Clarification regarding export policy of Roasted Gram

Dated 04th April, 2018 | Copy of | DGFT Policy Circular Notification No.5 To 1. All Custom Authorities 2. APEDA, New Delhi 3. Federation of Indian Export Organisations (FIEO) 4. All Regional Authorities of DGFT 5. All EPCs 6. All concerned Clarification regarding export policy of Roasted Gram - Removal of packing restriction - Reg. DGFT has received representations from exporters of Roasted Gram stating that while export of Pulses was earlier ‘Prohibited’, ‘Roasted Gram’ (whole/split), a value added product, was allowed for export in consumer packs upto 1 (one) Kg, vide DGFT Notification No.31 dated 21.01.2016 read with No.40 dated 15.02.2016. Now the Government has removed Prohibition’ on export of all varieties of pulses including organic pulses, vide DGFT Notification No. 38 dated ...

Irrespective of the value of the consignment

Dated 31st March, 2018 | Copy of | GST-UNION TERRITORY TAX NOTIFICATION No : 2 In exercise of the powers conferred by sub-section (1) of section 22 of the Union Territory Goods and Services Tax Act, 2017 (No. 14 of 2017) and section 164 of Central Goods and Services Tax Act, 2017 (No.12 of 2017) read with clause (d) of sub-rule 14 of rule 138 of the Central Goods and Services Tax Rules, 2017, the Central Government, on the recommendations of the Council, hereby notify that irrespective of the value of the consignment, no e-way bill shall be required to be generated where the movement of goods commences and terminates within the Union Territory of Andaman and Nicobar Islands.2. This notification shall ...

specifying jurisdiction of Commissioners of Customs(Appeals).

Dated 28th March, 2018 | Copy of | Customs Notification In exercise of the powers conferred by sub-section (1) of section 4 of the Customs Act, 1962 (52 of 1962), the Central Board of Excise and Customs, hereby makes the following further amendments in the notification of the Government of India, Ministry of Finance (Department of Revenue) No. 92/2017-Customs (N.T.), dated the 28th September, 2017, published vide number G.S.R. 1210(E), dated the 28th September, 2017, namely:- In the said notification, in the Table, in column (3),- (a) against serial number 1, for items (i) and (i a), the following shall be substituted, namely:- “(i) Commissioner of Customs (Airport and General), Delhi;”; (b) against serial number 2, ...

Due dates for filing FORM GSTR

Dated 23rd March, 2018 | Copy of | GST-Central Tax Notification :16 In exercise of the powers conferred by section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this notification referred to as the Act) read with sub-rule (5) of rule 61 of the Central Goods and Services Tax Rules, 2017, the Commissioner, on the recommendations of the Council, hereby specifies that the return in FORM GSTR-3B for the month as specified in column (2) of the Table below shall be furnished electronically through the common portal, on or before the last date as specified in the corresponding entry in column (3) of the said Table, namely:- Table 2. Payment of taxes for discharge of ...

Imports of Dimethylacetamide from China PR and Turkey Definitive anti-dumping duty imposed.

Dated 20th March, 2018 | Copy of | Notification No.12 | Whereas, in the matter of import of ‘Dimethylacetamide’ (hereinafter referred to as the subject goods) falling under the sub-heading 2924 19 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the Customs Tariff Act), originating in, or exported from China PR, and Turkey (hereinafter referred to as the subject countries), and imported into India, the designated authority in its final findings vide notification number 14/41/2016-DGAD, dated the 21st February 2018, published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 21st February 2018, has come to the conclusion that– (a) the product under consideration has been exported to India from ...

Prohibition on direct or indirect import and export from/to DPRK

Dated 7th March, 2018 | Copy of | DGFT Notification No.52 Amendment in Para 2.17 of the Foreign Trade Policy 2015-20 on “Prohibition on direct or indirect import and export from/to DPRK (Democratic People’s Republic of Korea) in terms of UNSC resolutions concerning DPRK. In exercise of the powers conferred by Section 5 and Section 14A of the Foreign Trade (Development and Regulation) Act, 1992, as amended, read with Para 1.02 of the Foreign Trade Policy (FTP) 2015-20, the Central Government hereby makes amendment to the Paragraph 2.17 of FTP 2015-20 as notified vide Notification No. 35/2015-20 dated 18th October 2017, with immediate effect. Consequently, the Appendix I of FTP 2015-20 also stands amended. 2. Paragraph 2.17 of the FTP 2015-20 stands ...

Services exports grew at 16.2% during Apr-Sept: Economic Survey

The Dollar Business Bureau India’s services sector registered a robust export growth of 16.2% during the first six months of the current fiscal while the import of services into the country were increased by 17.4% during the period, according to the Economic Survey 2017-18. “During the period April-September 2017-18, growth in services exports and services imports were robust at 16.2% and 17.4%, respectively, said the Survey tabled in the Parliament on Monday by Finance Minister Arun Jaitley. In 2016-17, the exports from the sector recorded a growth of 5.7%. “India remained the eighth largest exporter in commercial services in the world in 2016 with a share of 3.4%. This is double the share of India’s merchandise exports in the world at 1.7%, the Survey ...

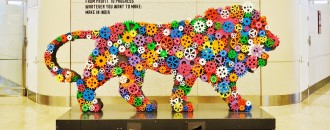

Make-in India led to a record $60 bn FDI inflow in FY17: Comm Min

The Dollar Business Bureau The ambitious ‘Make-in India’ initiative by the Government has led to a record inflow of foreign direct investment (FDI) of $60 billion in the financial year 2016-17, the Commerce Ministry said on Wednesday. “The Make in India initiative was launched on September 25, 2014 with the objective of facilitating investment, fostering innovation, building best in class manufacturing infrastructure, making it easy to do business and enhancing skill development,” the Ministry said in a statement. The Government is also increasing the focus to new emerging sectors under the Make in India initiative. These include biotechnology, aerospace and defence, new and renewable energy and information communication and telecom equipment manufacturing, it said. There were 21 key sectors identified for specific actions in ...