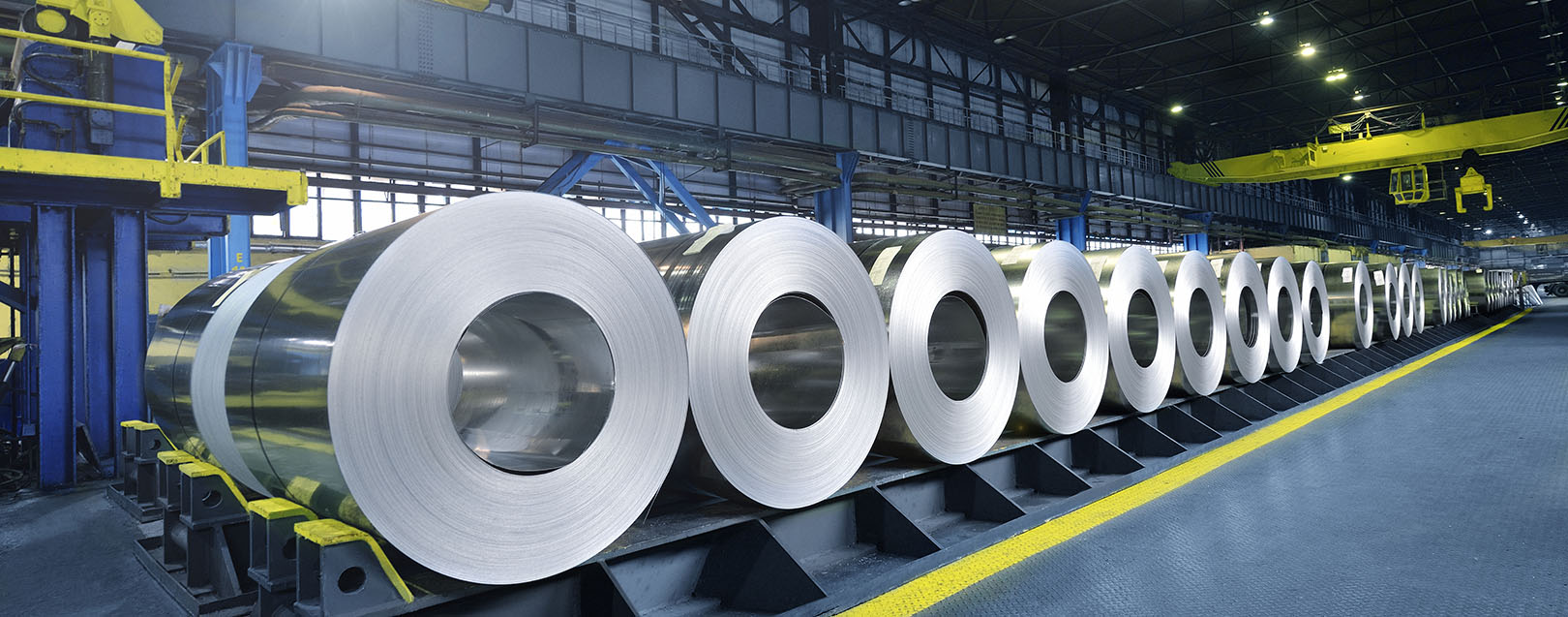

National Steel Policy sets capacity target of 300 MT by 2030-31

The Dollar Business Bureau

India takes pride in its position of 3rd largest steel producer in the world, and yet stands as a net importer of steel in 2015-16.

As per the National Steel Policy (NSP) 2017, the Ministry of Steel predicts annual crude steel capacity to reach 300 million tonnes (MT) in 2030-31 from 122 MT in 2015-16. The production goal is set at 255 MT in 2030-31 from 89 MT in 2015-16.

For the same year 2030-31, the export target is 24 MT and per capita steel consumption is expected to rise to 160 kg from the current figure of 61kg. In comparison to the world average for per capita steel consumption (208kg), this seems to be a modest target.

The draft policy aims to reduce imports of coking coal by half. Currently, 70% of India's coking coal requirement is imported. Increasing domestic availability of coking coal, the primary raw material, is one of the main pillars on which realisation of the proposed lofty target rests.

The high capital investment, manpower, natural resources in the form of raw materials and infrastructure required for the targeted upgradation of capacity pose major challenges.

On the bright side, the policy is optimistic about the rise in domestic demand in the consecutive years. Citing Japan and China's contracting demand in 2015, the draft proudly states that India is the only large economy in the world that grew in its steel demand by 5.3% in the same year.

The policy stresses on raising the level of R&D and acquiring best of manufacturing facilities to cut India's import of machinery and technology for steel plants. With an added focus on R&D spending, the 32-page document states that Indian steel enterprises devote a mere 0.05-0.5% of their turnover to R&D against the 1% figure observed in major steel companies abroad.

To introduce economies of scale and efficiency, the steel-making Central Public Sector Enterprises (CPSE) shall be encouraged to focus on their core competency and divest the non-core assets via mergers and restructuring.

Excess capacity in Chinese and Japanese steel industry has hurt Indian steel exports. From being a net exporter of steel in 2013-14, India became a net importer in the following years of 2014-15 and 2015-16.

There is an added emphasis on sustainability and reduction of carbon footprint by adopting a judicious mix of production routes rather than depending heavily on coal. To abide by the Paris agreement (COP 21), the policy states that the iron and steel sector is committed to reducing CO2 emissions.

Measures will be taken to increase the capacity of the domestic stainless steel industry, improving India's position as a net importer in the category. Currently, the stainless steel production is estimated at 50% of the capacity due to low-priced imports.

Steel Ministry has sought comments and suggestions from stakeholders and the general public by January 23, 2017. It can be concluded that the NSP 2017 draft is mainly focused on increasing steel production capacity sustainably by funding R&D ventures that will help the Indian steel sector become efficient and self-sufficient, securing India's position as a globally competitive steel producer.

to success.

to success.