Indian government invites Pre-Budget 2015-16 suggestions on duty structure, taxes

The Dollar Business Bureau | @TheDollarBiz

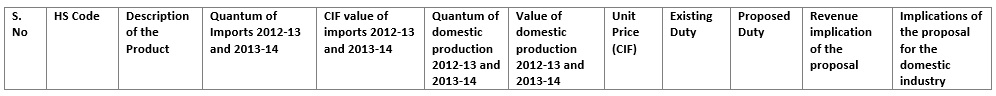

The Ministry of Finance, Government of India, has invited suggestions from Trade Associations and other related bodies on changes in the duty structure for various items for consideration in the Union Budget 2015-16. Proposals are also invited on correction of inverted duty structure for commodities, direct and indirect taxes, and changes in Customs and Central excise duty rates. Suggestions must include justification and relevant data about production, prices, and the impact of the changes. Request for correction of inverted duty structure must be supported by value addition details at each stage of manufacturing of the commodity, according to an official statement by the Budget Officer of the Tax Research Unit (TRU), Ministry of Finance. Malay Samir, Budget Officer, says, “It would not be feasible to examine suggestions that are either not clearly explained or which are not supported by adequate justification/statistics.” He adds, “Further, as regards direct taxes, the government policy is to phase out profit linked deductions and minimises exemptions; you may take this into consideration while forwarding proposals.” The deadline for submitting views and suggestions is November 10, 2014. Suggestions related to Customs & Central Excise can be sent in hard copies to Shri Alok Shukla, Joint Secretary (TRU-I), and Service Tax to Shri M. Vinod Kumar, Joint Secretary (TRU-II), CBEC, while suggestions related to Direct Taxes may be sent to Ms Pragya S. Saksena, Joint Secretary, Tax Policy and Legislation (TPL-I), Central Board of Direct Taxes (CBDT). Suggestions on Indirect Taxes (Customs, Central Excise and Service Tax) can be sent by email (as word document in the form of separate attachments) to [email protected], while those on Direct Tax could be sent to [email protected]. The official statement says that suggestions and proposals must adhere to the format below:

This article was published on November 3, 2014.

-Vertical.jpg)

to success.

to success.