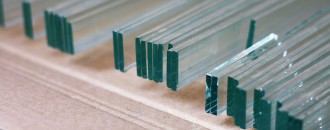

DGAD continues definitive ADD on imports of opal glassware from China and UAE

The Dollar Business Bureau The Directorate General of Anti-dumping has decided to continue the definitive anti-dumping duty on the imports of opal glassware from China and UAE. This was conveyed through a notification no.- 37/2017-CUSTOMS (ADD) dated August 9, 2017. According to the notification Opal Glassware exported by China PR will attract a duty of 30.64% of the cost insurance freight (CIF) value, while those from UAE will attract a duty of 4.38% of CIF value. The Indian petitioners M/s. La Opala RG Limited and M/s. Hopewell Tableware Pvt. Ltd. had filed for an investigation into the dumping of Opal Glassware sometime in 2010. The ADD on opal glassware from both the countries will be valid for the next 5 years.

Teaotia releases MIS report on export promotion schemes

The Dollar Business Bureau As a part of evaluation and monitoring of the Foreign Trade Policy (FTP) 2015-20, Commerce Secretary Rita Teaotia on Thursday released the “MIS Report on Export promotion Schemes 2017” of the Statistics Division of Directorate General of Foreign Trade (DGFT). The Report was released by Teaotia in the presence of DGFT and other senior officials of the Department of Commerce, on the occasion of the 11th ‘Statistics Day’ celebration to commemorate the birth anniversary of the Father of Indian Statistics - Professor Prasanta Chandra Mahalanobis. “The Report is an initiative taken by Statistics Division of DGFT as part of the monitoring and evaluation of the Foreign Trade Policy (2015-20),” said an official statement. The publication consists of latest information ...

Arrest And Bail In Relation To Offences Punishable Under Customs Act, 1962

Dated 23rd October, 2015 | Copy of | Circular No.28/2015-Customs | F.No.394/68/2013-Cus (AS) Government of India Ministry of Finance Department of Revenue Central Board of Excise & Customs (Anti-Smuggling Unit) New Delhi Revised Guidelines for Arrest and Bail in relation to offences punishable under Customs Act, 1962- reg. Attention of the field formations is invited to the guidelines for arrest and bail in relation to offences punishable under Customs Act, 1962 issued vide F.No.394/71/97-Cus (AS) dated 22.06.1999 and F.No.394/68/2013-Cus (AS) dated 17.09.2013. The threshold limit (s) specified in the guidelines issued on 17.09.2013 has been further streamlined in accordance with guidelines issued for launching of prosecution in relation to offences punishable under Customs Act, 1962 vide Circular No. …………../2015 [F.No.394/ 68/2013-Cus (AS)] dated 23.10.2015. ...