Govt sets up multi-agency probe team on money stashed abroad

Source: PTI

With 500 Indians being named in leaked 'Panama Papers' for alleged offshore holdings, the government on Monday formed a multi-agency group to monitor exposes in this regard and vowed to take action against all "unlawful" accounts held abroad.

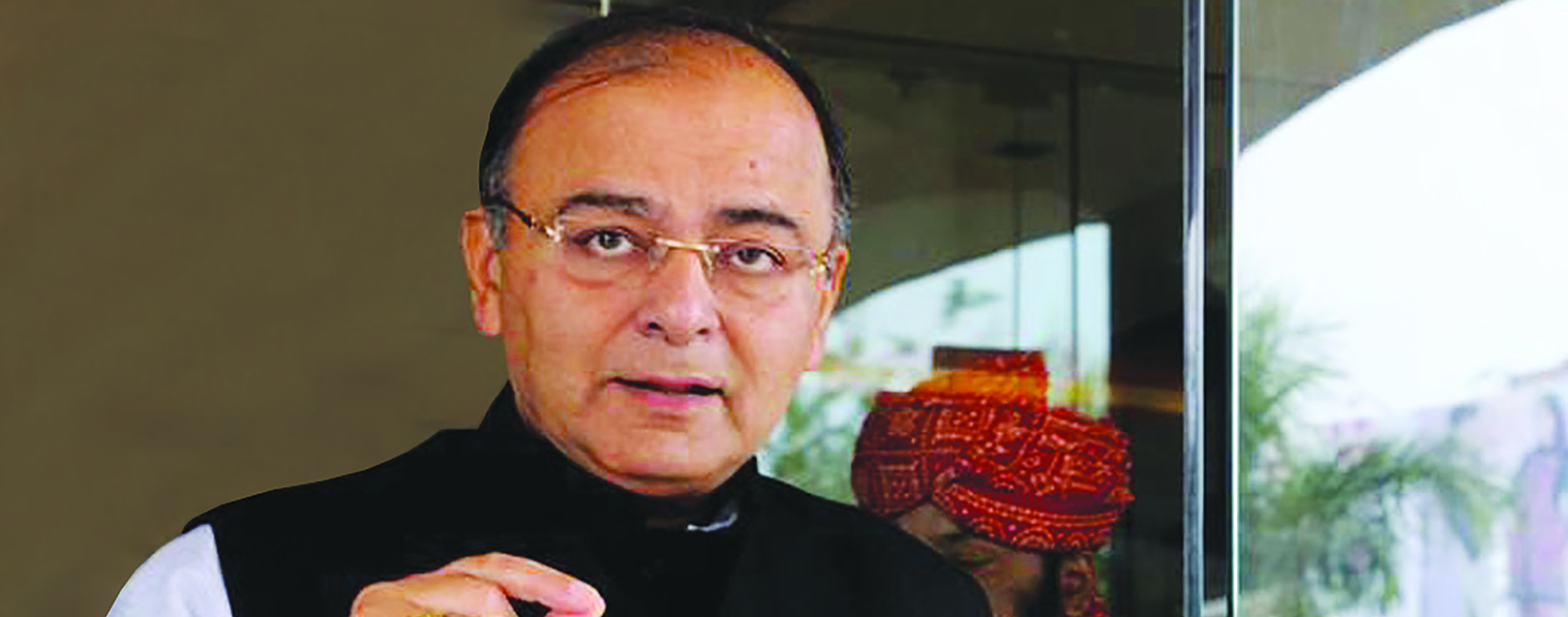

Indian Finance Minister Arun Jaitley told reporters that Prime Minister Narendra Modi discussed the issue with him this morning and on his advice the group has been set up comprising agencies like CBDT, RBI and FIU (Financial Intelligence Unit).

The Special Investigation Team (SIT) on black money also said it will investigate thoroughly the reported secret list exposed by the International Consortium of Investigative Journalists (ICIJ).

"The multi-agency group will comprise various government agencies -- the CBDT, FIU, FT&TR (Foreign Tax and Tax Research) and RBI. They will continuously monitor these (accounts) and whichever accounts are found to be unlawful, strict action as per existing laws will be taken," Jaitley said.

His comments came on a day the Indian Express carried a report based on leaked documents of a Panama-based law firm Mossack Fonseca which is said to feature links of over 500 Indians to firms and accounts in offshore tax havens.

This included a well-known actor and his daughter-in-law, a leading real estate tycoon and a number of other industrialists and their family members, most of whom have denied any wrongdoing.

The report said Onkar Kanwar, Chairman of Apollo Group, and his family members floated an offshore entity in British Virgin Islands in 2010 and two trusts in 2014.

Reacting to it, an authorised spokesperson said, "India lawfully permits foreign investments in accordance with certain regulations. Any investment abroad, that the Kanwar family may have, is in due compliance with the Indian laws, where applicable, including making disclosures wherever required.

"Much of the family members mentioned are NRIs. They are covered by other nation's permissible laws for their foreign investments and are not covered by Indian laws and restrictions on residents in matters such as Income Tax and RBI."

.jpg)

to success.

to success.