Anti-Dumping Investigation Corrigendum

Dated 12th March, 2018 | Copy of | CORRIGENDUM | ANTI-DUMPING INVESTIGATION Corrigendum NotificationAnti-Dumping investigation concerning imports of Sun/Dustcontrol film originating in or exported from China PR, ChineseTaipei, Hong Kong and Korea RP - Reg Corrigendum Notification. Having regard to the Customs Tariff Act 1975, as amended from time to time (hereinafter also referred to as the Act) and the Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules 1995, as amended from time to time (hereinafter also referred to as the Rules) thereof, the Designated Authority has issued the initiation notification, vide notification No.6/44/2017-DGAD (Case No.OI-47/2017) dated 17th January, 2018 in respect of the subject anti-dumping investigation.2. In partial modification thereof, necessitated because of ...

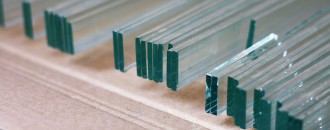

DGAD continues definitive ADD on imports of opal glassware from China and UAE

The Dollar Business Bureau The Directorate General of Anti-dumping has decided to continue the definitive anti-dumping duty on the imports of opal glassware from China and UAE. This was conveyed through a notification no.- 37/2017-CUSTOMS (ADD) dated August 9, 2017. According to the notification Opal Glassware exported by China PR will attract a duty of 30.64% of the cost insurance freight (CIF) value, while those from UAE will attract a duty of 4.38% of CIF value. The Indian petitioners M/s. La Opala RG Limited and M/s. Hopewell Tableware Pvt. Ltd. had filed for an investigation into the dumping of Opal Glassware sometime in 2010. The ADD on opal glassware from both the countries will be valid for the next 5 years.

Anti-Dumping investigation on Purified Terephthalic Acid initiated

The Dollar Business Bureau Yet another investigation is initiated for the anti-dumping concerning imports of Purified Terephthalic Acid (PTA) that are originating in or are exported from China PR, Iran, Indonesia, Malaysia & Taiwan. MCC PTA India Corp. Pvt. Ltd., and Reliance Industries Limited have jointly filed an application before the designated authority of Directorate General of Anti-Dumping & Allied Duties for initiating the anti-dumping investigation. The usual process of the filing has seen its success as the authorities have found a prima-facie evidence of the dumping of the ‘subject goods’ originating from ‘subject countries’ to the domestic industry. The decision has been taken to initiate the investigation into alleged dumping and the consequent injury to the domestic industry, so that ...

Anti-dumping duties on Potassium Carbonate from Korea and Taiwan; China & EU spared

Aadhira Anandh | The Dollar Business The anti-dumping investigation carried by the Directorate General of Anti-Dumping & Allied Duties on the sunset review of the matters relating to the import of potassium carbonate, have resulted in the central government continuing to impose definitive anti-dumping duties on potassium carbonate (subject goods). A Ministry of Commerce notification said that the petition was filed by Gujarat Alkalies and Chemicals Limited (GACL) in June 2009. GACL is one of the major producers of potassium carbonate for the Indian market and had filed this petition on the imports of potassium carbonate originating in or exported from the European Union, Korea RP, China PR and Taiwan. The results came out in such a way saying that duties ...

Anti-Dumping investigation on imports of 2-Ethyl Hexanol

Dated 9th December, 2014 | Copy of | Notification | Anti-Dumping Duty investigation concerning imports of “2-Ethyl Hexanol” originating in or exported from EU, Indonesia, Korea RP, Malaysia, Saudi Arabia, Chinese Taipei and USA: Extension of time for submission of Responses. Attention is invited to the Notification dated 20th November, 2014, initiating an Anti Dumping investigations concerning import of Plastic Processing Machines or Injection Moulding machines from Chinese Taipei, Philippines, Malaysia and Vietnam and letter dated November 25, 2014 advising the interested parties to file their responses within 40 days from the said date. The Authority has received requests from some interested parties seeking extension of time for submission of questionnaire responses. The Authority has considered the requests and the ...