Indian, Chinese banks to remain under pressure in 2017

The Dollar Business Bureau Indian and Chinese banks will continue to remain under pressure in 2017 due to escalating bad loans, even with earnings and capital buffers are in a situation to withstand any serious threat, Fitch said in a report. "Our 2017 outlook on more than three-quarters of the banks in the region is negative. Though earnings and capital buffers are generally strong enough to withstand these trends, we expect viability ratings to remain under pressure in China and India," the report said. Referring to the 2017 outlook on Asia-Pacific banks, the credit rating agency said, "Most of Asia-Pacific's banks are facing a cyclical deterioration in asset quality in 2017, as a challenging economic environment continues to put pressure on borrowers. Fitch noted ...

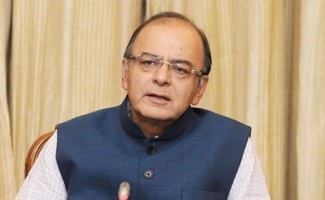

Jaitley to meet heads of PSU banks on Sep 16

PTI Amidst mounting bad loans, India's Finance Minister Arun Jaitley will hold a meeting with the heads of public sector banks on September 16 to find ways to deal with the situation."The Finance Minister will review the first quarter performance of public sector banks and financial institutions on September 16," sources said.Besides, he will also discuss credit growth and bad loan situation, they said, adding that the various recovery measures by banks and the legislative steps taken by the government to expedite recovery are also part of the agenda.The banks have stepped up efforts as far as recovery of bad loans is concerned, the sources added.Gross NPA of the public sector banks have surged from 5.43 per cent (INR 2.67 lakh crore) in ...

Banks have all powers to deal with wilful defaulters: FM

Source: PTI Finance Minister Arun Jaitley said the health of PSBs is a key issue, as the carried over problem of the past continues to persist and relates to unacceptable level of NPAs and impaired assets Concerned over “unacceptable” NPA levels, Finance Minister Arun Jaitley on Monday discussed with PSU bank chiefs the issue of wilful defaulters and said that the lenders have all the powers and autonomy to deal with them. In the second quarterly performance review in six months, Jaitley brainstormed with SBI Chairperson Arundhati Bhattacharya and other PSU bank heads as well as RBI officials over the rising bad loans in different sectors including steel, credit offtake, health of the lenders, and status of social security schemes. ...