India, UAE ink 9 pacts to boost trade and investment

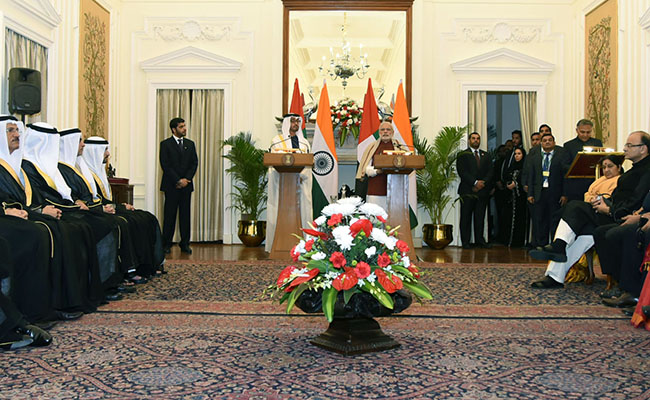

Prime Minister Narendra Modi and the Crown Prince of Abu Dhabi, His Highness Sheikh Mohammed Bin Zayed Al Nahyan during the exchange MoUs, at Hyderabad House, in New Delhi on Thursday

Prime Minister Narendra Modi and the Crown Prince of Abu Dhabi, His Highness Sheikh Mohammed Bin Zayed Al Nahyan during the exchange MoUs, at Hyderabad House, in New Delhi on ThursdayFebruary 13, 2015 | 4:58pm IST.

to success.

to success.