Robots: The new gamechanger for China’s supremacy in everything, including trade

Bidhu Bhushan Palo | @TheDollarBiz

Automotive industry accounts for almost 40% of industrial robot demand, but sales to other sectors such as metal working, electronics, and food industry are growing. Sales to pharma and cosmetic industry grew 69% (y-o-y) in 2013, according to World Robotics

Automotive industry accounts for almost 40% of industrial robot demand, but sales to other sectors such as metal working, electronics, and food industry are growing. Sales to pharma and cosmetic industry grew 69% (y-o-y) in 2013, according to World RoboticsRobotics have truly come of age – from toy-like pigmy structures with antennas we saw in movies a few decades ago to industrial arms that manufacture cars, kill Ebola virus, run electricity grids, explore oil reserves and breach borders. BMW’s Dr. Stefan Markus Baginski explains the increasing role of robots in future. He says, "If we look at how extensively our mobile devices are linked together with the telephone network, social platforms and cloud services. All these efforts are to create a better service for us and make our life much more convenient. To adapt this to a fleet of robots is one of the challenges of the future." While the average consumer is likely to be attracted by the robotic mop and the office assistant, industrial robots are expected to play a key role in manufacturing in coming years, helping reduce production costs, and drive up efficiency and quality. Importantly, robots will play a key role in the adaptation of another gamechanger – the Internet of Things (IoT) which is projected to drastically change the way we live.

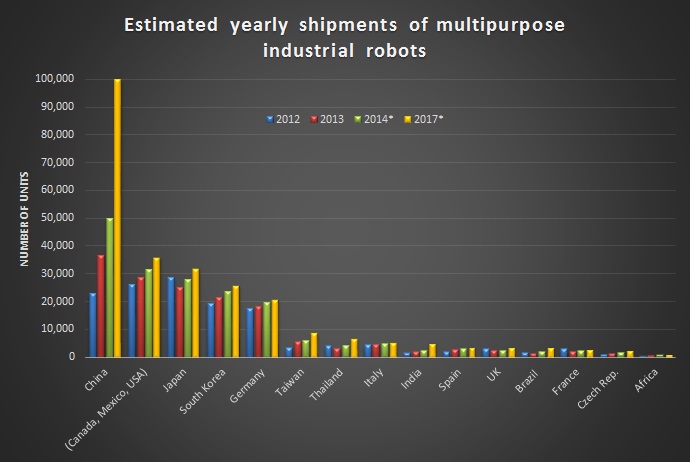

Sources: IFR, National robot associations

Sources: IFR, National robot associations However, it is not USA, Japan (the current leader in robot usage) or Germany, but China which is much ahead than the rest in all this. Since the beginning of this year, the world has been watching the supposed slowdown in China’s economic growth. Some analysts say that rising labour costs (around 10% per annum) in China provide an opportunity for countries like USA, India and Brazil to become the next manufacturing hub. However, it might be a mirage which robots will bust sooner than later. Mathias Wiklund, COO of the Italy-based Comau Robotics, says that China has a longer “financial horizon” than the Western World, but the lack of qualified labour is expected to be a problem for China in about 10 years and in order to mitigate such a risk, investment in robots and automation is necessary. That’s what China is doing. According to the International Federation of Robotics (IFR), China is forecast to lead the robot market in the next three years. While globally, robotics use is expected to increase by around 12-15% in 2015-17, every fifth robot sold in the world in 2013 was installed in China, and at the end of 2017 over 400,000 (20% of global figures) industrial robots will be installed in the factories of China alone (an increase of 25% per year).  In comparison, robot sales to the Americas (mainly North America and Brazil) is forecast to grow by 11%, to Germany by 6%, and India is not even there in the picture (robot installations in India stood at around 1,900 in 2013). Arturo Baroncelli, President, IFR, says, “No other country will have such a high operational stock of industrial robots (by 2017).” While robots and IoT will change the way the world perceives China and Chinese products in coming years, robot exports in itself will be a huge market, with China leading the way again. The current market for robot systems (including software) is estimated at $29 billion and is expected to grow at the rate of at least 12-15% per annum and China’s share is rapidly growing. According to IFR, of the 37,000 industrial robots sold in China in 2013, Chinese robot suppliers accounted for around 9,000 units (around 25%). While foreign robot suppliers increased their sales by 20% in China last year, installations by Chinese companies grew 300% y-o-y, says IFR. It adds, “More and more Chinese robot suppliers (around 30 this year!) have been entering the market and the competition between foreign and Chinese robot suppliers is deemed to increase.”

In comparison, robot sales to the Americas (mainly North America and Brazil) is forecast to grow by 11%, to Germany by 6%, and India is not even there in the picture (robot installations in India stood at around 1,900 in 2013). Arturo Baroncelli, President, IFR, says, “No other country will have such a high operational stock of industrial robots (by 2017).” While robots and IoT will change the way the world perceives China and Chinese products in coming years, robot exports in itself will be a huge market, with China leading the way again. The current market for robot systems (including software) is estimated at $29 billion and is expected to grow at the rate of at least 12-15% per annum and China’s share is rapidly growing. According to IFR, of the 37,000 industrial robots sold in China in 2013, Chinese robot suppliers accounted for around 9,000 units (around 25%). While foreign robot suppliers increased their sales by 20% in China last year, installations by Chinese companies grew 300% y-o-y, says IFR. It adds, “More and more Chinese robot suppliers (around 30 this year!) have been entering the market and the competition between foreign and Chinese robot suppliers is deemed to increase.”

This blog was published on October 27, 2014.

to success.

to success.