Increase in duty will discourage cheap import of textile products: Irani

The Dollar Business Bureau Textiles Minister Smriti Zubin Irani said on Tuesday that the hike in customs duty on silk and manmade fibre, announced in the Budget, will discourage cheap imports of textile products from China and benefit the local manufacturers. “Increase in customs duty on silk and manmade fibre will discourage cheap Chinese textile products from flooding the market and benefit domestic manufacturers in the power loom sector,” Irani said while addressing media in New Delhi on Budget allocation for the Ministry. On reduction of corporate tax to 25% from 30% announced in the Budget, the Minister said that reclassification of micro, medium and small enterprises (MSMEs) and reduction in tax by 5% of enterprises having turnover up to Rs.250 crore will ...

Union Budget 2018-19: Focus on agriculture, employment, MSMEs

The Dollar Business Bureau Guided by mission to strengthen agriculture, employment, rural development, health, education, MSMEs and infrastructure sectors, Finance Minister Arun Jaitley presented the Union Budget 2018-19 in Parliament on Thursday. Reiterating the pledge given by the Government to the people of the country four years ago to give an honest, clean and transparent Government, Jaitley said that the Government under Prime Minister Narendra Modi has successfully implemented a series of fundamental structural reforms to propel India among the fastest growing economies of the world. Jaitley said that India’s agri-exports potential is as high as $100 billion against current exports of $30 billion and to realise this potential, export of agri-commodities will be liberalised. While presenting the Budget, he said, “Indian society, polity ...

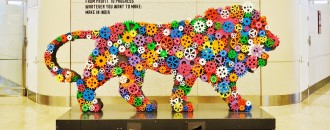

Make-in India led to a record $60 bn FDI inflow in FY17: Comm Min

The Dollar Business Bureau The ambitious ‘Make-in India’ initiative by the Government has led to a record inflow of foreign direct investment (FDI) of $60 billion in the financial year 2016-17, the Commerce Ministry said on Wednesday. “The Make in India initiative was launched on September 25, 2014 with the objective of facilitating investment, fostering innovation, building best in class manufacturing infrastructure, making it easy to do business and enhancing skill development,” the Ministry said in a statement. The Government is also increasing the focus to new emerging sectors under the Make in India initiative. These include biotechnology, aerospace and defence, new and renewable energy and information communication and telecom equipment manufacturing, it said. There were 21 key sectors identified for specific actions in ...

Govt has not attracted much FDI in manufacturing, Prakash Karat

By Manishika Miglani The ruling party BJP had made a host of promises during its election campaign such as creating enough jobs and consolidating the business sentiments in the country. Prakash Karat, former General Secretary, Communist Party of India (Marxist), in an interview with The Dollar Business, talks about the current government’s performance on these fronts and also shared his views on the impact and scenario post-demonetisation. TDB: Has the demonetisation move by the Government served its purpose of eradicating black money, stopping terrorism funding and driving India towards a cashless economy? Prakash Karat (PK): The stated intention of the Government for withdrawing Rs.500 and Rs.1000 notes from circulation was to help curb black money, corruption and to stop terrorist funding. But this exercise has ...

IIP growth dips to 3.1% in Apr 2017

By Abin Daya Thanks to many exporter conferences that I have been involved in, I have had the opportunity to meet and interact with quite a few businesses recently. A very common theme that is emerging in my discussions with them is a sense of frustration and exhaustion with the sheer number of ‘disruptive changes’ that have been coming through one after the other. Starting with the demonetisation in Nov 2016, they have had to handle the fall-out of the exporters’ caution list, and now are preparing to be compliant for GST, all of which have negatively impacted business in the short-term. Businesses do not have time to do business as they are busy with complying with the changing requirements, the cost of ...

Sitharaman and Swedish minister set up mechanism to further trade

Sourced from Press Information Bureau The Eighteenth Session of India-Sweden Joint Commission for Economic, Industrial and Scientific Cooperation (JCEC) was held in New Delhi on May 17, 2017. The Indian delegation led by Nirmala Sitharaman, and the Swedish delegation led by Ann Linde, Minister for Trade and EU Affairs, Ministry for Foreign Affairs, expressed their satisfaction that considerable substance and contents had been added to bilateral relations during the last 2 years and reiterated their mutual desire and commitment to further strengthen the existing trade and investment relations and all-round bilateral cooperation. The deliberations at the JCEC meeting provided an excellent opportunity to review the current state of ongoing cooperation in diverse fields such as Trade and Investment, Sustainable Urban development, Micro Small ...

Industry welcomes government push to infrastructure developments and inclusive growth

The Dollar Business Bureau With stepping up capital expenditure, proposing a better synergy among railways, roads, waterways and civil aviation, and putting a sharp focus on rural infrastructure development and with many more announcements in the Union Budget 2017, the government has reiterated its commitment to economic growth and development. These moves have been welcomed by business and trade associations. “The government has provided a balanced and growth-oriented budget. The tax benefits to small taxpayers, MSMEs and Infra status to affordable housing are encouraging and would pave the way for a higher growth trajectory in the coming times,” says Gopal Jiwarajka, President, PHD Chamber of Commerce and Industry. Another key takeaway from this year’s budget is the government’s renewed focus on agriculture. The ...

Budget hopes from industry heads in Hyderabad

The Dollar Business Bureau Jitendra Kumar, Partner, JBRK & CO., CA: This is a 'hope' budget. The government is expected to give an improved direction to the already set focus on policy and fiscal prudence. There must be a cut in corporate tax to 25% to boost the industry. To leverage India's demographic strength, we need good spending on education and skills training. Anil Kumar, CFO, Nuland Laboratories: GST will be favourable to regulated and organised industries like pharma. For cash dependent economies, it might have an unfavourable inflationary impact. K.Harish Reddy, MD, Dynatech Industries Pvt Ltd., speaking of what the manufacturing and MSMEs hope from the Budget said, " Interest rates for loans to MSMEs must be brought down from current 14-16% to 8-10%. A maximum ...