JSW to raise $750 mn from foreign investments

The Dollar Business Bureau

Sajjan Jindal-led JSW Steel is planning to pool in $750 million from foreign investors. A meeting of the Board of Directors of JSW is scheduled to take place on July 27, 2016 to deliberate on this.

The company, in its regulatory filing, stated that the BoD members will consider long-term funding via issuance of non-convertible senior unsecured fixed rate bonds worth $750 mn (approximately Rs 5,032 crore) denominated in rupee or foreign currency in foreign markets.

Earlier in June, steel manufacturer JSW was planning to approach the stakeholders for funds up to $2 billion from global capital markets to meet its capex requisites, debt refinancing and meet any unlikely shortage in unforeseen situations.

In an effort to maximize the capital structure for growth in future, the move is in the company interests to gather long-term investments with convertible provision.

The earnings from the issue will be used as funds to meet the planned capital expenditure and other corporate needs, said the company while adding that the refinancing of the debts will reduce the cost of internet.

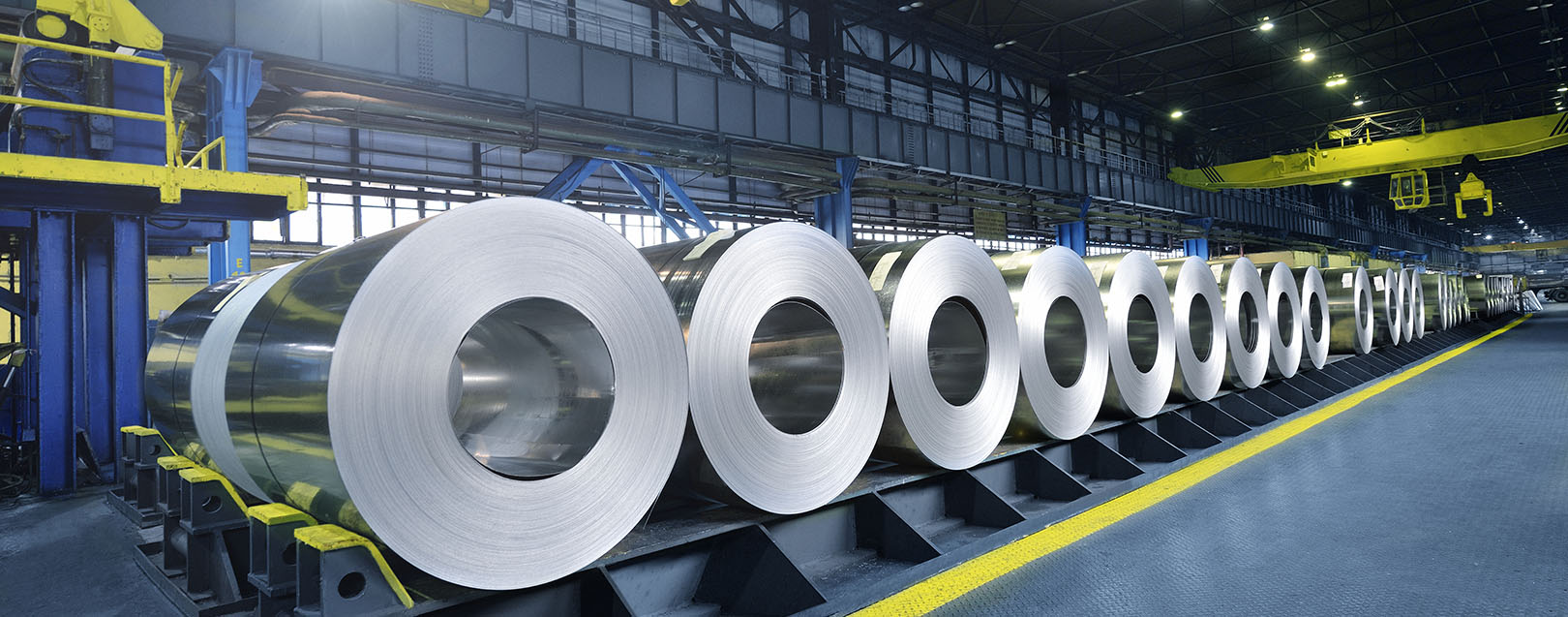

Recently, JSW steel company touched 18 million tonne per annum, completing its brownfield expansion plan, and set its new target to achieve 40 MTPA by 2025 with key investments in minor resources, chiefly in iron ore and coal.

JSW steel, India's second largest private sector steel company, has six plants located at Salem in Tamil Nadu, Vijayanagar in Karnataka, and Tarapur, Vasind, Kalmeshwar and Dolvi in Maharashtra.

to success.

to success.