Notification No. 12/2012-Customs, dated 17/3/2012 amended No-30

Dated 5th May, 2016 | Copy of | Notification No.30/2016-Customs |

In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962), the Central Government being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue) No.12/2012-Customs, dated the 17th March, 2012, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.185(E), dated the 17th March, 2012, namely:-

In the said notification,-

(A) in the Table,-

(i) in serial number 163A, for the entry in column (3), the entry “Medical use fission Molybdenum-99 (Mo-99) for use in the manufacture of radio pharmaceuticals” shall be substituted;

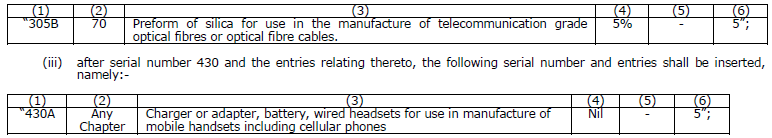

(ii) after serial number 305A and the entries relating thereto, the following serial number and entries shall be inserted, namely:-

(iv) against serial number 431, in column (3), in item (i), the words “and speakers” shall be omitted;

(v) serial number 431D and entries relating thereto shall be omitted;

(vi) against serial number 431E, in column (3), in item (a), after the words “Parts, components and accessories”, the brackets and words “(except populated printed circuit boards)” shall be inserted;

(vii) against serial number 431F, in column (3), in item (a), after the words “Parts, components and accessories”, the brackets and words “(except populated printed circuit boards)” shall be inserted;

(viii) against serial number 431G, in column (3), in item (a), after the words “Parts, components and accessories”, the brackets and words “(except populated printed circuit boards)” shall be inserted;

(ix) against serial number 431H, in column (3), in item (a), after the words “Parts, components and accessories”, the brackets and words “(except populated printed circuit boards)” shall be inserted;

(x) against serial number 431-I, in column (3), in item (a), after the words “Parts, components and accessories”, the brackets and words “(except populated printed circuit boards)” shall be inserted;

(xi) against serial number 431J, in column (3), in item (a), after the words “Parts, components and accessories”, the brackets and words “(except populated printed circuit boards)” shall be inserted;

(xii) against serial number 431K, in column (3), in item (a), after the words “Parts, components and accessories”, the brackets and words “(except populated printed circuit boards)” shall be inserted;

(xiii) after serial number 431K and the entries relating thereto, the following serial number and entries shall be inserted, namely:-

(xiv) against serial number 448, in column (3), for the exisiting entry, the following entry shall be substituted, namely:-

“Parts, testing equipment, tools and tool-kits for maintenance, repair, and overhauling of,-

(i) aircraft falling under heading 8802; or

(ii) components or parts, including engine, of aircrafts of heading 8802, by the units engaged in such activities.”

(xv) after serial number 448A and the entries relating thereto, the following serial number and entries shall be inserted, namely:-

Sd/-

(Anurag Sehgal)

Under Secretary

F.No.334/8/2016-TRU

Issued by:

Ministry of Finance

(Department of Revenue)

New Delhi

Note.- The principal notification No.12/2012-Customs, dated the 17th March, 2012 was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.185(E), dated the 17th March, 2012 and last amended by notification No.29/2016-Customs, dated the 26th April, 2016, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide, number G.S.R.444(E), dated the 26th April, 2016.

to success.

to success.