Imports of '1,1,1,2-Tetrafluoroethane or R-134a' from China PR

MINISTRY OF COMMERCE & INDUSTRY

DEPARTMENT OF COMMERCE

(DIRECTORATE GENERAL OF ANTI-DUMPING & ALLIED DUTIES)

Final Findings

Subject: Sunset review (SSR) investigation of the anti-dumping duties imposed on the imports of ‘1,1,1,2-Tetrafluoroethane or R-134a’, originating in or exported from China PR.

No. 15/23/2014-DGAD: Having regard to the Customs Tariff Act 1975, as amended from time to time (hereinafter also referred to as the Act) and the Customs Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules 1995, as amended from time to time (hereinafter also referred to as the Rules) thereof;

A. Background of the case

2. Whereas, the original anti-dumping investigation concerning imports of “1, 1, 1, 2- Tetrafluoroethane” also known as “R-134a” (hereinafter also referred to as the subject goods), originating in or exported from China PR and Japan, was initiated by the Designated Authority (hereinafter also referred to as the Authority) vide Notification No. 14/24/2009- DGAD dated 19th August, 2009, on the basis of an application filed by M/s SRF Ltd.

3. Whereas, in the original investigation, the preliminary finding was issued by the Authority recommending imposition of provisional anti-dumping duties on the imports of the subject goods, originating in or exported from China PR and Japan, vide Notification No.14/24/2009- DGAD dated 19th February, 2010. Accordingly, the provisional antidumping duties were imposed by the Central Government on the imports of the subject goods, originating in or exported from China PR and Japan, vide Notification No.52/2010-Customs dated 19th April, 2010.

4. Whereas, the final finding of the original investigation was issued by the Authority, recommending imposition of definitive anti-dumping duties, on the imports of the subject goods, originating in or exported from China PR and Japan, vide Notification No.14/24/2009-DGAD dated 10th May 2011.

Accordingly, definitive anti-dumping duties were imposed by the Central Government, on the imports of the subject goods, originating in or exported from China PR and Japan, vide Notification No.61/2011-Customs dated 15th July, 2011.

5. Whereas, M/s. SRF Ltd., the domestic industry in the original investigation and the sole producer of the subject goods in India (hereinafter also referred to as the petitioner) has filed a duly substantiated application, in accordance with the Act and the Rules, alleging dumping of the subject goods, originating in or exported from China PR and consequent injury to the domestic industry and likelihood of continuation or recurrence of dumping and injury in the event of revocation of the anti-dumping duty. The applicant has filed the application for sunset review in respect of the anti-dumping duty imposed against China PR only, stating that there is neither dumping nor likelihood of dumping of the subject goods from Japan. The applicant has requested for continuation and enhancement of the anti-dumping duty, imposed on the imports of the subject goods, originating in or exported from China PR (hereinafter also referred to as the subject country) only.

B. Procedure

6. The procedure described below has been followed with regard to the investigation:

i. The Authority sent copy of the initiation notification dated 10th April, 2015 to the embassy of the subject country in India, known exporters from the subject country, known importers and other interested parties, as per available information. The known interested parties were requested to file questionnaire response and make their views known in writing within the prescribed time limit. Copies of the letter and questionnaires sent to the exporters were also sent to embassy of the subject country along with a list of known exporters/producers, with a request to advise the exporters/producers from the subject country to respond within the prescribed time.

ii. Copy of the non-confidential version of the application filed on behalf of the applicant was made available to the known exporters and the embassy of the subject country in accordance with Rule 6(3) of the Rules.

iii. The Authority forwarded a copy of the public notice initiating the sunset review to the following known producers/exporters in the subject country and gave them opportunity to make their views known in writing within forty days from the date of the letter in accordance with the Rules:

a) Zhejiang Juhua Group I/E Co., Ltd.

b) Shandong Dongyue Chemical Ltd.

c) Sinochem Environmental Protection Chemicals (Taicang) Co.,Ltd

d) Jiangsu Kangtai Fluorine Chemical Co.,Ltd.

e) Changshu 3F Zhonghao New Chemical Materials Co., Ltd.

f) Zhejiang Fotech International Co., Ltd.

g) Du Pont China Holding Co Ltd

h) Zhejiang Pujiang Bailian Chemical Co. Ltd.

i) Mitsui DuPont Fluorochemicals Co Ltd

j) Jiangsu Bluestar Environmental Protection Technology Co Ltd

k) Sinochem Modern Environmental Protection Chemicals (Xi'an) Co.,Ltd

l) Jiangsu JIN XUE Group Co., Ltd

m) Jinhua Yonghe Fluorochemical Co., Ltd,

n) Zhejiang Sanmei Chemical Ind.Co.,Ltd

iv. In response to the initiation of the subject investigation, following producers/exporters from China PR have filed questionnaire response:

a) Sinochem Environmental Protection Chemicals (Taicang) Co.,Ltd

b) Sinochem Modern Environmental Protection Chemicals (Xi'an) Co.,Ltd

c) Zhejiang Sanmei Chemical Industry Co., Ltd. (“Sanmei”)

d) Zhejiang Quzhou Juxin Fluorine Chemical Co., Ltd. (“Juxin”)

e) Zhejiang Juhua Co., Ltd Organic Fluor-chemistry Plant

f) Zhejiang Quzhou Lianzhou Refrigerants Co., Ltd.

g) Zhejiang Quhua Fluor-chemistry Co., Ltd.

h) Chemours Chemical (Shanghai) Co Ltd (formerly Du Pont Trading (Shanghai) Co Ltd.

v. Market Economy Treatment (MET) questionnaire was also forwarded to the known producers/exporters in China PR and the Embassy of China PR in India with the request to provide relevant information to the Authority within the prescribed time limit. While for the purpose of initiation, the normal value in China PR was considered based on the cost of production of the subject goods in India, duly adjusted, the Authority informed the known producers/exporters from China PR that it proposes to examine the claim of the applicant in the light of Para 7 and Para 8 of Annexure I of Anti-dumping Rules, as amended. The exporters/producers of the subject goods from China PR were, therefore, requested to furnish necessary information/sufficient evidence as mentioned to enable the Authority to consider whether market economy treatment can be granted to the cooperative exporters/producers in China PR. However, none of the respondent producers/exporters from China PR filed MET questionnaire response rebutting the non-market economy presumption.

vi. Questionnaires were sent to the following known importers/users/associations of subject goods in India calling for necessary information in accordance with the Rules:

a) E.I. Dupont India Private Ltd.

b) Navine Fluorine International Ltd

c) Stallion Enterprises

d) Value Refrigerants Private Ltd.

e) Mangali Petrochem Ltd.

f) KPL International Limited

g) Refex Refrigerants

h) KIRO Refrigerants Pvt Ltd.

i) Honeywell International (I) Pvt. Ltd.

j) O. B. Fluoro Chems Pvt. Ltd

k) Brenntag India Pvt.Ltd.

l) Cipla Ltd.

vii. In response to the above notification, importers questionnaire response has been filed only by M/s Navine Flourine International Ltd., along with injury submissions. viii. Injury submissions have also been made by China Chamber of Commerce of Metals Minerals & Chemicals Importers & Exporters (CCCMC), respondent Chinese producers/exporters, importers/users in India and the domestic industry.

ix. Exporters, producers and other interested parties who have not responded to the Authority in the prescribed format, nor supplied information relevant to this investigation, have been treated as noncooperating interested parties.

x. At the application stage, of the domestic industry provided information with regard to imports based on Eximkey data (secondary source). Subsequently, the domestic industry also obtained the transaction wise imports data from the DGCI&S and furnished it to the Authority for placement in the public file. Accordingly, the same was also made available in the public file. The Authority also made request to the Directorate General of Commercial Intelligence and Statistics (DGCI&S) to arrange for details of imports of subject goods for the past three years, including the period of investigation, which was received by the Authority. The Authority has relied upon the DGCI&S imports data for computation of the volume & value of imports and injury analysis in the present finding.

xi. Optimum cost of production and cost to make & sell the subject goods in India based on the information furnished by the domestic industry on the basis of Generally Accepted Accounting Principles (GAAP) was worked out so as to ascertain if anti-dumping duty lower than the dumping margin would be sufficient to remove injury to Domestic Industry. The NIP has been determined by the Authority in terms of the principles laid down under Annexure III to the Anti-dumping Rules.

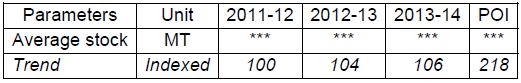

xii. The period of investigation for the purpose of the present review is 1st October 2013 to 30th September 2014. However, the injury analysis has been done for the period 2011-12, 2012-13, 2013-14 and Period of Investigation.

xiii. In accordance with Rule 6(6) of the Anti-dumping Rules, the Authority provided opportunity to the interested parties to present their views orally in a public hearing held on 6th November, 2015. The parties who presented their views in oral hearing were requested to file written submissions of the views expressed orally, followed by rejoinder submissions.

xiv. The submissions made by the interested parties during the course of this investigation, wherever found relevant, have been considered by the Authority in this finding.

xv. Verification to the extent deemed necessary was carried out in respect of the information & data submitted by the domestic industry and the cooperative producers/exporters.

xvi. Information provided by the interested parties on confidential basis was examined with regard to sufficiency of the confidentiality claim. On being satisfied, the Authority has accepted the confidentiality claims wherever warranted and such information has been considered as confidential and not disclosed to other interested parties. Wherever possible, parties providing information on confidential basis were directed to provide sufficient non-confidential version of the information filed on confidential basis.

xvii. Wherever an interested party has refused access to, or has otherwise not provided necessary information during the course of the present investigation, or has significantly impeded the investigation, the Authority has considered such parties as non-cooperative and recorded the findings on the basis of the facts available.

xviii. In accordance with Rule 16 of Rules Supra, the essential facts of the investigation were disclosed to the known interested parties vide disclosure statement dated 18th May, 2016 and comments received thereon, considered relevant by the Authority, have been addressed in this final finding.

xix. *** represents information furnished by an interested party on confidential basis and so considered by the Authority under the Rules.

xx. The average exchange rate of 1US$ = Rs 61.65 prevailing during the POI has been adopted by the Authority in this finding. xxi. The Department of Revenue vide their OM No. 354/24/2010-TRU (Pt.1) dated 5th April, 2016 extended the time limit for completing this investigation up to 9th June, 2016.

C. PRODUCT UNDER CONSIDERATION AND LIKE ARTICLE

Submissions made by the Domestic Industry

7. The domestic industry has made the following submissions with regard to the product under consideration (PUC):

i. Present investigation being a review investigation, the scope of the product under consideration remains the same as has been defined in the original investigation.

ii. The product under consideration is ‘1,1,1,2-Tetrafluoroethane or R-134a’ of all types.

iii. R-134a, is also known as tetrafluoroethane, Genetron 134a, Suva 134a or HFC-134a. It is a haloalkane refrigerant with thermodynamic properties similar to R-12 (dichlorodifluoromethane), but without its ozone depletion potential.

iv. R-134a is used as "high-temperature" refrigerant for domestic refrigeration and automobile air conditioners. Other uses include plastic foam blowing, as a cleaning solvent and as a propellant for the delivery of pharmaceuticals (e.g. bronchodilators), gas dusters, and in air driers, for removing the moisture from compressed air. It has also been used to cool computers in some over clocking attempts. It is also commonly used as a propellant for air soft air guns.

v. There are broadly two kinds of the product under consideration - industrial and pharma. However, in pharma segments, there are now two variants of the product under consideration - (a) cGMP approved plant product and (b) normal product not produced in a cGMP approved plant. Normal product not produced in a cGMP approved plant has been described as "propellant" grade by the petitioner in a bid to distinguish and differentiate with cGMP approved pharma grade product. It is, however, clarified that this terminology is not an approved/internationally recognized terminology.

vi. There are only two grades of the product under consideration being imported from China and both are being produced by the domestic industry. These are product under consideration for industrial use and also medical use for non-regulated markets. The grades being produced by the domestic industry and being imported from China are comparable and can be interchangeably used. However, there is another grade, a variant of medical use R134a for regulated markets, which is produced only in USA and Europe. This is USFDA approved R134a for pharma application. This grade is being described as "pharma grade", while the grade being produced and supplied by the domestic industry is being described as "propellant grade". Since this propellant grade has higher level of impurities than the "pharma grade", this propellant grade cannot substitute the "pharma grade" being imported from USA.

vii. Petitioner and Chinese producers are unable to produce the 'pharma grade' (i.e., cGMP approved plant product) for the reason that the Petitioner and Chinese producers lack manufacturing facilities required for the purpose. Such manufacturing facilities are described as "cGMP" in the market parlance. Resultantly, Petitioner and Chinese producers are unable to get USFDA certification that these products pass the requirements of Pharma grade R134a. Since Petitioner and Chinese producers are unable to meet these specifications, Petitioner is constrained to meet this requirement of Indian market through imports.

viii. Compliance with the requirements of cGMP implies different production technology, manufacturing process, raw materials, plant & equipment, additional investment of the order of Rs. 25 crores. The resultant product has different product specifications (lower level of impurities) than the other R134a produced & supplied by the domestic industry.

ix. Identification of the product type in the import data is not difficult for the reason that the companies sell different grades in different brand names and these brand names are specified in the import data. Since USFDA approved product produced in cGMP compliant plant has significantly higher costs and prices, this product cannot substitute the normal R134a. Even though it is technically substitutable, it is not commercially substitutable.

x. No special Govt. permission is required for producing various grades. All permissions are usual regulations in the Country. However, the buyers of Pharma grade product shall buy the product only if the plant is cGMP compliant.

xi. Since the present investigation is for sunset review, the scope of the product under consideration remains the same as that of the original investigation. Further, the issue of ‘Like Article’ has been well examined and determined by the Designated Authority at the time of original investigations. No significant development has taken place in this regard.

xii. There is no known difference in the subject goods produced by the domestic industry and exported from the subject country. Subject goods produced by the petitioner and imported from the subject country are comparable in terms of physical & technical characteristics, manufacturing process & technology, functions & uses, product specifications, pricing, distribution & marketing and tariff classification of the goods. The two are technically and commercially substitutable. The consumers are using the two interchangeably.

xiii. The DI does not have facilities for production of medical grade 134a compliant to cGMP. In fact, petitioner itself is buying this product from the market which clearly establishes absence of any investment in the present plant.

xiv. The PUC in the present case does not exclude any type of R-134a. Without prejudice, if cGMP approved pharma grade is excluded from the imports, the same does not vitiate the present case in any manner, given that this grade has been imported only from USA.

Submissions by producers/exporters/importers/other interested parties

8. With regard to the product under consideration, following submissions have been made by the other interested parties:

i. Definition of the product under consideration clearly shows that R-34a is used for making R-134a Pharma Grade. Both R 134a technical grade and Pharma grade are different grades and categories. Production of Pharma grade requires further process after R 134a is produced.

ii. Pharma Grade of PUC is not manufactured by Domestic industry and the same should be excluded from scope of PUC. There should be grade wise examination of injury analysis of various grades of PUC.

iii. DYMEL / SOLKANE are medical grades, which should be excluded from the scope of product concerned.

iv. There has been import in large quantity of Dangerous Gas R-22 during the said POI under the pretext of the subject product R-134a. Nearly 80 tonnes of the said gas R-22 was seized by the Revenue intelligence during the POI. The import statistics provided by the petitioner is unreliable and over stated in this respect and should not be considered.

v. SRF did not have facilities to manufacture Pharma Grade R-134a. They have acquired technology to manufacture Pharma grade R-134a only in 2015. During the period of review, SRF was not manufacturing Pharma Grade R-134a. SRF has been misleading the Authority since the original investigations by making false statements that they have manufactured and supplied both the grades of R-134a.

Examination by the Authority

9. In the original investigation, the PUC was defined as follows:

51. The product under consideration in the present investigation is 1,1,1,2- Tetrafluoroethane or R-134a of all types. R-134a, is also called as Tetrafluoroethane, Genetron 134a, Suva 134a or HFC-134a, HFA- 134a, and Norflurane. It is a haloalkane refrigerant with thermodynamic properties similar to R-12 (dichlorodifluoromethane), but without its ozone depletion potential. It has the chemical formula CH2FCF3, and a boiling point of −26.3 °C (−15.34 °F). It is an inert gas used primarily as a high temperature refrigerant for domestic refrigeration and automobile air-conditioners. Other uses of the subject goods include plastic foam blowing, as a cleaning solvent and as a propellant for the delivery of pharmaceuticals (e.g. bronchodilators), gas dusters, and in air driers, for removing the moisture from compressed air.

52. The subject goods are being imported under Chapter 29 of the Customs Tariff Act under subheading 2903 under “Halogenated Derivatives of Hydrocarbons”, under subheading 29033919 as “Other Fluorinated Derivatives”, under the Indian Trade Classification (based on Harmonized Commodity Description and Coding System). The petitioner has, however claimed that the product under consideration does not have any dedicated customs classification code and are being imported under various other Customs sub-headings. However, the customs classification is indicative only and in no way binding on the scope of this investigation.

10. The scope of the product under consideration in the present sunset review investigation remains the same as the scope of the product under consideration in the final findings earlier notified in the original investigation. The product under consideration (PUC) in the present SSR application, as in the original investigation, is “1,1,1,2- Tetrafluoroethane” also known as “R- 134a”.

11. The subject goods are being imported under Chapter 29 of the Customs Tariff Act under subheading 2903 under “Halogenated Derivatives of Hydrocarbons”, under subheading 29033919 as “Other Fluorinated Derivatives”, under the Indian Trade Classification (based on Harmonized Commodity Description and Coding System). The product under consideration, however, does not have any dedicated customs classification code and are being imported under various other Customs sub-headings. However, the customs classification is indicative only and in no way binding on the scope of this investigation.

12. With regard to like article, Rule 2(d) of the Anti-Dumping Rules provides as under:

"like article" means an article which is identical or alike in all respects to the article under investigation for being dumped in India or in the absence of such article, another article which although not alike in all respects, has characteristics closely resembling those of the articles under investigation;

13. The petitioner has claimed that there is no known difference in R-134a produced by them and exported from subject country. R-134a produced by the petitioner and imported from the subject country are having comparable characteristics in terms of parameters such as physical & chemical characteristics, manufacturing process & technology, functions & uses, product specifications, pricing, distribution & marketing and tariff classification of the goods.

14. With regard to different types/grades of the subject goods, the Authority notes that in terms of end use, broadly there are two types of the subject goods i.e. industrial and pharmaceutical grade. The industrial grade is used in refrigeration and air-conditioning etc, whereas the pharmaceutical grade is used as a drug propellant mainly for human consumption. The plant and machinery, raw material and the process of production of both the types are same. The differences between the two is only the level of purity, the purity required for the pharmaceutical grade meant for human consumption is minimum 99.98%. The subject goods meant for human consumption can be used for industrial purpose, the purity level being higher, the industrial type cannot be used for human consumption. However, the cGMP approved pharma grade is excluded from the purview of the PUC, since the same is neither produced by the domestic industry nor imported from the subject country.

15. Product under consideration produced by the domestic industry and those imported from the subject country are comparable in terms of characteristics such as physical & chemical characteristics, manufacturing process & echnology, functions & uses, product specifications, pricing, distribution & marketing and tariff classification of the goods. The two are technically and commercially substitutable. The consumers are using the two interchangeably. In view of the above, the Authority holds that subject goods produced by the Domestic Industry are, therefore, being treated as like article to the subject goods imported from the subject country, in accordance with the Anti-Dumping Rules.

D. SCOPE OF DOMESTIC INDUSTRY AND STANDING

Submissions by producers/exporters/importers/other interested parties

16. None of the interested parties have made any submissions with regard to the scope and standing of the Domestic Industry.

Submissions made by the Domestic Industry

17. The domestic industry has made following submissions in this regard:

i. SRF Ltd., the petitioner, is the sole producer of R134a in the country and accounts for 100% of the Indian production.

ii. The petitioner has not imported the subject goods from subject countries during the period of investigation. Further, Petitioner is not related to any exporter or producer of the subject goods in subject countries or an importer or user of the product under consideration in India.

iii. Without prejudice to the legal position that the present investigations being sunset review investigations, the Authority is not required to ascertain standing of the petitioner to file the present petition, the petition satisfies the requirement of standing under the Rules and petitioner constitutes the domestic industry within the meaning of Rule 2(b) of the Rules.

Examination by the Authority

18. Rule 2(b) defines domestic industry as under:-

"(b) “domestic industry” means the domestic producers as a whole engaged in the manufacture of the like article and any activity connected therewith or those whose collective output of the said article constitutes a major proportion of the total domestic production of that article except when such producers are related to the exporters or importers of the alleged dumped article or are themselves importers thereof in such case the term ‘domestic industry’ may be construed as referring to the rest of the producers”

19. The Authority notes that M/s SRF Ltd, the petitioner in the original as well as present investigation, constitutes 100% of Indian production. It constitutes the domestic industry within the meaning of the Rule 2(b) and satisfies the requirement of standing under the Rules 5 of the Rules.

E. Confidentiality

Submissions made by the Domestic Industry

20. The following are the submissions concerning confidentiality made by the domestic industry and considered relevant by the Authority:

i. Costing information is incapable of being summarized and as per Rule 7, it is not necessary for summarization.

ii. Petitioner has furnished the non-confidential information to the extent relevant. The Rules do not envisage any specific form in which the petitioner should furnish the data.

Submissions made by producers/exporters/importers/other interested parties

21. The following are the submissions concerning confidentiality made by the producers/exporters/importers/other interested parties and considered relevant by the Authority:

i. The petition suffers from excessive confidentiality.

ii. Petitioner has neither provided the transaction-wise import data in soft copy, nor provided any meaningful summary of information provided by it on confidential basis.

EXAMINATION BY THE AUTHORITY

22. As regards the submissions concerning confidentiality the Authority notes that Rule 7 of Anti-dumping Rules provides as follows:-

Confidential information: (1) Notwithstanding anything contained in sub-rules and (7) of rule 6, sub-rule (2), (3) (2) of rule 12, sub-rule (4) of rule 15 and sub-rule (4) of rule 17, the copies of applications received under sub-rule (1) of rule 5, or any other information provided to the designated authority on a confidential basis by any party in the course of investigation, shall, upon the designated authority being satisfied as to its confidentiality, be treated as such by it and no such information shall be disclosed to any other party without specific authorization of the party providing such information.

(2) The designated authority may require the parties providing information on confidential basis to furnish non-confidential summary thereof and if, in the opinion of a party providing such information, such information is not susceptible of summary, such party may submit to the designated authority a statement of reasons why summarization is not possible.

(3) Notwithstanding anything contained in sub-rule (2), if the designated authority is satisfied that the request for confidentiality is not warranted or the supplier of the information is either unwilling to make the information public or to authorise its disclosure in a generalized or summary form, it may disregard such information.

23. Information provided by the interested parties on confidential basis was examined with regard to sufficiency of the confidentiality claim. On being satisfied, the Authority has accepted the confidentiality claims, wherever warranted and such information has been considered confidential and not disclosed to other interested parties. Wherever possible, parties providing information on confidential basis was directed to provide sufficient non confidential version of the information filed on confidential basis. The Authority also made available the non-confidential version of the evidences submitted by various interested parties in the form of public file.

F. MISCELLANEOUS ISSUES

Submissions made by the Domestic Industry

24. The following are the miscellaneous submissions made by the domestic industry and considered relevant by the Authority:

i. The anti-dumping duty was imposed in the instant case vide notification dated 15 July 2011 and therefore shall be in force till 14 July 2016. It is, therefore, without any basis that the anti-dumping duty has expired on 18th April 2015. The interim anti-dumping duty imposed on the imports of the product under consideration was set aside by the Chennai High Court and the same was not stayed by the Supreme Court. Therefore, there was no interim anti-dumping duty applicable in this product by virtue of provisional duty recommended and five years period is required to be counted from the date of imposition of definitive duty which shall be 14 July 2016.

ii. The power of the DA to review the form and quantum of duty is well settled. The DA has been consistently considering that in case import volumes in the current period are significant, the quantum of anti dumping duty shall be modified based on dumping margin and injury margin in the present period. The only exception in India is when the dumping and/or injury margin is negative, but the duty is extended on the grounds of likelihood.

iii. There is no requirement under the law that DI should explain in the petition as to how it refined the import statistics from the raw import statistics procured by it. The only requirement under the rules is quantification of volume and value of imports and providing source of the information. The petitioner has provided transaction wise import data which adequately and elaborately establishes what is the import adopted by the petitioner.

iv. The investigation was initiated based solely on “duly substantiated” petition by the domestic industry. The petition contains all relevant information in this regard. The petitioner has provided evidence to the extent available. Petition clearly establishes existence of continued dumping and injury to the DI.

v. The interested parties need not adjudicate whether DI has received protection for adequate period. It is settled legal position that anti dumping duty shall apply as long as necessary and so long as dumping and consequent injury to the domestic industry is likely.

vi. Possible future ban on the product does not imply license to dump the product in Indian market. In fact, the domestic industry clearly considers that the product is going to remain in Indian market sufficiently beyond the period for which present measure is being considered. Above all, if the product is likely to be banned, how does the present duty prejudice the exporters?

Submissions made by producers/exporters/importers/other interested parties

25. The following are the miscellaneous submissions made by the exporters, importers and other interested parties and considered relevant by the Authority:

i. Sunset review is initiated at the request of domestic industry; the request needs to be a "duly substantiated" request. The request made by DI in the present investigation cannot be termed as a "duly substantiated" request, since the petition does not contain any evidence with respect to the Normal Value and the Export price.

ii. The DI has failed to provide sufficient evidence to justify the initiation of the investigation. It has neither been able to substantiate existence of continued dumping, nor has it substantiated the likelihood of recurrence of dumping & injury in future, if anti-dumping duties are revoked.

iii. The original anti-dumping duty has expired on 18th April 2015 and Ministry of Finance had not issued any customs notification for extending the anti-dumping duty even after the duty ceased to exist. The Ministry of Finance ought to have extended the duty on the subject product before the expiry of the parent Notification. The sunset review investigations are carried out only for the duty which is in force and not for the duty which ceased to exist due to efflux of time. So the present investigation must be terminated.

iv. The power of the DA in the sunset review is restricted only to withdrawal of duty and not for its enhancement. So the duty rate cannot be increased in review.

v. The import statistics submitted by the DI is faulty as it has included the medical grade and classified the same as the product concerned.

vi. There has been import in large quantity of Dangerous Gas R-22 during the said POI under the pretext of the subject product R-134a. Nearly 80 tones of the said gas R-22 was seized by the Revenue intelligence during the said POI. Therefore the import statistics provided by the petitioner should not be considered.

vii. There is no explanation in the petition as to how the Domestic Industry refined the import statistics from the raw import statistics procured by it. It also fails to disclose how the subject product is segregated from nonsubject product and what all product types have been included in the import statistics relied upon. Unless such information is made available, correctness of the information provided with respect to allegation of injury cannot be analyzed properly.

viii. There is a shift in consumption pattern due to environmental concerns. The subject product is on the path of being outdated. The developed countries like EU & US are banning the use of subject product, due to its ozone depletion characteristics. The subject product has undergone technology development and new improved version i.e HFO-1234yf which is a more environmentally friendly alternative to R-134a has come in to the market.

ix. The original existing duty was levied in the form of fixed duty. Fixed duty is only related to the quantity of products and cannot reflect the change of materials price. So the anti-dumping duty, if any proposed to be imposed in the present sunset review investigation, be levied in the form of reference price.

x. Zhejiang Sanmei Chemical Ind. Co. Ltd., a respondent exporter, has exported some PUC prior to POI, but not during the POI. Zhejiang Sanmei Chemical Ind. Co. Ltd. requests the authority to confirm the eligibility to apply for individual dumping margins in terms of Rule 22.

Examination by the Authority

26. As regards the submission that there is absence of ‘sufficient evidence’ in the application filed to justify initiation of this investigation, it is noted that there was sufficient prima facie justification to initiate the investigation. The present investigation was initiated only upon receipt of a written application, which was in the form and manner as specified by the Authority and was supported by relevant and necessary evidence relating to dumping, injury and causal link. The investigation was initiated after determining that the application was made by or on behalf of the domestic industry and after sufficient examination with regard to accuracy and adequacy of the evidence provided in the application and due satisfaction of the Authority that there was sufficient prima facie evidence regarding dumping, injury and causal link to justify the initiation of investigation.

27. It is true that the global demand for the new improved and technologically advanced version HFO-1234yf is increasing. But, it is does not mean that R134a is going to be replaced in the market overnight. The demand for R134a is still commanding very high, especially in the Indian market.

28. The definitive anti-dumping duty was imposed in the instant case vide notification dated 15 July 2011 for five years from the date of notification and is in force till 14 July 2016. It is, therefore, without any basis that the antidumping duty has expired on 18th April 2015. The interim anti-dumping duty imposed on the imports of the product under consideration was set aside by the Chennai High Court and the same was not stayed by the Supreme Court.

29. As regards the contention that the power of the DA in the sunset review is restricted only to withdrawal of duty and not for its enhancement, the Authority notes that the power of the designated authority to review the form and quantum of duty in an anti-dumping investigation is well settled. In a sunset review investigation, the designated authority can recommend by modifying the form and quantum of the anti-dumping duty, subject to the lesser duty rule adopted by India.

30. As regards contention that the form of duty, if any, should be on reference price basis, the Authority notes that the form of duty is governed by facts of a case.

31. As regards the contention that the import statistics submitted by the DI is faulty as it has included the medical grade and classified the same as the product concerned, the Authority notes that the imports data obtained from the DGCI&S has relied upon in this investigation after identifying the relevant transactions.

32. As regards the claim of Zhejiang Sanmei Chemical Ind. Co. Ltd., China PR for individual margins despite nil export during POI, the Authority notes that nil export during POI does not entitle Zhejiang Sanmei for individual margins in the present investigation.

G. MARKET ECONOMY TREATMENT, NORMAL VALUE, EXPORT PRICE AND DUMPING MARGIN

Submissions made by the domestic industry

33. The submissions made by the domestic industry with regard to normal value, export price and dumping margin and considered relevant by the Authority are as follows:

i. China is a non-market economy and should be treated so by the Authority in the present investigation. No country has granted market economy country status to China after following elaborate evaluation parameters. The factual matrix remains the same since the original and review investigations. Chinese companies should be considered as not entitled for market economy treatment.

ii. Designated Authority should follow Para 7 of AD Rules for determining Normal Value for China PR. Goods are also being exported from USA in the Indian market. The import price of the product under consideration from USA can be considered as a representative price and can be considered as the price from a third country to India and normal value determined on that basis.

iii. Normal value for China PR cannot be determined on the basis of price or constructed value in a market economy third country for the reason that the relevant information is not publicly available.

iv. The dumping margin from China is not only significant, but also substantial in both packed and unpacked form of imports, thus establishing existence of significant dumping of the product under consideration in India. The import volume of China has remained significant throughout the present injury period, despite anti dumping duty in force.

Submissions made by exporters, importers and other interested parties

34. The submissions made by the exporters, importers and other interested parties with regard to normal value, export price and dumping margin and considered relevant by the Authority are as follows:

i. The Domestic Industry has submitted that it has determined the Normal Value in China PR on the basis of (a) Import Price from USA into India, (b) selling price in India, and (c) Cost of production in India, duly adjusted, including selling, general and administrative expenses and profits. The petition does not contain any evidence with respect to the Normal Value and the Export price. Therefore, the DI has failed to discharge its obligation with regard to determination of normal value and export price.

ii. The calculations of normal value and export price provided by the domestic industry are wrong and arbitrary. The petitioner has not provided evidences regarding the adjustments to the export prices as claimed by the domestic industry.

iii. The accuracy of information submitted by the domestic industry should be examined. The normal value constructed by the domestic industry is incorrect as Annexure 3.2 of the petition considers Russia as appropriate surrogate country. However, the petitioner has claimed normal value on the basis of import price of USA in India.

iv. For determination of normal value for China PR, the normal value cannot be constructed on the basis of costs incurred by domestic industry unless there are sufficient evidences that India is an appropriate surrogate country in present case. The Authority may base normal value on the data submitted by the co-operating exporters.

Examination of the Authority

H. Determination of Normal Value for producers and exporters in China PR

35. The Authority notes that in the past three years China PR has been treated as a non-market economy country in the anti-dumping investigations by other WTO Members. Therefore, in terms of Para 8 (2) of the annexure 1 of AD rules, China PR has been treated as a non-market economy country subject to rebuttal of the above presumption by the exporting country or individual Producers/Exporters in terms of the above Rules.

36. As per Paragraph 8 of Annexure I of the Anti-dumping Rules, the presumption of a non-market economy can be rebutted, if the exporter(s) from China PR provide information and sufficient evidence on the basis of the criteria specified in sub paragraph (3) of Paragraph 8 and establish the facts to the contrary. The cooperating exporters/producers of the subject goods from People’s Republic of China are required to furnish necessary information/sufficient evidence as mentioned in sub-paragraph (3) of paragraph 8 in response to the Market Economy Treatment questionnaire to enable the Authority to consider the following criteria as to whether:

a. the decisions of concerned firms in China PR regarding prices, costs and inputs, including raw materials, cost of technology and labour, output, sales and investment are made in response to market signals reflecting supply and demand and without significant State interference in this regard, and whether costs of major inputs substantially reflect market values;

b. the production costs and financial situation of such firms are subject to significant distortions carried over from the former non-market economy system, in particular in relation to depreciation of assets, other write-offs, barter trade and payment via compensation of debts;

c. such firms are subject to bankruptcy and property laws which guarantee legal certainty and stability for the operation of the firms and

d. the exchange rate conversions are carried out at the market rate.

37. Paragraph-7 of the Annexure-1 to the Anti-dumping Rules provides as follows:

“In case of imports from non-market economy countries, normal value shall be determined on the basis of the price or constructed value in the market economy third country, or the price from such a third country to other countries, including India or where it is not possible, or on any other reasonable basis, including the price actually paid or payable in India for the like product, duly adjusted if necessary, to include a reasonable profit margin. An appropriate market economy third country shall be selected by the designated Authority in a reasonable manner, keeping in view the level of development of the country concerned and the product in question, and due account shall be taken of any reliable information made available at the time of selection. Accounts shall be taken within time limits, where appropriate, of the investigation made in any similar matter in respect of any other market economy third country. The parties to the investigation shall be informed without any unreasonable delay the aforesaid selection of the market economy third country and shall be given a reasonable period of time to offer their comments”

38. According to these Rules, the normal value in China can be determined on any of the following basis:

a) On the basis of the price in a market economy third country, or

b) The constructed value in a market economy third country, or

c) The price from such a third country to other countries, including India.

d) If the normal value cannot be determined on the basis of the alternatives mentioned above, the Designated Authority may determine the normal value on any other reasonable basis including the price actually paid or payable in India for the like product duly adjusted to include reasonable profit margin.

39. The domestic industry has claimed that normal value in China can be determined on the basis of the import price of the product under consideration from USA. The domestic industry has argued that the same price can be considered as a representative price and can be considered as the price from a third country to India and normal value determined on that basis.

40. The Authority notes that consequent upon the initiation notice issued by the Authority, none of the producers or exporters from China PR has filed response claiming market economy treatment. The Authority further notes that adoption of the import price of the product under consideration from USA for determination of normal value in respect of China, as requested by the domestic industry, cannot be accepted for the reason that USA and China are not in the similar level of development. Moreover, for determination of normal value based on third country cost and prices, the complete and exhaustive data on domestic sales or third country export sales, as well as cost of production and cooperation of such producers in third country is required, which is not available with the Authority in the present investigation. Also, no such verifiable information with regard to prices and costs prevalent in other such market economy third countries have been provided either by the domestic industry or by the responding exporters, nor any publicly available information could be accessed, nor the responding Chinese companies have made any claim with regard to an appropriate market economy third country.

41. Under the circumstances, the Authority is not in a position to apply Para 8 of Annexure 1 to the Rules and therefore proceeds to construct the normal value based on any other reasonable basis in terms of Para 7 of Annexure 1 to the Rules. Accordingly, in terms of Para 7 of Annexure 1 to the Rules, the Authority has constructed the Normal value for the Chinese producers on the basis of domestic prices of the major raw materials as the same were found to be less than the international prices of the major raw materials as available in the World Trade Atlas data and efficient consumption norms and conversion cost of the domestic industry, after including selling, general & administrative costs and reasonable profit margin.

42. For the purpose of conducting a fair comparison and in view of significant difference in the cost of production of packed and unpacked form of the product under consideration, separate normal value has been calculated for packed and unpacked form of the subject goods produced and sold. However, the dumping margins so arrived for packed and unpacked form have been weighted averaged for the ‘product under consideration’ as a whole thereafter by considering associated export volumes. Accordingly, the Authority has determined the weighted average normal value as mentioned in the dumping margin table given below.

I. Export Price

43. Pursuant to initiation of the present investigation, following producers/exporters from China PR have filed questionnaire response:

i. Zhejiang Sanmei Chemical Industry Co., Ltd. (“Sanmei”)

ii. Sinochem Modern Environmental Protection Chemicals (Xi'an) Co.,Ltd

iii. Sinochem Environmental Protection Chemicals (Taicang) Co.,Ltd

iv. Zhejiang Quzhou Juxin Fluorine Chemical Co., Ltd. (“Juxin”)

v. Zhejiang Juhua Co., Ltd Organic Fluor-chemistry Plant

vi. Zhejiang Quzhou Lianzhou Refrigerants Co., Ltd.

vii. Zhejiang Quhua Fluor-chemistry Co., Ltd.

viii. Chemours Chemical (Shanghai) Co Ltd (formerly Du Pont Trading (Shanghai) Co Ltd.

Zhejiang Sanmei Chemical Industry Co., Ltd. (“Sanmei”)

44. As per the exporter’s questionnaire (EQ) response, Zhejiang Sanmei Chemical Industry Co., Ltd., China PR is a producer of subject goods. Based on the information furnished in the EQ response, the Authority notes that Zhejiang Sanmei Chemical Industry Co., Ltd. did not export subject goods to India during the POI.

Sinochem Modern Environmental Protection Chemicals (Xi’an) Co., Ltd.

45. As per the exporter’s questionnaire (EQ) response, Sinochem Modern Environmental Protection Chemicals (Xi’an) Co., Ltd., China PR is a producer/exporter of the subject goods, belonging to Sinochem Group. Based on the information furnished in the EQ response, the Authority notes that Sinochem Modern Environmental Protection Chemicals (Xi’an) Co., Ltd., did not export the subject goods to India during the POI.

Sinochem Environmental Protection Chemicals (Taicang) Co. Ltd.

46. As per the exporter’s questionnaire (EQ) response, Sinochem Environmental Protection Chemicals (Taicang) Co. Ltd, China PR, is a producer/exporter of the subject goods, 100% owned by Sinochem Modern Environmental Protection Chemicals (Xi’an) Co., Ltd., which belongs to the Sinochem Group of China. During the POI, Sinochem Environmental Protection Chemicals (Taicang) Co. Ltd directly exported a total quantity of *** MT of subject goods to India for a total value of US$ ***.

47. Sinochem Environmental Protection Chemicals (Taicang) Co. Ltd, China PR was subjected to on the spot verification by the Authority. During verification, it was noted that another related entity of Sinochem Group, namely Sinochem Ningbo, also exported *** MT of PUC to India during the POI, but not filed EQ response. On being questioned, it was clarified by Sinochem Environmental Protection Chemicals (Taicang) Co. Ltd, China PR that Sinochem Ningbo is not a producer of the subject goods and has exported the goods by procuring from other Chinese producers who do not fall within the Sinochem Group. Further, the SAP sales data shown by the Company did not exhibit any such transaction of PUC by Sinochem Taikang with Sinochem Ningbo.

48. However, the Authority notes that Sinochem Ningbo belongs to the Sinochem Group. As per the web based information, it is a producer of chemicals, although it is not clear whether it produces the subject goods. Despite exporting sizable volume of the subject goods to India during the POI, neither had it filed the exporter’s questionnaire response, nor the related respondent companies declared this information upfront in their responses.

49. Post disclosure, it has been informed by Sinochem Taichang that by the time the present sunset review was initiated on 10th April, 2015, Sinochem Ningbo was no longer related to Sinochem Taichang and it had changed its name from Sinochem Ningbo to Ninhua Group. However, the Authority notes that the said claimed development is a post POI occurrence and therefore implies that prior to the initiation of this investigation, Sinochem Ningbo was related to Sinochem Taichang and was also involved in the export of subject goods to India during the POI. But, neither in the exporters questionnaire response, nor during on the spot verification, these facts were substantiated with documentary evidence. In view of the above position, the Authority does not grant individual margins to Sinochem Environmental Protection Chemicals (Taicang) Co. Ltd, China PR.

Zhejiang Juhua Co., Ltd. (Juhua-Producer), Zhejiang Quzhou Juxin Fluorine Chemical Co., Ltd. (Juxin-Producer), Zhejiang Quhua Fluorchemistry Co., Ltd., Zhejiang (Quhua -Exporter), Quzhou Lianzhou Refrigerants Co., Ltd. (Lianzhou – Exporter) and Chemours Chemical (Shanghai) Co Ltd, formerly Du Pont Trading (Shanghai) Co Ltd.

50. Zhejiang Juhua Co., Ltd. (Juhua-Producer), Zhejiang Quzhou Juxin Fluorine Chemical Co., Ltd. (Juxin-Producer), Zhejiang Quhua Fluor-chemistry Co., Ltd., Zhejiang (Quhua -Exporter), Quzhou Lianzhou Refrigerants Co., Ltd. (Lianzhou – Exporter) are related Chinese companies, which filed EQ responses in the present investigation, and are collectively known as “Juhua Group”. Juxin, Quhua and Lianzhou are wholly owned subsidiaries of Zhejiang Juhua Co., Ltd. While Juhua and Juxin are producers of subject goods, Quhua and Lianzhou are only exporters. The said companies were subjected to on the spot verification by the Authority.

51. As per the information available in the EQ responses, during the POI, Juhua and Juxin, the two related producers sold subject goods to Quhua and Lianzhou, the two related exporters and also to a few unaffiliated customers in China. While Quhua exported the subject goods in bulk form, Lianzhou packed the subject goods in various commercial sizes in its packing unit and exported. During POI, while Lianzhou sold the subject goods directly to customers in India, Quhua made its entire sales to Du Pont Trading (Shanghai) Co., Ltd., renamed as Chemours Chemical (Shanghai) Co Ltd, which then made sales to its Indian affiliated party. Chemours Chemical (Shanghai) Co Ltd did not cooperate for on the spot verification of their data/information.

52. During the POI, Juhua and Juxin sold ***MT of subject goods in the domestic market, out of which ***MT was sold to Lianzhou and ***MT was sold to Quhua, and the balance ***MT was sold to other unrelated customers. During the POI, Quhua exported only *** MT (only bulk variety) of subject goods to India having a gross invoice value of US $ ***, entirely through Du Pont Trading (Shanghai) Co., Ltd. During the POI, Lianzhou exported ***MT of packed subject goods to India directly, after packing the bulk subject goods procured from its related producers (Juhua and Juxin), for a gross invoice value of US $ ***.

53. The Authority notes that Du Pont Trading (Shanghai) Co., Ltd exported *** MT of subject goods, all in bulk variety, to India during the POI by procuring from Juhua Group. The Authority further notes that the said exports were made by Du Pont Trading (Shanghai) Co., Ltd to its related Indian party namely E I Dupont India Private Limited. In view of the facts that after filing EQ response, Du Pont Trading (Shanghai) Co., Ltd, renamed as Chemours Chemical (Shanghai) Co Ltd, did not cooperate for verification of their data by the authority. Moreover, the sales were entirely made to its related Indian company, whose sales prices in the Indian market are not known due to their non-cooperation as well.

54. Post disclosure, it has been argued by the respondent companies that even if Chemours has not cooperated, the authority could readily have calculated export price for the other channel of exports of Juhua Group which accounted for 67% of the total exports to India during the POI. In this regard, the Authority notes that without complete information being filed by the producers/exporters involved in the transactions and that too when substantial sales have been made to related buyers, it is neither feasible nor desirable for the Authority to determine individual margins, as lack of complete participation and cooperation of the exporters involved in the transactions limits the authority’s scope to determine dumping margin meaningfully. In view of the above reasons, the Authority does not consider the exports made by Juhua Group to India during the POI for determination of individual margins.

Export price for the Non-Co-operative producers-exporters from China PR

55. The Authority has determined the Export Price in respect of non-cooperative exporters from China PR as per facts available in terms of Rule 6(8) of the Antidumping Rules. Accordingly, after making the due adjustments, the weighted average net export price at ex-factory level, in respect of all non-cooperative exporters from China PR, has been determined as mentioned in the table below.

J. DUMPING MARGIN

56. Considering the normal value and export price as determined above, the dumping margin for all exporters of the subject goods from the subject country is determined as below:

K. METHODOLOGY FOR INJURY DETERMINATION AND EXAMINATION OF INJURY AND CAUSAL LINK

Submissions made by the domestic industry

57. Following are the submissions made by the domestic industry in this regard:

i. The demand/apparent consumption of the subject goods has increased over the injury period including the POI. Imports from subject country have remained significant despite anti-dumping duty, both in absolute terms and in relation to production/consumption in India.

ii. The domestic industry enhanced capacity in POI. The enhancement in capacity was fully justified by the present and potential demand for the product in the Country and in the global market. The production of the domestic industry declined in 2012-13, and then increased in 2013-14 and the POI. However, the capacity utilization of the domestic industry declined consistently over the injury period.

iii. Landed price of imports (after including basic customs duties) have been significantly below the selling prices of the domestic industry, thus resulting in significant price undercutting. Imports have had significant depressing effect on the prices of the domestic industry in the market. The effect of dumped imports on the domestic industry has been significantly adverse. Under the circumstances, should the present anti-dumping duty cease, the imports would further undercut the prices of the domestic industry, which would further depress the prices of the domestic industry to a significant degree.

iv. The performance of the domestic industry improved after the imposition of anti dumping duty. However, profits of the domestic industry declined once again over the injury period as the cost increased and the domestic industry could not increase its selling price as they had to align their prices with the declining import prices. The domestic industry has not been able to earn reasonable profits due to continued dumping of the product under consideration in the Country.

v. Growth of the domestic industry in terms of production and sales has shown a positive trend, however, capacity utilization has declined. Profits, cash profits and return on investment have shown declining trends. This negative growth in price parameters is clearly due to continued dumping of the product under consideration in the market at declining import prices of the subject country over the injury period.

vi. Though the market share of the domestic industry declined in 2012-13, it was at the same level in the POI as was in the base year. This is the situation when anti-dumping duty is in existence. The situation is likely to worsen in the event of cessation of anti-dumping duty.

vii. Even though performance of the domestic industry has improved in respect of production and sales volumes, the same is because of (i) anti-dumping duty imposed, (ii) price at which the domestic industry sold the product. Since the domestic industry has lowered the selling price aligning with the import price from China, they have been able to sell the volumes. Had the domestic industry fixed its prices considering reasonable return on investments, its sales volumes would have fallen flat. Performance of the domestic industry deteriorated in terms of profits, return on investments, cash flow. The various parameters relating to domestic industry collectively and cumulatively establish that the domestic industry has suffered material injury.

viii. Even if cost of production, selling price and profit/loss of the domestic industry is determined by considering optimum capacity utilization, it would be seen that the data in any case shows significant decline in profitability. Even if performance of the domestic industry is adjusted for optimum capacity, it would be seen that the data nevertheless shall show that the domestic industry suffered injury.

ix. While there has been some decline in prices of raw materials, the decline in import price is far more than decline in costs on account of raw materials. The decline in import price of the PUC is far higher than the decline in costs on account of TCE. Thus, the decline in the prices of R134a is not because of decline in cost.

x. As regards the contention that the losses to the DI are because of excessive capacity, petitioner submits that even if calculations are done by considering optimum capacity utilization. (i.e. the highest capacity utilization achieved over the injury period), it would be seen that the data clearly establishes significant deterioration in profitability of the domestic industry even at optimum capacity utilization. Thus, the reason for decline in profitability is not excessive capacity. It is dumped imports. Further, the dumped imports are not only from China but also form USA.

xi. The capacity of 12,500 MT was put up considering the projected demand and the technical aspects. The capacity of 12,500 MT comprises of two parallel reactors of equal capacities. As per the process requirements, the reactors are to be taken off for about two weeks, every 45 days, for regeneration of catalyst. So by planning catalyst regeneration in sequence, continuous production is ensured. The existing plant at Bhiwadi is proposed to be converted to HFC-32, as the existing capacities at Dahej are sufficient to take care of the demand. Since SRF does not have the manufacturing facility to produce cGMP grade HFC-134a, the Board of Directors in their meeting held on 6-Aug-2015 approved a proposal to put up these facilities at a cost of Rs.26 crores. The above information is available in the public domain.

Submissions made by the exporters, importers and Other Interested Parties

58. Following are the submissions made by exporters, importers and other interested parties:

i. There should be grade wise examination of injury analysis of various grades of PUC.

ii. The imports of subject product from China PR have decreased from 1600MT in 2011-12 to 1289 in POI. Whereas the import from USA has increased from 1622 MT in 2011-12 to 2897 MT in POI. Further, the share of imports from China PR has also decreased from 39.39% to 28.62 %, whereas the share of import from USA has increased from 39.91% to 64.31 %, which is almost double. The applicants have acknowledged the fact that imports from USA and not from China PR are causing serious injury to them.

iii. During the POI, production of the petitioner is 4,454 MT and total imports into India is 4504 MT as per the petition filed by the domestic industry. Therefore, in case imports of subject product from all the sources are stopped and petitioner is allowed to satisfy the whole demand in India, even then the petitioner can achieve at max 51% capacity utilisation (capacity 17500 MT). Thus, there will be always substantial idle capacity with the Petitioner. Thus, any injury suffered by domestic industry is due to wrong management and incorrect assessment of demand.

iv. The domestic industry has increased its capacity from 5000 MT in 2013-14 to 17,500 MT during POI. Increasing capacity by 250% times during POI has no economic sense in view of decreasing demand. The major reason for losses suffered by the petitioner is its excess capacity and imports from other countries other than China PR.

v. The main reason for decline in profitability of the Petitioner is rampant increase in capacity which has led to substantial increase fixed cost and semi variable costs. Therefore, authority should exclude the excess fixed cost and semi variable costs from cost of sales.

vi. The current capacity is almost double the domestic sales of product under consideration resulting into unutilised capacities. These unutilised capacities have escalated injury margins unreasonably. The same may be adjusted while determining NIP and Normal value.

vii. The major user of the subject product is the automobile industry which is showing a declining trend. Therefore, enhancing capacity by 3 times by the petitioner reflects poor management decision.

viii. If landed value of subject goods from China PR is lower than domestic selling price of the Petitioner, the sales of domestic industry would have shown a declining trend as imports are lower than selling price of domestic industry. However, the sales of domestic industry are more than the imports from China PR. If the imports from China are undercutting the prices of the domestic industry than the sales volume of the domestic industry should have decreased as there is no economic rationale in procuring the subject goods from the domestic industry. This leads to conclusion that there is no link between the prices offered by domestic industry and imports from China PR.

ix. The cost of production has escalated due to unreasonable increase in number of employees, installed capacity, interest cost , other fixed and semi variable cost. If there has been no increase in capacity by the petitioner, the cost of production would have declined and there would have been no decline in profits or price suppression. These factors are the reasons of price injury suffered by the domestic industry.

x. There is significant increase in import of PUC from other countries including USA. The market share of imports from non-subject country has increased from 35 percent to 41.22 percent. The inventory of the domestic industry has doubled during POI, while the imports from China PR have declined. There is no correlation of imports from China PR and inventories during POI.

xi. Claims of the DI that 12500 Mt capacity plant has been put up to match economy of scale is totally incorrect. Originally, DI had put up the first plant with a capacity of 3000 Mt and later on it was expanded to 5000 Mt. So smaller capacity additions are possible. Now to rectify their mistake of putting wrong size plant they are converting the plant for production of R 32. They are also putting up Medical grade plant at Dahej.

xii. The Chinese imports declined since 2013-14 and also the Chinese import price was reduced significantly. With decline in prices, imports from China should have increased. However, this trend is not evident so there is no correlation between volume of imports and import prices.

xiii. The market share of Chinese imports declined due to the imposition of the duty and such reduced market share was occupied by other countries’ imports, the market share of the DI remained unchanged.

xiv. Costs of the two raw materials (TCE and AHF) account for about 65-70% of the total production cost of R-134a. The decrease of the export price to India during POI was due to the decrease of the price of raw materials in China. Landed value of imports from China PR has behaved in line with prices of raw materials which constitute almost 60-70% of the total cost of R 134a.

xv. Costs claimed by the DI in the petition do not match with the trends of costs of the main raw materials. The domestic industry which was earlier importing TCE has started manufacturing actively. It is noted that the price of main raw materials in India has come down by 32.63%. Norm of TCE to R-134a is 1.4 to 1 which means that decline in raw material prices have impacted the cost of R 134a by (70-52)*1.4=Rs. 25.20 . This means variable cost has come down by Rs. 25.20/kg. On the contrary SRF has claimed that its cost has gone up by 7%. Designated Authority should also analyse the transfer price of TCE within the company as adopted by the Petitioner for determination of cost of sales.

xvi. Demand in the country has risen by 800 Mt during last 4 years, whereas the Domestic Industry has increased its capacities by 12500 Mt. This has resulted into losses to the DI. Illogical increase in capacity has also resulted into increase in wages, depreciation and interest cost. Main aim for the expansion of capacity by 12,500 Mt has been put up to capture US market created due to imposition of Anti-dumping Duty on Chinese Imports.

xvii. It has been claimed by the DI that it enhanced its capacities threefold to meet global demand. On the contrary during the POI export sales declined by 48%. The decision of SRF to expand its capacities was to capture export market; however R-134a is in the process of phasing out.

xviii. When the imports were at its peak the DI was earning profit. With decline in imports the DI has started incurring losses. This clearly shows that imports are not causing injury to the Domestic Industry.

xix. The non- injurious price determined by the designated authority is highly inflated and is not based on real situation. The DGAD has been adopting 22% ROCE to arrive at the Non-injurious Price. DGAD should adopt ROCE earned by the Industry when there was no allegation of dumping as reasonable profit margin and not 22% ROCE.

xx. Price undercutting analysis does not show any correlation between imports and trend of sales price and volumes of domestic sales on Domestic Industry. Price suppressions and depression is claimed bases on inflated costs by the Domestic Industry.

xxi. In 2011-12 sale of subject goods by domestic industry was in tune of 2977 and it increased to 3297 in POI. During POI and injury period, the market share of Chinese subject goods declined from 23 per cent to 17 per cent and the market share of domestic producer remained stable. During the injury period, the export sales of the domestic industry have declined by 48 per cent. Therefore any loss suffered by the domestic industry is attributed to other factors and not the Chinese Goods.

xxii. Since inception of production of PUC, various injury parameters have reflected better results. Sales of domestic industry, capacity utilisation has displayed positive trend. Price suppression and depression alleged by the domestic industry is negative. Thus there is no causal link between injury of the domestic industry and import of subject goods from China PR.

xxiii. The demand for R-134 has come down drastically in OEM segment of refrigerators as such manufacturers have already shifted to environment friendly R-600a.

xxiv. In OEM segment of automobiles, the manufacturers are interested in buying R-134 from local manufacturers due to reliable and timely supply by domestic manufacturers and other technical reasons. The OEM segment of automobiles is also not interested in buying product of Chinese manufacturers.

xxv. The after sales market of smaller companies is in field of servicing or maintenance of automobiles and refrigerators. Such companies buy subject goods trough local distributors and channel partner wherein SRF is the leader with maximum market share.

xxvi. There is separate demand of packed and bulk R-134. The consumers of bulk R-134A are OEM’s and the packed R-134 is consumed by after sales market. There are different segments of consumers who buy DuPont or SRF or Chinese product on the basis of brand loyalty. There is no impact of antidumping or pricing on such consumers.

xxvii. The domestic industry during the time of public hearing had requested for 26 % ROCE. The Authority has in various cases in past, considered 22 % as ROCE. Therefore, the Designated Authority should consider reasonable ROCE in the present investigation as well.

Examination By The Authority

59. The injury analysis made by the Authority hereunder ipso facto addresses the various submissions made by the interested parties. However, the specific submissions made by the interested parties, and considered relevant, are addressed by the Authority as below:

i. As regards the submission concerning methodology of determination of NIP, the Authority notes that relevant guidelines in this regard are well laid down under Annexure III of Antidumping Rules. The authority has determined NIP for the domestic industry on the basis of provisions laid down under Annexure-III of the Anti-dumping Rules. Moreover, Authority has adopted 22% ROCE as a matter of consistent approach.

ii. As regards the submission that there should be grade wise examination of injury analysis of various grades of PUC, the Authority notes that present investigation is a sunset review and the meaning and scope of the PUC remains the same as that in original investigation. Therefore, the methodology of injury analysis also remains the same as that in the original investigation.

iii. As regards the contention that imports from USA and not from China PR are causing serious injury to the domestic industry, the Authority notes that the injury analysis done hereunder ipso facto speaks about the injurious impact of the imports of subject goods from China PR. As regards imports of subject goods from USA, the Authority notes that the domestic industry has already filed an antidumping application against USA.

iv. As regards the contention that substantial idle capacity with domestic industry is the main cause of their injury, the Authority notes that the domestic industry does have idle capacity, but that does not obviate the injurious effect of the dumped imports from China. While increasing demand motivated domestic industry to expand its capacity, continued dumping from China prevented the domestic industry to maximize its capacity utilisation.

v. As regards the contention that fall in demand for the subject goods in the automobile industry are the cause of injury to the domestic industry, the authority notes that the argument is unsubstantiated. None of the available data shows injury to the domestic industry on account of fall in demand for the subject goods in the auto sector.

iii. As regards the contention that there are different segments of consumers who buy DuPont or SRF or Chinese product on the basis of brand loyalty and therefore there is no impact of anti-dumping or pricing on such consumers, the Authority notes that the present finding is self explanatory in this regard. The present investigation is only a review investigation. In the original investigation, dumping, injury and causal link were well established and anti-dumping duties were imposed. The facts of the present sunset review investigation are not much different than the original investigation.

iv. As regards the contention that Authority should do grade wise examination of injury analysis of various grades of PUC, the Authority notes that in terms of end use, broadly there are two types of the subject goods i.e. industrial and pharmaceutical grade. The industrial grade is used in refrigeration and air-conditioning etc, whereas the pharmaceutical grade, which the domestic industry calls as propellant grade, is used as a drug propellant mainly for human consumption. The plant and machinery, raw materials and the process of production of both the types are same. The differences between the two is only the level of purity, the purity required for the pharmaceutical grade meant for human consumption is minimum 99.98%. This being a sunset review, the Authority has adopted the same methodology for injury analysis as was done in the original investigation.

60. In consideration of the various submissions made by the interested parties in this regard, the Authority proceeds to examine the current injury, if any, to the domestic industry. Rule 11 of Antidumping Rules read with Annexure–II provides that an injury determination shall involve examination of factors that may indicate injury to the domestic industry, “…. taking into account all relevant facts, including the volume of dumped imports, their effect on prices in the domestic market for like articles and the consequent effect of such imports on domestic producers of such articles….” In considering the effect of the dumped imports on prices, it is considered necessary to examine whether there has been a significant price undercutting by the dumped imports as compared with the price of the like article in India, or whether the effect of such imports is otherwise to depress prices to a significant degree or prevent price increases, which otherwise would have occurred, to a significant degree.

61. For the examination of the impact of the dumped imports on the domestic industry in India, indices having a bearing on the state of the industry such as production, capacity utilization, sales volume, stock, profitability, net sales realization, the magnitude and margin of dumping, etc. have been considered in accordance with Annexure II of the rules supra.

62. The present investigation is a sunset review of anti-dumping duties in force. Rule 23 provides that provisions of Rule 11 shall apply, mutatis mutandis in case of a review as well. The Authority has, therefore, determined injury to the domestic industry considering, mutatis mutandis, the provisions of Rule 11 read with Annexure II. Further, since anti-dumping duties are in force on imports of the product under consideration, the Authority considers whether the existing anti-dumping duties on the imports of subject goods from the subject country are required to be considered while examining injury to the domestic industry. The Authority has examined whether the existing antidumping measure is sufficient or not to counteract the dumping which is causing injury.