The Union Budget has largely met the expectations of the Electronics Systems Design and Manufacturing (ESDM) sector with number of changes in Indirect tax structure to strengthen manufacturing of IT hardware and mobile phones, says ELCINA

Sai Nikesh | The Dollar Business

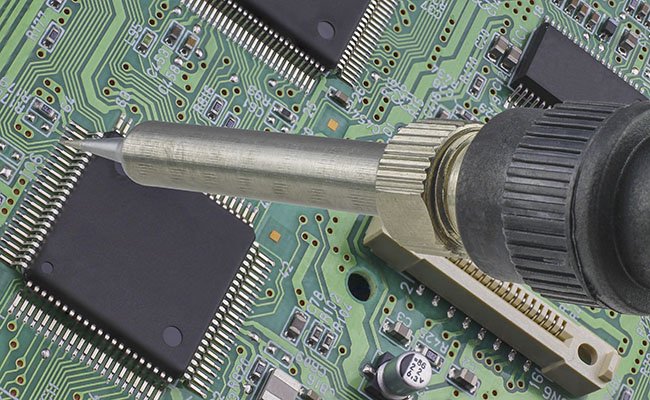

“Introduction of Special Additional Duty (SAD) on populated PCBs for a variety of equipment’ is another key step that would boost Electronic Manufacturing Services (EMS) activity and drive up the demand for components”

March 01, 2016 | 06:43pm IST.

“Introduction of Special Additional Duty (SAD) on populated PCBs for a variety of equipment’ is another key step that would boost Electronic Manufacturing Services (EMS) activity and drive up the demand for components”

“Introduction of Special Additional Duty (SAD) on populated PCBs for a variety of equipment’ is another key step that would boost Electronic Manufacturing Services (EMS) activity and drive up the demand for components”

to success.

to success.