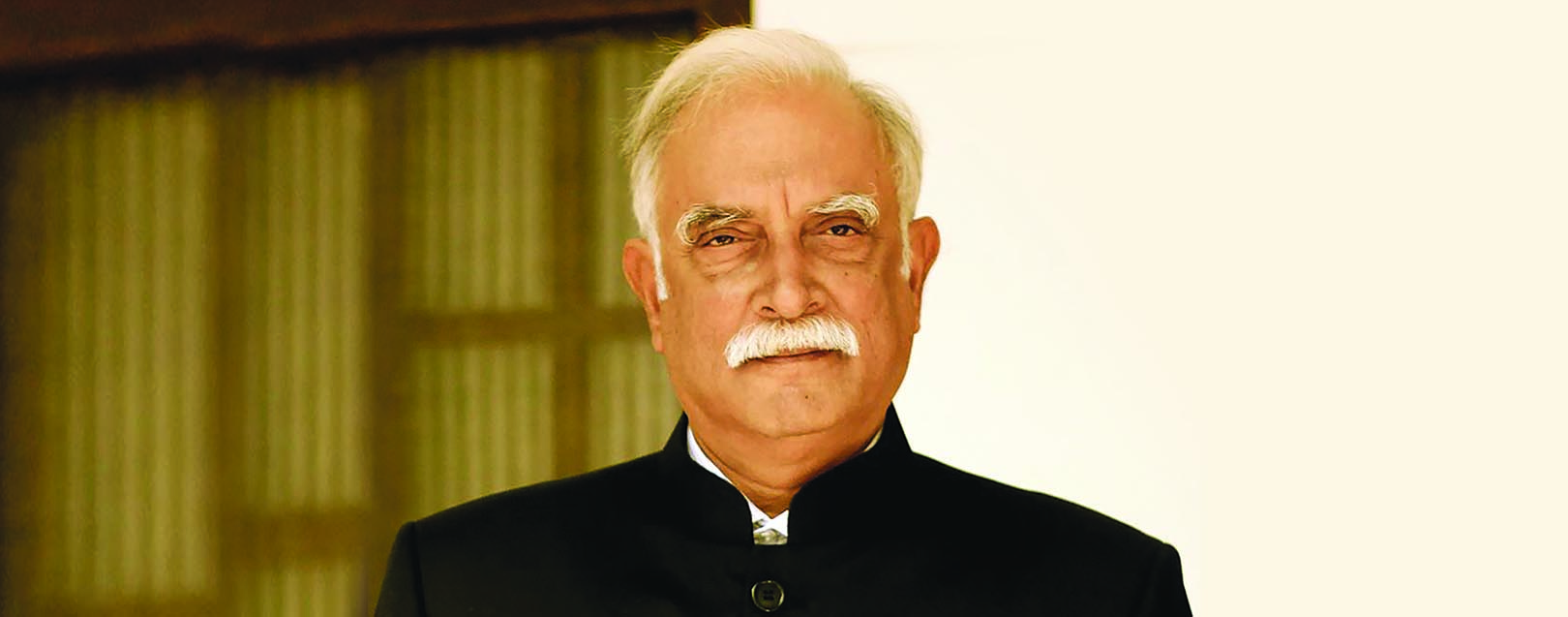

Ashok Gajapathi Raju, Union Minister For Civil Aviation

P. Ashok Gajapathi Raju, Union Minister for Civil Aviation, GoI, is not one to shy away from posers on thorny issues affecting the civil aviation segment. In a candid conversation with The Dollar Business, he argues that the sector is still focussed on passenger-driven ‘belly of the aircraft’ revenues and not freight cargo, and that he still believes the ‘5/20 rule’ of protectionism needs to go.

Interview by Satyapal Menon | May 2016 Issue | The Dollar Business

TDB: The uptrend in the performance of Air India and private airlines is attributed to reductions in oil price and operational costs. Does it mean that this is only a temporary phase enabled by declining prices on the input side or do you foresee India’s airlines readying for a takeoff from this point?

Ashok Gajapathi Raju (AGR): More than that, I would like to say that their books are better now and obviously that would help. There are certain factors which have an immediate impact on the economy and there are some which will impact on a long term basis. With oil prices coming down there will be good and bad impacts in different spheres. A case in point could be Kerala, a state from where a large number of Indians are working in oil producing countries. During my recent visit to this state, I was told that these companies were tightening their belts because their economy was on the downside as a result of downslide in oil prices. And this had a repercussion even in Kerala. So the impact is interdependent.

TDB: What we want to point out is that due to global ATF prices falling, the going now is good for the Indian aviation sector. Will the good times continue?

AGR: There could be an increase at some point in time. The oil watchers – I would like to call them that – are saying that the increase will not happen beyond a particular level because then the production moves from one place to another globally and also because of some types of oil becoming economical. So I feel that oil prices may not go back to the highs it has reached in the past – that does not look probable – and there would be some kind of improvement in growth and performance of the sector as well.

TDB: It is quite inexplicable why there is absolutely no focus on enhancing air cargo facilities and infrastructure and capitalise on the sector’s untapped potential. The new draft of the civil aviation policy does mention some initiatives but results are yet to materialise. Is implementation proving to be a tough task for the government?

AGR: Presently, not much of transportation is happening by air. We do have some movement of vegetables and fruits to Singapore but it is only in the ‘belly’ of the aircraft and not through freighters. There are freighters coming into Bangalore, Delhi and Mumbai. But they are very few in numbers. Moreover, air is an expensive mode of transport and not many stakeholders can afford to transport their commodities by air. Another factor that needs to be looked into is the low demand for freighters in India. Air transportation is a feasible option for high-value-low-volume goods, perishables and many of the products marketed through the online platform. But in India, the thinking for using this option is yet to take-off. We are contemplating to develop this sector and are in the process of putting it across the trade and industry associations to create the market for air transportation of commodities.

TDB: There are many regions which have inadequate road and rail connectivity. The stakeholders, specifically in processed agri-products sector, in these areas are unable to market their resources due to this lack of connectivity. Don’t you think these areas will be better served by air connectivity?

AGR: Agriculture products definitely need focus. They are perishables and are being exported at a miniscule level. The activity has to be scaled up. Infrastructure-wise there is a bottleneck in terms of runway space for freighters – length of runways is limited. Presently, there are only few airports in India which have proper infrastructure to accommodate freighters – Bangalore, Delhi, Hyderabad and Mumbai. Bangalore airport can handle 20 freighters or more because it is a modern airport. Hyderabad and Delhi also have similar advantages. Mumbai and Chennai have problems because they are congested airports. In a congested airport you cannot increase freighter movements. Another aspect is that there are no Indian players in the freighters segment except Blue Dart. We are keen to promote freighters by creating the infrastructure and clearing policy bottlenecks if there are any.

We have in fact been emphasising on this on every platform during our interaction with representatives of the industry. We are interacting with some states about establishing exclusive air freight stations with supporting infrastructure. But the main thing is that the market has to demand it and the economic activity has to provide that product. We do see tremendous potential in air cargo and this can be harnessed to everybody’s benefit.

We Are Keen To Promote Freighters By Clearing The Bottlenecks In Policy, If Any

TDB: But this again is a chicken-and-egg situation – if the facility is there, the trade will come in, or if the trade is there the facility will be established.

AGR: It is definitely not a chicken-and-egg situation. If the demand is there, the facility would come up.

TDB: Is there a communication gap?

AGR: There is no communication gap. It is reflected in the number of interactions we have had with the trade and industry at different levels and places.

TDB: But again, is it not rather unfortunate that realisation is yet to dawn upon the government to create infrastructure despite the existing necessity for air cargo facilities all these years?

AGR: India is a big country. If you take the case of Singapore, whether you land or take off, you are looking into the sea. And Dubai, how many destinations does it have? There is only one basically! If you take all the countries in the United Arab Emirates there would be only three or four destinations. Compared to that, we do have the infrastructure here but somehow there is a block. And that infrastructure development has not happened is a reality. It’s probably because the mindset of Indian aviation has always been passenger-centric.

TDB: ...and the mindset persists?

AGR: I think it continues among the captains of economic activity. They have to change their mind. It is only then that we will see activity on the ground.

TDB: But then you need to provide them the facilities. Shouldn’t you?

AGR: That is why I said, transport should not become a bottleneck. So, we need to work together. If you work in isolation, it will not happen.

TDB: So, what are your expectations from the industry and trade?

AGR: See, if there is growth – which is clearly visible in terms of number of passengers and number of aircraft – and if the industry has contributed to the economic growth then it goes back into the industry. It is mutual and works both ways. So, if you get this going you will be able to harness this big resource which everybody agrees is hardly being utilised.

TDB: You were quite critical about 5/20 rule for allowing private operators the right to ply international routes. But at the same time the draft aviation policy finds mention of this rule. If you are so convinced about the 5/20 being unscientific, why was it offered as one of the options in the draft policy?

AGR: Politically speaking and going into the manifesto of the political parties, aviation has been a non-issue. Of course, there is a sentence of regional connectivity in the BJP manifesto and since it is a major partner of the NDA we thought of keeping that as sacrosanct. The decision making it mandatory for players to have 5 years flying experience and 20 aircraft to qualify for plying international routes was taken by the Cabinet earlier. Now to reverse it we need the decision of the Cabinet again. I am convinced that the 5/20 rule slows down Indian players and will remain convinced about it. Now, Indian players have become used to the comfort or discomfort of protection – whatever you call it and whichever way you see it. Their angle or contention is that if new players are allowed to come in, they have the advantage of access to financial resources since their books are clean. The 5/20 players are of the view that they are at a disadvantage since they had slogged under the old system where their books were not that good.

Ashok Gajapathi Raju on the flight simulator at the AI Central Training Establishment (CTE) in Hyderabad.

Ashok Gajapathi Raju on the flight simulator at the AI Central Training Establishment (CTE) in Hyderabad.TDB: Do they feel that they would not benefit from the rule being rescinded?

AGR: They said they are put to a disadvantage. But in the last one year, with the passenger traffic going up and ATF prices coming down, economies behaving better and profits being reported, this contention does not hold good. So, we are trying to convince our colleagues that this is a rule that would be restrictive to Indian players.

TDB: FDI inflow into the MRO segment is expected to be a game changer for the civil aviation segment. Going forward, what advantages do you foresee as a result of MRO companies sprouting on India’s firmament?

AGR: MRO (maintenance, repair, and overhaul) issues need to be addressed because that will generate a lot of jobs. As of now, barring the public sector airlines, private airlines are going abroad for their routine maintenance. They are going to places like Singapore, Dubai and Sri Lanka. From Indian players’ point of view, it’s a $600-700 million business going out of the country. The impediments seem to be from two sides as far as the government is concerned – one is the service taxes and the other is Customs duties. The Customs duty has a window of one year i.e., if you get a spare part you have to consume it within one year. There were suggestions from the players that it should be extended to three years. On these two issues, I think a decision would come from the government soon to address these issues once the policy is finalised. It will enable the players to bring this activity to India. And it need not stop at that. Foreign players can also come here for maintenance, when they have a cost advantage. It is difficult to estimate the value as of now, but that possibility is very much there. There is the issue of VAT when it comes to the states. So, this activity would go to states which are aviation friendly. We are getting a lot of enquiries because this is a known business. See, if you take any airline, even IndiGo, they are now flying out to get their standard checks done. Airlines could only be too happy to get it done here, if the facilities exist, because of time and cost advantages.

TDB: In many instances, regulations and regulatory processes seem to be an impediment in ease of doing business. For instance, in the Kingfisher collateral issue. What are your plans to facilitate smooth passage for the players in the aviation industry?

AGR: From the aviation point of view there are two important aspects: safety, which has to be regulated and cannot be compromised on, and security. On these two, we are very rigid. On other aspects, we are very flexible. On the Kingfisher collateral issue, Indian aviation took a drubbing and Indian leasing costs went up. Kingfisher was the last airline which crashed. After that SpiceJet went through a turbulent period, but now I have a feeling that it is coming out of that. We have been telling them that we will be helpful in terms of payment of their current bills and settling old dues in instalments. It did help them a little bit. But you should manage your own problems. They worked on their problems and have come out of it. But in case of Kingfisher we cannot say much, because it happened a few years back, and the government of the day in their wisdom decided what they had to.

Get the latest resources, news and more...

By clicking "sign up" you agree to receive emails from The Dollar Business and accept our web terms of use and privacy and cookie policy.

Copyright @2026 The Dollar Business. All rights reserved.

Your Cookie Controls: This site uses cookies to improve user experience, and may offer tailored advertising and enable social media sharing. Wherever needed by applicable law, we will obtain your consent before we place any cookies on your device that are not strictly necessary for the functioning of our website. By clicking "Accept All Cookies", you agree to our use of cookies and acknowledge that you have read this website's updated Terms & Conditions, Disclaimer, Privacy and other policies, and agree to all of them.