Government introduces minor changes to start-up definition

The Dollar Business Bureau

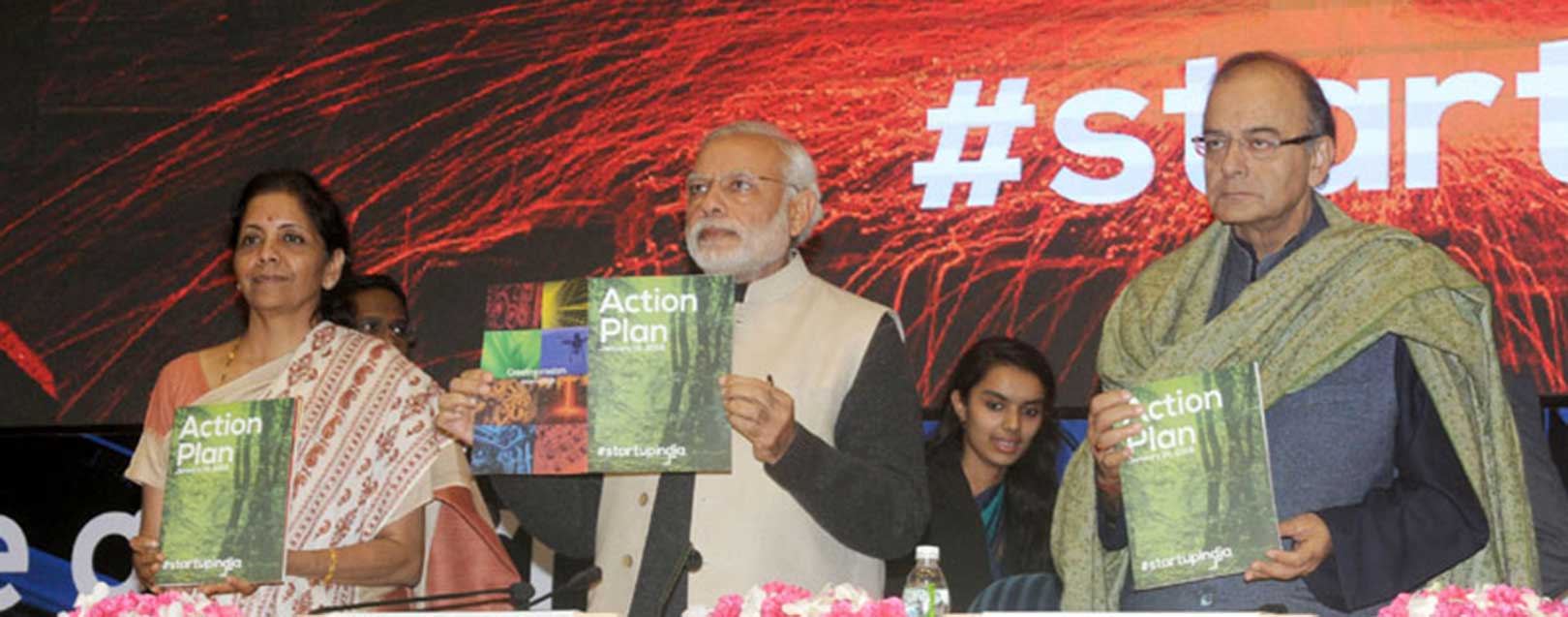

The Government has introduced some slight changes to the definition of start-up and said that an entity not older than 7 years will now be eligible to get benefits under the ‘Start-up India’ Action Plan.

Currently, only businesses incorporated five years back were eligible for sops under the Action Plan, which was announced by the government in 2016.

According to the new definition, an enterprise with a turnover of less than Rs.25 crore shall be considered a startup if it has not finished 7 years from its date of registration/incorporation.

However, for the start-ups in biotechnology sector, this period shall be 10 years, a notification by the Ministry of Commerce and Industry said.

“An entity shall be considered as a startup if it is working towards innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation,” it said.

The entity shall become ineligible to be considered as a startup if it has completed 7 years from its date of registration/incorporation or its turnover for any preceding year crosses Rs.25 crore, it added.

To attain tax benefits under the Plan, a startup should have to acquire a certificate for an eligible business from the inter-ministerial board as established by the Department of Industrial Policy and Promotion (DIPP), the notification said.

It further said that the process of getting recognition would be via an online application process made through mobile app or portal created by the DIPP.

If an entity obtained the recognition without uploading the required documents or by way of false information, the notification said that the DIPP has the right to cancel immediately the recognition and its certificate of eligible business, without any reason or prior notice.

The definition is vital for promising enterprises to get government-sponsored funds and tax and other incentives.

Some sections of the industry had criticised the previous definition of start-ups, citing that defining of such entities which are less than five-year old as restrictive.

There is no requirement to get a recommendation letter from an incubator or industry association for either tax benefits or recognition, it said.

to success.

to success.