Imports of 4, 4 Diamino Stilbene2, 2 Disulphonic Acid (DASDA) from China PR Sl-108

Dated 26th September, 2016 | Copy of | Notification Sl108 |

GOVERNMENT OF INDIA

MINISTRY OF COMMERCE & INDUSTRY

DEPARTMENT OF COMMERCE

(DIRECTORATE GENERAL OF ANTI-DUMPING & ALLIED DUTIES)

Final Findings

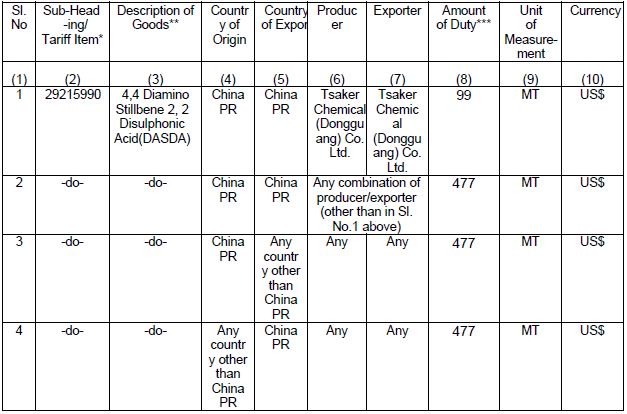

Subject: Mid Term Review (MTR) of the Anti-dumping Duties imposed on the imports of "4,4Diamino Stilbene2, 2 Disulphonic Acid" (DASDA), originating in or exported from China PR.

No. 15/18/2015-DGAD: - Having regard to the Customs Tariff Act 1975 as amended from time to time (hereinafter referred as the Act) and the Customs Tariff (Identification. Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995 thereof, as amended from time to time (hereinafter referred as the Rules);

A. Backoround of the case:

2. Whereas, the Designated Authority (hereinafter referred to as the Authority), had notified its final findings vide Notification 1411/2012-DGAD dated 2216 November 2013, recommending imposition of definitive anti-dumping duty on the imports of 4,4 Diamino Stilbene 2, 2 Disulphonic Acid (hereinafter referred to as the subject goods, or "DASDA", originating in or exported from China PR (hereinafter referred to as the subject country). The definitive anti- dumping duties were imposed by the Central Government vide Notification No. 0912014 — Customs (ADD) dated 23rd January 2014.

3. The Dyestuffs Manufactures Association of India, Mumbai, a representative body of importers/users of the subject goods, has submitted an application requesting for initiation of a review of the anti-dumping duties imposed on the imports of the subject goods from the subject country in accordance with section 9A of the Customs Tariff Act 1975 read with Rule 23 of the Rules. They have claimed that the circumstances that were prevalent during the period of investigation of the original investigation have changed significantly leading to a situation where the existing anti-dumping duties are no longer warranted.

4. Whereas, the applicant has submitted that the import prices of the subject goods have increased significantly; that domestic selling prices have also increased significantly and that the cost of major raw material has also decreased. The applicant has further submitted that coupled with a significant increase in import prices leading to an increase in the landed value of imports, the injury margin has come down and as a consequence, a need for reviewing the current level of duties has arisen.

5. Further, in the original investigation, Hebei Hua-Chem Dye Chemical Co., Ltd, China PR (Producer/Exporter) was accorded individual duty. Subsequently, an application has been filed by Tsaker Chemical (Dongguang) Co Ltd, China PR informing that the name of Hebei Hua-Chem Dye Chemical Co., Ltd, has been changed to Hua Ge Chemical (Dongguang) Co., Ltd., and then to Tasker Chemical (Dongguang) Co Ltd and requested for a change of name in the anti-dumping duty notification from Hebei Hua-Chem Dye Chemical Co., Ltd, China PR (Producer/Exporter) to Tsaker Chemical (Dongguang) Co Ltd, China PR (Producer/Exporter). The present midterm review investigation was also initiated to investigate in to the stated request for change of name, subject to the condition that Tsaker Chemical (Dongguang) Co Ltd, China PR (Producer/Exporter) cooperates with the Authority and files questionnaire response along with all required information/documents.

6. And Whereas, Rule 23 of the Rules read with Section 9A of the Act require that the Designated Authority shall review the need for the continued imposition of any antidumping duties, wherever warranted, on its own initiative or upon request by any interested party who submits positive information substantiating the need for such review, and a reasonable period of time has elapsed since the imposition of the definitive anti-dumping duty and upon such review, the Designated Authority shall recommend to the Central Government for its withdrawal, where it comes to a conclusion that the injury to the domestic industry is not likely to continue or recur, if the said anti-dumping duty is removed or varied and is therefore no longer warranted.

7. Having regard to the information provided by the applicant substantiating the need for such review and indicating changed circumstances necessitating a review of the measure in force, the Designated Authority, vide Notification No. 15/18/2015-DGAD dated 1st October, 2015, initiated the present Mid-term Review (MTR) investigation of the final findings notified vide Notification 14/1/2012-DGAD dated 22th November 2013 published in the Gazette of India, Extraordinary Part I, Section I and the definitive duties imposed by the Central Government vide Notification No., 09/2014 – Customs (ADD) dated 23rd January 2014, to review the need for continued imposition of the anti-dumping duties and the change of name claimed by Tasker Chemical (Dongguang) Co Ltd., China PR.

B. Procedure

8. The procedure described below has been followed with regard to the investigation:

i. The Authority sent copies of the initiation notification dated 1st October 2015 to the embassy of the subject country in India, known exporters from the subject country, known importers and other interested parties, and the domestic producers, as per available information. The known exporters were requested to file the questionnaire responses and make their views known in writing within the prescribed time limit. Copies of the letter and questionnaires sent to the exporters were also sent to embassy of the subject country along with a list of known exporters/producers, with a request to advise the exporters/producers from the subject country to respond within the prescribed time.

ii. Copy of the non-confidential version of the application filed on behalf of the applicant was made available to the known exporters, domestic producers and the embassy of the subject country in accordance with Rule 6(3) of the AD Rules.

iii. The Authority forwarded a copy of the public notice initiating the present MTR to the following known producers/exporters in the subject country, with copy to the embassy of China PR in India, and gave them opportunity to make their views known in writing within forty days from the date of the letter in accordance with the Rules:

a) Shanxi Xiangyu Chemical Co. Ltd.

b) HeBei HengShui DongGang Chemical Co. Ltd.

c) Hebei Hua-Chem Group

d) HengShui Jingheng Chemical Products Co. Ltd.

e) Botou Tianhe Chemical co Ltd.

f) Yanshi Dongyuan Chemical Co Ltd.

g) Tsaker Chemical (Dongguang) Co Ltd.

iv. In response to the initiation of the investigation, separate exporters questionnaire responses (EQR) have been filed by Hebei Hua-Chem Dye Chemical Co., Ltd, China PR and Tsaker Chemical (Dongguang) Co Ltd, China PR, claiming that the name of Hebei Hua-Chem Dye Chemical Co., Ltd was changed to Hua Ge Chemical (Dongguang) Co., Ltd., and then to Tsaker Chemical (Dongguang) Co Ltd. It has been further claimed that during the POI, a major volume of the subject goods actually produced by Tsaker Chemical (Dongguang) Co Ltd., were exported in the name of Hebei Hua-Chem Dye Chemical Co., Ltd., to avail the low anti-dumping duty imposed on Hebei Hua-Chem Dye Chemical Co., Ltd., in the original investigation.

v. Questionnaires were sent to the following known importers/users of subject goods in India calling for necessary information in accordance with Rule 6(4) of the Anti-dumping Rules:

a) Daikaffil Chemicals

b) Khyati Chemicals Pvt. Ltd.

c) Pranav Chemicals

d) Pragna Dye Chem

e) Jaysree Chemicals

f) J.B.Industries

g) Raghunath Dye Chem

h) Paramount Minerals & Chemicals Ltd

i) Aishwarya Chemicals

j) BASF India Ltd

k) Hind Prakash International Ltd

l) Itachem International

m) Anil Organics

n) Clariant Chemicals (India) Ltd

o) Paramount Minerals

p) CAMEX Ltd

q) Sanjay Sales Corporation

r) Modern Chemicals

s) The Dyestuffs Manufacturers Association of India

vi. In response to the above notification, following importers/users have filed importer questionnaire response and made submissions.

vii. Questionnaires were also sent to M/s Deepak Nitrite Ltd. (DNL, the domestic industry of the subject goods in the original investigation.

viii. Exporters, producers and other interested parties who have not responded to the Authority, nor supplied information relevant to this investigation, have been treated as non-cooperating interested parties.

ix. Request was made to the Directorate General of Commercial Intelligence and Statistics (DGCI&S) to arrange for details of imports of subject goods for the past three years, including the period of investigation. The Authority has, therefore, relied upon the DGCI&S data for computation of the volume of imports and required analysis.

x. Optimum cost of production and cost to make & sell the subject goods in India based on the information furnished by the domestic industry on the basis of Generally Accepted Accounting Principles (GAAP) was worked out so as to ascertain if anti-dumping duty lower than the dumping margin would be sufficient to remove injury to Domestic Industry. The NIP has been determined by the Authority in terms of the principles laid down under Annexure III to the Anti-dumping Rules.

xi. A Market Economy Treatment (MET) questionnaire was also forwarded to all the known producers/exporters and embassy of China PR with a request to provide relevant information to the Authority within the prescribed time. The exporters/producers of the subject goods from China PR were therefore requested to furnish necessary information/sufficient evidence as mentioned in sub-paragraph (3) of paragraph 8 to enable the Authority to consider whether market economy treatment can be granted to cooperative exporters/producers. However, none of the respondent Chinese producers/exporters have claimed market economy treatment.

xii. The period of investigation for the purpose of the present review is 1st April, 2014 to 31st March, 2015. The injury investigation period will, however, cover the periods 2011-12, 2012-13, 2013-14 and the POI. The Authority also called relevant information/data from the interested parties for post POI for conducting likelihood analysis.

xiii. In accordance with Rule 6(6) of the Anti-dumping Rules, the Authority also provided opportunity to all interested parties to present their views orally in a public hearing held on 19th April, 2016. The parties, which presented their views in the oral hearing, were requested to file written submissions of the views expressed orally, followed by rejoinder submissions.

xiv. The submissions made by the interested parties during the course of the investigation have been considered by the Authority, wherever found relevant, in this finding.

xv. Verification to the extent deemed necessary was carried out in respect of the information & data submitted by the domestic industry and the cooperating producers/exporters.

xvi. Information provided by interested parties on confidential basis was examined with regard to sufficiency of the confidentiality claim. On being satisfied, the Authority has accepted the confidentiality claims wherever warranted and such information has been considered as confidential and not disclosed to other interested parties. Wherever possible, parties providing information on confidential basis were directed to provide sufficient non-confidential version of the information filed on confidential basis.

xvii. In accordance with Rule 16 of the Rules supra, the essential facts were disclosed by the Authority to the known interested parties vide a disclosure statement issued on 15th September, 2016 and comments received on the same, to the extent considered relevant by the Authority, have been considered in this finding.

xviii. Wherever an interested party has refused access to, or has otherwise not provided necessary information during the course of the present investigation, or has significantly impeded the investigation, the Authority has recorded the final findings on the basis of available facts.

xix. ***represents information furnished by an interested party on confidential basis and so considered by the Authority under the Rules.

xx. The average exchange rate of 1US$ = Rs 61.69 prevailing during the POI has been adopted by the Authority in this finding.

C. PRODUCT UNDER CONSIDERATION AND LIKE ARTICLE:

9. The Product under Consideration (PUC) in the original investigation as well as in the present review is ‘4,4Diamino Stilbene2, 2 Disulphonic Acid”(DASDA). It is also known as 2, 2’-(1,2-Ethylenediyl) bis (5-aminobenzenesulfonic acid), 4, 4’- Diaminostilbene-2, 2’-Disulfonic Acid, 2, 2’-ethene-1, 2-diylbis (5-amino benzene sulfonic acid), Amsonic Acid and DSD Acid. DASDA is a light yellow color powder/cream, which is used in synthesis of dye stuffs, like optical brightening agents, fluorescent brightening agents, etc. Subject goods are classified under heading 29215990. The subject goods are also being imported under other tariff headings such as 29214290, 29222190, 29222990, 29309099, etc. However, the customs classification is indicative only and in no way binding on the scope of the investigation.

10. None of the interested parties, including the petitioner, the exporter and the domestic industry, has filed any comment or submission with regard to product under consideration and like articles. The applicant submitted that they have no issues regarding the product under consideration and like article. In view of the above, the Authority notes that the scope of the product under consideration in the present review investigation remains the same as that in the original investigation.

D. SCOPE OF DOMESTIC INDUSTRY AND STANDING

11. The Authority notes that Rule 2(b) of the Anti-dumping Rules reads as follows:-

“domestic industry” means the domestic producers as a whole engaged in the manufacture of the like article and any activity connected therewith or those whose collective output of the said article constitutes a major proportion of the total domestic production of that article except when such producers are related to the exporters or importers of the alleged dumped article or are themselves importers thereof in such case the term ‘domestic industry’ may be construed as referring to the rest of the producers”.

12. In the original investigation the application was filed by Deepak Nitrite Ltd., on behalf of the domestic industry. In terms of Rule 2(b) read with Rule 5 (3) of Antidumping Rules, the Authority had determined Deepak Nitrite Ltd as domestic industry in the original investigation. In the present MTR investigation, no submission has been made by any interested parties with regard to standing and scope of domestic industry. In view of this position, the Authority determines Deepak Nitrite Ltd as domestic industry within the meaning of the Rule 2 (b) and Rule 5 (3) of the Rules supra in the present MTR investigation.

E. Confidentiality

13. The petitioner and other interested parties have submitted that the non-confidential version of the Proforma IV A provided by Deepak Nitrite Ltd (DNL) has not disclosed the volume of captive consumption of DASDA for their Optical Brightening Agents (OBA) production. Even, a trend analysis of the same has not been provided.

14. The domestic industry has made the following submissions with regard to confidentiality:

i. DNL has disclosed the trend of volume of captive consumption of DASDA in the non-confidential version of the response/submissions.

ii. The exporter has claimed a major proportion of information as confidential and has not even provided a non confidential summary of the information filed by them. Non-confidential version of their questionnaire response is grossly inadequate. Even information publicly available has not been disclosed by them in their non-confidential version of response. Further the exporter has not filed proper and sufficient non-confidential summary of the information claimed as confidential, so as to enable the respondent to give meaningful comments.

iii. The responses filed by the producer/exporter are in utter disregard to the standards laid down under the law. Tsaker has tried to evade the responsibility to provide relevant information in the guise of confidentiality.

EXAMINATION BY THE AUTHORITY

15. With regard to confidentiality of information, Rule 7 of Anti-dumping Rules provides as follows: -

Confidential information: (1) Notwithstanding anything contained in sub-rules and (7)of rule 6, sub-rule(2),(3)(2) of rule12,sub-rule(4) of rule 15 and sub-rule (4) of rule 17, the copies of applications received under sub-rule (1) of rule 5, or any other information provided to the designated authority on a confidential basis by any party in the course of investigation, shall, upon the designated authority being satisfied asto its confidentiality, be treated as such by it and no such information shall be disclosed to any other party without specific authorization of the party providing such information.

(2)The designated authority may require the parties providing information on confidential basis to furnish non-confidential summary thereof and if, in the opinion of a party providing such information, such information is not susceptible of summary, such party may submit to the designated authority a statement of reasons why summarization is not possible.

(3) Notwithstanding anything contained in sub-rule(2), if the designated authority is satisfied that the request for confidentiality is not warranted or the supplier of the information is either unwilling to make the information public or to authorise its disclosure in a generalized or summary form, it may disregard such information.

16. Information provided by the interested parties on confidential basis was examined with regard to sufficiency of the confidentiality claim. On being satisfied, the Authority has accepted the confidentiality claims, wherever warranted and such information has been considered confidential and not disclosed to other interested parties. Wherever possible, parties providing information on confidential basis were directed to provide sufficient non confidential version of the information filed on confidential basis. The Authority made available the non-confidential version of the evidences submitted by various interested parties in the form of public file. The Authority notes that any information which is available in the public domain cannot be treated as confidential.

F. MISCELLANEOUS SUBMISSIONS

Submissions made by the Petitioner and other interested parties

17. Following miscellaneous submissions have been made by petitioner and other interested parties:

i. The economic indicators concerning the subject goods have undergone tremendous changes vis-à-vis the POI of the original investigation. Crucial parameters such as landed price of imports, non-injurious price and injury margin have undergone significant changes justifying MTR investigation and withdrawal of duty.

ii. Purpose of anti-dumping measure is not to facilitate the domestic industries to create a monopoly on prices, but to eliminate the tradedistorting effects of injurious dumping. DNL not only used the ADD to increase their prices but used the same to dictate prices in the downstream OBA sector.

iii. Deepak Nitrite Ltd. (DNL) is using Anti-dumping duties to manage the Optical Brightening Agent (OBA) market and there are no pressures on DASDA produced by DNL per se from imports. The dyestuff manufacturers are now directly competing with DNL in the Optical Brightening Agents (OBA) market which is the downstream product of DASDA.

iv. The continued imposition of measures on imports of the product concerned would have detrimental consequences on the Indian users of the product concerned.

Submissions made By Domestic Industry

18. Following miscellaneous submissions have been made by the domestic industry:

i. The applicant must come before the Authority with sufficient prima facie evidence that there exists significant change in circumstances and the changes are of lasting nature.

ii. While quality and quantity of evidence might improve as an investigation progresses, the petition must in any case contain duly substantiated relevant claims on all factors relevant for withdrawal of anti-dumping duty including information with regard to “no dumping”, “no likelihood of dumping”, “no injury”, “no likelihood of injury”.

iii. It has been alleged that since the domestic industry have a good standing in the downstream industry and presence in the raw material sector, they have a better standing and are in a position to dictate prices to the prejudice of the consumer. However, if the price undercutting is determined with and without anti dumping duty, it would be seen that the price undercutting with anti dumping duty is negative throughout the period of anti dumping duty imposition. Further, if the price undercutting is determined pre and post the period where the domestic industry is producing downstream product as well, it would be seen that the price difference that had prevailed before the domestic industry commenced commercial production of downstream product and the price difference that is now prevailing after the domestic industry commenced commercial production of downstream product is not materially different. In fact, the price undercutting was earlier higher. This would not be the case had the domestic industry dictated prices to the extent of anti dumping duty in force or if the domestic industry had wished creating disadvantages to the consumers in the downstream product. In fact, if the monthly price undercutting is examined, it would be seen that the price undercutting without anti dumping duty also became significantly negative when the import prices were abnormally higher.

iv. Imposition of anti-dumping duties might affect the price level of the product in India, but fair competition in the Indian market will not be reduced by the anti dumping measures.

v. OBA and DASDA are two different products. Domestic industry has not managed OBA or DASDA business in a manner which can cause prejudice to the downstream producers. The facts of the case also establish that the domestic industry has not got any excessive profit in DASDA. The import price of DASDA in the current period is lower than the import price prevailing at the time of original investigations.

vi. The exporter has made submissions in the hearing completely on injury and price parameters and has not made any submission on the name change which was the sole reason of their application.

vii. In view of significant change in the prices, it is vital that the dumping margin, price undercutting and injury margin are examined by undertaking month by month analysis.

EXAMINATION OF THE AUTHORITY

19. Rule 23 of Anti-dumping Rules states as follows:

(1) Any anti-dumping duty imposed under the provision of section 9A of the Act, shall remain in force, so long as and to the extent necessary, to counteract dumping, which is causing injury.

(1A) The Designated Authority shall review the need for the continued imposition of any anti-dumping duty, where warranted, on its own initiative or upon request by any interested party who submits positive information substantiating the need for such review, and a reasonable period of time has elapsed since the imposition of the definitive anti-dumping duty and upon such review, the Designated Authority shall recommend to the Central Government for its withdrawal, where it comes to a conclusion that the injury to the domestic industry is not likely to continue or recur, if the said anti-dumping duty is removed or varied and is therefore no longer warranted.

(1B) Notwithstanding anything contained in sub-rule (1) or (1A), any definitive anti-dumping duty levied under the Act, shall be effective for a period not exceeding five years from the date of its imposition, unless the Designated Authority comes to a conclusion, on a review initiated before that period on its own initiative or upon a duly substantiated request made by or on behalf of the domestic industry, within a reasonable period of time prior to the expiry of that period, that the expiry of the said anti-dumping duty is likely to lead to continuation or recurrence of dumping and injury to the domestic industry.

(2) Any review initiated under sub-rule (1) shall be concluded within a period not exceeding twelve months from the date of initiation of such review.

(3) The provisions of rules 6, 7, 8, 9/10, 11, 16, 17, 18, 19, and 20 shall be mutatis mutandis applicable in the case of review.

20. Article 11.2 of the Anti-dumping Agreement provides that the Authority shall review the need for the continued imposition of the duty, where warranted, on their own initiative or, provided that a reasonable period of time has elapsed since the imposition of the definitive anti dumping duty, upon request by any interested party which submits positive information substantiating the need for a review. Interested parties shall have the right to request the authorities to examine whether the continued imposition of the duty is necessary to offset dumping, whether the injury would be likely to continue or recur if the duty were removed or varied, or both. If, as a result of the review under this paragraph, the Authority determines that the anti dumping duty is no longer warranted, it shall be terminated immediately.

21. While the petitioner and the other interested parties have argued that the improvement in performance of domestic industry in the POI is of lasting nature and the Authority should decide the fate of the antidumping duty on the basis of performance of DI during the POI, the domestic industry has contended that in a mid-term review, current performance alone is insufficient to conclude whether the anti-dumping duty should be withdrawn and that the Authorities is required to consider the likely situation when anti dumping duty is withdrawn.

22. The Authority examined the issues raised by the interested parties and domestic industry and notes that Rule 23 of the Anti-dumping Rules obligates the Authority to review the need for the continued imposition of an antidumping duty, inter alia, upon request by any interested party who submits positive information substantiating the need for such a review after a reasonable period of time has elapsed since the imposition of the definitive anti-dumping duty and upon such review, the Authority shall recommend to the Central Government for its withdrawal, where it comes to the conclusion that the injury to the domestic industry is not likely to continue or recur if the said anti-dumping duty is removed or varied and is therefore no longer warranted.

23. The Authority notes that Rue 23 (1A) of the Anti-dumping Rules mandates the Authority to examine if there is any likelihood for the continuation or recurrence of injury if the said anti-dumping duty is removed or varied and whether the changed circumstances stated are of lasting nature. The objective of a midterm review investigation is to come to a conclusion whether injury to the domestic industry is not likely to continue or recur, in the event of revocation of the anti-dumping duty. Thus, the performance of the domestic industry during the POI alone is insufficient to conclude whether the anti dumping duty can be withdrawn.

24. As regards the contention that DNL’s monopolistic behavior over sales of the subject goods is making the OBA producers incompetitive, the Authority notes that the objective and purpose of imposing antidumping duty is to prevent unfair trade practices and not to promote monopolization of trade by any interested party. The Authority further notes that Anti-dumping Rules do not require that the a domestic industry must be able to fulfill the demand in the domestic market to the fullest extent for seeking redressal of injury caused to it on account of dumping. Moreover, OBA and DASDA are two different products and the present investigation is in respect of DASDA only. No documents/information has been provided by the interested parties substantiating the claim that DNL has managed OBA or DASDA business in a manner which has caused prejudice to the OBA producers.

25. As regards the contention that continued imposition of measures on imports of the product concerned would have detrimental consequences on the users, the Authority notes that the purpose of imposing anti-dumping duties, in general, is to eliminate injury caused to the domestic industry by the unfair trade practices of dumping. Imposition of anti-dumping duties may affect the price levels of the product in the domestic market, but would not restrict imports of the subject goods from the subject country in any way, and therefore, would not affect the availability of the product to the consumers.

G. Determination of Dumping Margin

Market Economy, Normal Value, Export Price and Dumping Margin

Submissions made by the Petitioner and Other Interested Parties

26. The following submissions have been made by Hebei Hua-Chem Dye Chemical Co. Ltd:

i. Hua-Ge Holding Group Co. Ltd., China PR (hereinafter referred to as “HG Group”) is the 100 percent controller of Hebei Hua-Chem Dye Chemical Co. Ltd.,(hereinafter referred to as “Hua-Chem”), the respondent producer/exporter in the original investigation and holder of individual duty.

ii. Hua-Chem was a limited liability company established under the Company Law of PRC. It has been cancelled on 24th March, 2015.

iii. On 7th May, 2013, HG Group established a new company i.e. Hua-Ge Chemical (Dongguang) Co. Ltd. (hereinafter referred to as Hua-Ge) who subsequently changed its name into Tsaker Chemical (Dongguan) Co. Ltd. (hereinafter referred to as “Tsaker”), with the purpose of substituting Hua-Chem.

iv. On 10th Oct. 2013, Hua-Chem and Hua-Ge signed the Asset Reorganization Contract, according to which Hua-Chem’s enterprise assets-inventory, fixed assets, all machines, equipment and facilities in the target enterprise, construction in process, prepayment, intangible asset-credits, debts and labor were transferred to Hua-Ge as a whole.

v. After that, production lines were completely transferred to Hua-Ge and on 24th March, 2015, Hua-Chem was finally cancelled by HG Group.

vi. Hua-Chem was actually the predecessor of the current company Tsaker.

vii. From April to November of 2014, during which Hua-Chem had not been finally cancelled, subject goods were produced by Tsaker and exported in the name of Hua-Chem who participated in the original anti-dumping investigation and enjoyed a relatively low anti-dumping duty rate.

viii. Starting from November 2014, goods were exported in the name of Tsaker, considering the company’s listing affairs and to evade related party transaction.

ix. Hua-Chem did not produce subject products during the POI. After Hua- Chem and Hua-Ge signed the Asset Reorganization Contract, it no more had any production lines. For those subject products exported in name of Hua-Chem with the purpose of enjoying its relatively low antidumping duty rate, from April to November of 2014, it was actually produced by Tsaker. So, there was no company supply inputs with Hua-Chem.

27. The following submissions have been made by Tsaker Chemical (Dongguang) Co. Ltd., (hereinafter referred as Tsaker):

i. Tsaker was first established on 7th May, 2013 and registered as the name of Hua-Ge Chemical (Dongguang) Co. Ltd.

ii. On 13 October, 2014, Hua-Ge changed into its current name of Tsaker Initially, Hua-Chem’s 100 percent controller, Hua-Ge Holding Group Co., Ltd. intended to list Hua-Chem in the stock exchange, but considering its complicated evolution, HG Group decided to establish a new company, i.e. Hua-Ge (predecessor of Tsaker) to supersede Hua- Chem.

iii. On 10th October 2013, Hua-Chem and Hua-Ge signed the Asset Reorganization Contract, according to which Hua-Chem’s enterprise assets-inventory, fixed assets, all machines, equipment and facilities in the target enterprise, construction in process, prepayment, intangible asset-credits debts and labor were transferred to Hua-Ge as a whole. After that, production lines were completely transferred to Hua-Ge and on 24th March, 2015, Hua-Chem was finally cancelled by HG Group in Administration for Industry and Commerce of Cangzhou City.

iv. Tsaker is wholly owned by Tsaker Chemical (Cangzhou) Co., Ltd. v. Tsaker is currently the only factory involved in production of the subject goods.

vi. From April to November of 2014, during which Hua-Chem had not been finally cancelled, subject goods were produced by Tsaker and exported in the name of Hua-Chem who participated the original antidumping investigation and enjoyed a relatively low anti dumping duty rate. Starting from November 2014, goods were exported in the name of Tsaker, considering the company’s listing affairs and to evade related party transaction.

vii. The Company-Hua-Ge Chemical (Dongguang) Co. Ltd. was established on 26th May, 2013 to inherit Hebei Hua-Chem Dye Chemical Co., Ltd., Hebei Hua-Chem Dye Chemical Co., Ltd., participated as an exporter in the original investigation. Hua-Ge changed its name into Tsaker Chemical (Dongguang) Co., Ltd. Hua Ge had exported the subject goods to India till its name changed to Tsaker.

viii. In case the Authority considers to continue with the Anti-dumping Duty on the subject material from China PR, separate rate of duty may be accorded to Tasker Chemical (Dongguang) Co Ltd, China PR.

Submissions made by the domestic industry

28. The submissions made by the domestic industry are as follows:

i. The claimed change in the concerned Chinese companies is not a mere change of name.

ii. It has been admitted that to enjoy ‘low anti dumping duty rate’ the products were exported in the name of Hua Chem from April to November 2014 when actually produced by Tsaker. It clearly amounts to evading the duty.

iii. Tsaker Chemical (Dongying) Co. Ltd is also a production base for DASDA owned by Tsaker Chemical (Cangzhou) Co. Ltd. However that has not been declared in the exporter’s questionnaire response.

Examination by the Authority

29. As regards the claimed change of name from Hebei Hua-Chem Dye Chemical Co., Ltd., to Hua-Ge Chemical (Dongguang) Co. Ltd., and then to Tasker Chemical (Dongguang) Co Ltd, the Authority has verified the data/information of the concerned exporters and from the copy of the Global Offering of Tsaker Chemical Group Ltd., prepared by Frost & Sullivan, noted the following:

i. The Company is the leading producer of DASDA in the world. It accounts for 57.4% of World market share for DASDA by production volume in 2014.

ii. It is also the leading producer of many other dyes and chemical intermediates in the world.

iii. The Company’s major owned production facilities are located in Dongguang, Hebei Province and the leased Dongao production plant located in Dongying in Shandong Province.

iv. Another production plant is also being set up in Dongying in Shandong Province, primarily for production of DSD Acid and other dye and pigment intermediates.

v. Company’s planned production capacity of DASDA as of 2015 end is 55000 MT.

vi. As of end of December, 2014, the designed production capacity of the Company for DSD acid is 35, 000 MT and actual production volume by the said date is 30, 001 MT.

vii. Global DSD Acid demand by the end of 2014 is 52, 300 MT.

viii. The operation history of Tsaker Group can be traced back to the establishment of Huage Dye by Huayu Chemical plant (which was established in May, 1995 as a wholly state owned enterprise) in December, 1997. Huage Dye has been principally engaging in the production and sale of DSD Acid.

ix. The operating assets of Huage Dye were acquired by Tsaker Donguang in September, 2013. x. Tsaker Cangzhou was established in September, 2005 by Huage fine Chemicals.

xi. On 7th May, 2013, Tsaker Donguang was established in China with a registered capital of RMB 50 Million to acquire certain operating assets of Huage Dye and to engage in the production and sale of DSD Acid and other dye intermediates.

xii. On September 30, 2013, Tsaker Donguang and Huage Dye entered in to an Asset Restructuring Agreement (which was supplemented by a supplemental agreement dated October 10, 2013) pursuant to which Tsaker Donguang acquired the operating assets owned by Huage Dye used for production (including, among others, fixed assets, raw materials, work-in-progress, construction-in-progress, land use rights, trade payables, and advance to suppliers) for a cash consideration of approximately RMB 124.71 Million, which was legally and properly settled on December 25 , 2013.

xiii. On May 20, 2014, Tsaker Dongying was established in the PRC with a registered capital of RMB 30 Million to focus on the production and sale of DSD Acid, PNT, ONT, MNE and NMP.

30. The above stated details noted from the Group Company’s Global Offering evidences that Tsaker Chemical (Dongguang) Co. Ltd is not merely a new name for Hebei Hua-Chem Dye Chemical Co. Ltd., or Hua-Ge Chemical (Dongguang) Co. Ltd. It is a new Company which was established to take over the assets of Hua-Ge Chemical (Dongguang) Co. Ltd.

31. The above details also defy the claims made by the Company regarding their capacity of production (claimed capacity of Tsaker is 15, 000 MT) and number of plants for the subject goods. The above details noted from the Global offerings of the Group company evidences that it has much more actual production and capacity of production than what they claimed, which further indicates that apart from Dongguang plant, they have other production centres for production of DASDA. It also proves that contrary to their claims, Tsaker Dongying is also involved in the production and sale of DASDA.

32. The verification report was shared with the concerned exporter. The following comments were made by the concerned exporter:

i. Since change of Hua Ge to Tsaker was only a name change, the establishment date of Tsaker is still regarded as 7th May, 2013, same with Hua-Ge.

ii. There was infact an equity transfer contract between Hua-Ge Cangzhou and Tsaker Cangzhou.

iii. Company did not report the 15000 MT production capacity for DASDA. The company’s production capacity is 35000 MT.

iv. Tsaker group only has one DASDA plant currently. Dongying plant is yet to be established.

33. The Authority notes that during the verification it was informed by the Company that Tsaker Chemical (Dongguang) Co. Ltd was established on7th May, 2013 and on 13 October, 2014, Hua-Ge Chemical (Dongguang) Co. Ltd., changed its name as Tsaker Chemical (Dongguang) Co. Ltd. But, both these statements are contradictory. If Tsaker Company was floated on 7th May, 2013, then how Hua Ge can change its name to Tsaker, which was established much before. Now, in their comments on verification report, the exporter has continued their stand that the change of Hua Ge in to Tsaker was only a name change and the establishment date of Tsaker is still regarded as 7th May, 2013. But, actually, as per the Global Offering report of Tsaker, The operating assets of Huage Ge were acquired by Tsaker Donguang in September, 2013 through an Asset Restructuring Agreement. This proves that the assets of Hua Ge were taken over by Tsaker involving a structural change or change of ownership and not merely a nomenclature change. Further, as per the capacity document furnished by Tsaker, its Donguang plant’s current production capacity has been shown as 15000 MT. This contradicts their present claim that Donguang plant’s current production capacity is 35, 000 MT. This is perhaps being done by the Company to prove that they have no other plant for DASDA other than the Donguang plant. But, their own Global Offering paper clearly states that on May 20, 2014, Tsaker Dongying was established in the PRC with a registered capital of RMB 30 Million to focus on the production and sale of DSD Acid. In view of the above, the Authority does not accept the claimed change of name from Hebei Hua-Chem Dye Chemical Co. Ltd., to Hua-Ge Chemical (Dongguang) Co. Ltd., and then to Tsaker Chemical (Dongguang) Co. Ltd.

34. From the submissions made by the concerned exporters and their records, the Authority further notes that during the POI, Hebei Hua-Chem Dye Chemical Co. Ltd., the holder of individual duty in the original investigation ceased to exist as the Company along with its assets were taken over initially by Hua-Ge Chemical (Dongguang) Co. Ltd., and then by Tsaker Chemical (Dongguang) Co. Ltd. But, as stated by Tsaker Chemical (Dongguang) Co. Ltd, during April to November of 2014, the subject products, actually produced by Tsaker were exported in the name of Hua-Chem with the purpose of enjoying its relatively low anti-dumping duty rate. The Authority notes that such action by the Company, amounts to evasion of duty.

35. In view of the above position, the Authority does not accept the export transactions made to India during the POI in the name of Hebei Hua-Chem Dye Chemical Co. Ltd., as eligible exports by Tsaker Chemical (Dongguang) Co. Ltd for calculation of their export price and determination of the margins. Instead, for the purpose of calculation of export price and determination of margins in respect of Tsaker Chemical (Dongguang) Co. Ltd, China PR, the Authority accepts only those transactions which have been made by the said company in their own name during the POI.

Examination of Market Economy Claims

36. The Authority sent copies of the MET questionnaire to all the known exporters for rebutting presumption of non-market economy in accordance with criteria laid down in para 8(3) of Annexure-I to the Rules. The Authority also requested Government of China to advise producers/exporters in their country to provide the required information.

37. As per Paragraph 8, Annexure I to the Anti Dumping Rules as amended, the presumption of a non-market economy can be rebutted if the exporter(s) from China PR provide information and sufficient evidence on the basis of the criteria specified in sub paragraph (3) in Paragraph 8 and establish to the contrary. The cooperating exporter/producer of the subject goods from China are required to furnish necessary information/sufficient evidence as mentioned in sub-paragraph (3) of paragraph 8 in response to the Market Economy Treatment questionnaire to enable the Designated Authority to consider the following criteria as to whether:-

i. The decisions of concerned firms in China PR regarding prices, costs and inputs, including raw materials, cost of technology and labor, output, sales and investment are made in response to market signals reflecting supply and demand and without significant State interference in this regard, and whether costs of major inputs substantially reflect market values;

ii. The production costs and financial situation of such firms are subject to significant distortions carried over from the former nonmarket economy system, in particular in relation to depreciation of assets, other write-offs, barter trade and payment via compensation of debts;

iii. Such firms are subject to bankruptcy and property laws which guarantee legal certainty and stability for the operation of the firms and

iv. The exchange rate conversions are carried out at the market rate.

38. In the original investigation, Hebei Hua-Chem Dye Chemical Co. Ltd did not claim market economy treatment. In the present MTR investigation also, the respondent Chinese producers/exporters have not claimed market economy treatment. In view of the above position and in absence of rebuttal of nonmarket economy presumption by the respondent Chinese companies, the Authority considers it appropriate to proceed with para-7 of Annexure-I to the Rules for determination of normal value.

H. Determination of Normal value

39. Para 7 of Annexure I of the AD Rules provides that:

“In case of imports from non-market economy countries, normal value shall be determined on the basis of the price or constructed value in the market economy third country, or the price from such a third country to other countries, including India or where it is not possible, or on any other reasonable basis, including the price actually paid or payable in India for the like product, duly adjusted if necessary, to include a reasonable profit margin. An appropriate market economy third country shall be selected by the designated Authority in a reasonable manner, keeping in view the level of development of the country concerned and the product in question, and due account shall be taken of any reliable information made available at the time of selection. Accounts shall be taken within time limits, where appropriate, of the investigation made in any similar matter in respect of any other market economy third country. The parties to the investigation shall be informed without any unreasonable delay the aforesaid selection of the market economy third country and shall be given a reasonable period of time to offer their comments.”

40. Accordingly, the ex-works Normal Value of the product under consideration for all exporters from China PR has been constructed by taking into account the international price of the major raw materials and the consumption norms, conversion cost and SGA expenses of the domestic industry. After adding a reasonable profit margin of 5%, the Authority has constructed the normal value for all producers/exporters of China PR as US$ ***/MT.

I. EXPORT PRICE

Tsaker Chemical (Dongguang) Co. Ltd., China PR

41. The Authority notes that during the POI, Tsaker Chemical (Dongguang) Co. Ltd, China PR exported ***MT of subject goods for the gross invoice value of US$ ***. After making the adjustments on account of Commission, Ocean Freight, Inland Freight and Cargo Handling Charges, Overseas Insurance, Credit Cost, Bank Charges and VAT refund, the Authority determined the net export price as US$ ***/MT.

Determination of Export Price for other Producers/Exporters from China PR

42. The Authority has determined the net export price in respect of other producers/exporters of China PR as US$ ***/MT, based on the prices of the cooperative exporter from China, on facts available basis, in terms of Rule 6(8) of the Anti-dumping Rules,.

J. DUMPING MARGIN

43. Considering the Normal values and net export prices as determined above, the dumping margins during the POI has been determined as below:

K. METHODOLOGY FOR INJURY DETERMINATION AND EXAMINATION OF INJURY AND CAUSAL LINK

Submissions made by the Petitioner and other Interested Parties

44. The following submissions have been made by the petitioner and other interested parties:

i. The economic indicators concerning the subject goods have undergone tremendous changes vis-à-vis the POI of the original investigation and the time of publication of final findings.

ii. Key economic parameters of domestic producers show significant improvement that is considerably lasting in nature. The performance of the domestic industry has tremendously improved over the years and there are no signs of any kind of reversal.

iii. The price of Para Nitro Toulene (PNT), one of the major raw materials, has significantly declined in present POI as compared to original POI.

iv. Import prices of subject goods have increased significantly from subject country during the POI of this MTR in comparison to the POI of original investigation. The change in import prices has been very significant and material which substantiates the need for withdrawal of existing duties.

v. There is significant increase in domestic prices of subject goods supplied by the domestic industry during the present POI as well and the DI has increased its NSR beyond reasonable levels when the core raw material prices have declined.

vi. Selling price of the domestic industry is significantly higher than noninjurious Price. Therefore, there is no likelihood of continuation or recurrence of injury to the domestic industry.

vii. Further, the landed price of imports of subject goods from subject country is above non-injurious price in the POI as well as post POI (April 2015 to September 2015) resulting in negative injury margin. Thus, the current imports are not causing any injury to the domestic industry.

viii. Once it is established that the injury margin in respect of imports of subject goods from subject country is negative, it is entirely immaterial whether the dumping margin is positive or negative. There is no justification for continuation of anti-dumping duty in case the injury margin is negative.

ix. Profitability of the domestic industry should be examined after excluding captive transfers of DASDA for production of OBA.

x. Contrary to the clam of DNL about the dip in DASDA price to historically low levels, the real dip was in raw material price and not in the price of DASDA. Even the argument of DNL qua the Indian Rupee depreciation is baseless. The importers pay the duty in Indian rupee and the appreciation of US$ has increased the duty burden of importers since the AD duty is imposed in terms of US$ per KG. The DI is in fact getting the additional benefit of rupee depreciation which itself is a good cause to review the duty in force.

xi. The price undercutting has been negative in the POI. Also, the landed price of imports have been higher than the NIP of the DI and any positive price undercutting could only be result of huge increases of price by DI which has no justification in view of the existing anti- dumping duties. Also, there is neither any price suppression nor depression on domestic prices on account of imports of subject goods from China PR. Such being the case, the present duties should be revoked forth with.

xii. The market share of imports between POI and immediate previous year declined by some 9% whereas share of DI in the same period increased by about 9%, thus, there haven’t been any adverse impact of volume on the DI. It may also be noted that the landed price of such imports are even higher than the estimated NIP of the DI, negating any price effect.

SUBMISSIONS MADE BY THE DOMESTIC INDUSTRY

45. The following submissions have been made by the domestic industry:

i. There was a short lived sharp increase in the prices of DASDA around Aug.-Sept., 2014. After peaking in Nov., 2014, the prices had already declined by the month of March, 2015. Import price in the present period has declined to Rs.***, despite sharp devaluation of INR. Therefore it is clear that presently the situation is worse than the POI.

ii. Aberrational price for brief period cannot become ground for premature withdrawal of anti dumping duty. The import price of DASDA increased quite significantly for a very brief period. The import price in US Dollar is now in fact materially lower than the import price that had prevailed at the time of investigation period of the original case. The anti dumping duty should not be withdrawn at a premature stage only because of aberrational pricing in few months.

iii. The allegation that the PNT cost has declined by 18% in the present POI vis-a-vis the original POI but the DI has not reduced their selling price is not correct. The fact remains that the increase in selling price in the period Aug.-Nov., 2014 was far higher than increase in cost of production, whereas the decline in selling price after Nov., 2014 was far higher than the decline in cost of production.

iv. PNT is largely captively produced by the domestic industry and therefore the trends in the import price of PNT are entirely irrelevant for the present purposes. In fact, as the DASDA dumping once again intensified after Dec., 2014, the Chinese producers started dumping PNT as well. Since PNT is largely a captive production for the domestic industry, the Designated Authority is required to consider the costs on the basis of PNT cost of production of the domestic industry.

v. The prices have evidently remained below the cost of imported product. Some increase in prices of the respondents should be seen in consonance with the increase in the import prices. In fact, if the monthly price undercutting is examined, it would be seen that the price undercutting without anti dumping duty also became significantly negative when the import prices were abnormally higher.

vi. Contrary to the claims of petitioner, it will be seen that profits had declined in 2013-14, and thereafter increased in 2014-15, which has thereafter declined again in the post POI period. The return on investments has shown a similar trend. The cash profits had increased till the POI and thereafter declined in the post POI period. So significant was the decline in the import price after the POI that despite the fact that the domestic industry did not reduce the prices to the same extent as that of imports and yet the domestic industry suffered financial losses. Further, so significant was the decline in the profitability that the cash profits and ROI became negative after the POI.

vii. While the landed price of import was above NIP if both are compared on weighted average basis, if month by month analysis is undertaken, it would be seen that the injury margin was positive towards beginning of the POI and became negative thereafter during September 2014 to February 2015 period. The injury margin was once again positive in March 2015 and thereafter. In entire post POI, the injury margin was positive.

viii. If performance of domestic industry is examined by considering weighted averages, it shall show improvement. If performance of the domestic industry is examined within POI by undertaking month by month analysis, it would be seen that the performance of the domestic industry improved during period June 2014- December 2014 and declined thereafter.

ix. While on weighted average basis, selling price of the domestic industry might be higher than NIP, if the selling price and NIP are compared on month by month basis, it would be seen that the selling price was below NIP in the beginning of the POI and therefore the change in circumstance alleged by the petitioner was highly temporary in nature and were not of lasting nature. In fact, the circumstances have shown material change after four months aberrational period to such an extent that domestic industry is already suffering financial losses to such a significant extent that the cash profit and return on investment are also negative.

EXAMINATION BY THE AUTHORITY

46. The Authority has taken note of the arguments and counter-arguments of the interested parties on injury. The injury analysis made by the Authority based on the non-injurious price determined on month to month basis ipso facto addresses the various submissions made by the interested parties. However, the specific submissions made by the interested parties are addressed by the Authority as below.

47. As regards the submission that profitability should be examined after excluding captive transfers of DASDA for OBA, the Authority notes that the profitability of the domestic industry has been determined after excluding the captive transfer of DASDA for OBA production.

48. Rule 11 of Antidumping Rules read with Annexure–II provides that an injury determination shall involve examination of factors that may indicate injury to the domestic industry, “…. taking into account all relevant facts, including the volume of dumped imports, their effect on prices in the domestic market for like articles and the consequent effect of such imports on domestic producers of such articles….” In considering the effect of the dumped imports on prices, it is considered necessary to examine whether there has been a significant price undercutting by the dumped imports as compared with the price of the like article in India, or whether the effect of such imports is otherwise to depress prices to a significant degree or prevent price increases, which otherwise would have occurred, to a significant degree.

49. As regards the impact of dumped imports on the domestic industry, Para (iv) of Annexure-II of Anti-dumping Rules states as follows: “The examination of the impact of the dumped imports on the domestic industry concerned, shall include an evaluation of all relevant economic factors and indices having a bearing on the state of the industry, including natural and potential decline in sales, profits, output, market share, productivity, return on investments or utilization of capacity; factors affecting domestic prices, the magnitude of the margin of dumping; actual and potential negative effects on cash flow, inventories, employment, wages, growth, ability to raise capital investments.”

L. Volume Effect of the Dumped imports on the Domestic Industry

a) Demand and Market Share

50. Authority has defined, for the purpose of the present investigation, demand or apparent consumption of the product in India as the sum total of domestic sales of the domestic industry, estimated sales of other domestic producers as given by the petitioner and imports from all sources. The demand so assessed is given in the table below:

The aforesaid information shows that the demand of the subject goods in the domestic market has consistently increased up to 2013-14 and then declined marginally during the POI, but further increased during Post POI. While the share of the domestic industry in demand has gone up during the POI and Post POI as compared to the base year, that of the subject country has remained more or less at the same level.

Import volumes and market share

51. The Authority has relied upon the import information obtained from DGCI&S for the purpose of this final finding. Import volume from subject country and other countries and the dumped imports from subject country in relation to production and sale of the domestic industry, has been as under:-

The aforesaid information shows that the imports from China PR almost remain the sole source for India. The imports from China have declined during the POI, but further increased during Post POI and it commands a significant share in the domestic demand.

M. Price Effect of the Dumped imports on the Domestic Industry

52. With regard to the effect of the dumped imports on prices, the Designated Authority is required to consider whether there has been a significant price undercutting by the dumped imports as compared with the price of the like products in India, or whether the effect of such imports is otherwise to depress prices to a significant degree or prevent price increases, which otherwise would have occurred, to a significant degree. The impact on the prices of the domestic industry on account of the dumped imports from the subject country has been examined with reference to the price undercutting, price underselling, price suppression and price depression, if any. For the purpose of this analysis the cost of production, Net Sales Realization (NSR) and the Non-injurious Price (NIP) of the Domestic industry have been compared with the landed cost of imports from the subject country.

Price suppression and depression effects of the dumped imports:

53. The price suppression and price depression effect of the dumped imports has also been examined with reference to the cost of production, net sales realization and the landed values of the subject goods from the subject country in relation to injury period.

From the above information, the Authority notes that there is consistent increase in the cost of sales of the domestic industry since 2012-13 upto POI but declined during Post POI. Similar is the trend in the selling price of the domestic industry. During the POI the proportion of increase in selling price is more than the proportion of increase in the cost of sales, but during the Post POI, the proportion of decline in selling price is more than the proportion of decline in the cost of sales. Thus, in the Post POI there is price suppression.

Price undercutting and Price underselling effects Price Undercutting

54. While working out the net sales realization of the domestic industry, the rebates, discounts and commissions offered by the domestic industry and the central excise duty paid have been deducted.

From the aforesaid information, the Authority notes that the price undercutting effect of dumped imports from the subject country on the domestic price during POI and Post POI without ADD is negative.

Price Underselling

55. For the purpose of price underselling the landed prices of the imports from subject country based on DGCI&S data have been compared with the Noninjurious price of the domestic industry. It shows that the underselling effect is negative during the POI.

N. Examination of other Economic Parameters of Domestic Industry Sales volumes, Production, Capacity and Capacity Utilization

56. The Sales, Production, Capacity and Capacity Utilization details are as follows:

It is noted that while capacity of Production has remained constant, production, capacity utilization and sales have increased during POI and Post POI.

Inventories:

57. Data relating to inventories shows as follows:

From the aforesaid information, the Authority notes that the average inventories have declined during the POI as compared to the base year, but increased during Post POI. Moreover, the average inventory remains significant throughout the injury period.

Profits and actual and potential effects on the cash flow

58. The Profits and actual and potential effects on the cash flow are as follows. With regard to Profit/Loss and cash flow, it is observed that the profitability of domestic industry in terms of profit before tax and interest and cash profit has increased in the POI as compared to base year. During the Post POI as compared to the POI, all the above stated parameters show declining trend.

Employment, and Wages

59. The data relating to employment and wages show as follows:

It is seen that employment position has remained more or less at the same level throughout injury period including POI and Post POI, whereas wages have increased during the POI and Post POI as compared to the base year.

Productivity

60. The data relating to productivity show as follows:

Authority notes that productivity per day of the domestic industry during POI has decline as compared to base year but increased during Post POI.

Magnitude of dumping

61. It is observed from the section pertaining to Dumping Margin above that dumping margin in respect of the imports of the subject goods from the subject country is positive in the POI.

Growth

62. It is noted that the domestic industry showed growth in terms of almost all the price parameters till the POI, but during the Post POI the same parameters show negative growth.

Ability to raise funds:

63. It is noted that the domestic industry has not enhanced its capacity of production.

O. Magnitude of Injury and Injury Margin

64. The non-injurious price of the subject goods produced by the domestic industry as determined by the Authority has been compared with the landed value of the exports from the subject country for determination of injury margin. The injury determined by the Authority is positive on month to month basis during the POI. The injury margin thus determined for the POI is as under:

Conclusion on material injury

65. It is noted that during the POI, as compared to the base year, the performance of the domestic industry has improved in terms of production, sales volumes, market share, capacity utilisation, profit, cash profit and return on capital employed. This improvement is obvious, since the base year of the present MTR investigation constitutes a major part of the POI of the original investigation, in which the injury caused by the dumped imports of subject goods from the subject country was established by the Authority and imposition of the anti-dumping duty was recommended. The improvement demonstrated in the performance of the domestic industry after the POI of the original investigation was obviously the result of the anti-dumping duty imposed by the Central Government. However, despite the anti-dumping duty in force, the dumping margin and injury margin are found to be positive in the POI of the present MTR investigation, thereby signifying that the dumping and injury may intensify if the anti-dumping duty is revoked.

P. Other Known Factors & Causal Link

66. Having examined the existence of material injury, volume and price effects of dumped imports on the prices of the domestic industry, in terms of its price underselling and price suppression and depression effects, other indicative parameters listed under the Indian Rules and Agreement on Anti- Dumping have been examined by the Authority to see whether any other factor, other than the dumped imports could have contributed to injury to the domestic industry, as follows:-

(a) Volume and prices of imports from third countries

67. The Authority notes that during POI, import of the subject goods from subject country is the sole source of imports. Therefore, the imports from other countries cannot be considered to have caused injury to the domestic industry.

(b) Contraction of demand and changes in the pattern of consumption

68. The Authority notes that there is no contraction in the demand during injury period except a slight fall during the POI as compared to the immediate preceding year.

(c) Developments in technology:

69. The Authority notes that none of the interested parties have furnished any evidence to demonstrate significant changes in technology that could have caused injury to the domestic industry.

(d) Trade restrictive practices of and competition between the foreign and domestic producers

70. The Authority notes that the subject goods are freely importable. The domestic industry is the major producer of the subject goods. Domestically produced subject goods are competing with that imported from subject country at dumped prices.

(e) Export performance of the domestic industry:

71. The table below summarizes the performance of the domestic industry in respect of exports made by them:

The Authority notes that the export volumes of the domestic industry have declined. However, the price and profitability in the domestic and export market has been segregated by the Authority for the purpose of present injury assessment.

(f) Productivity of the Domestic Industry

72. Productivity of the domestic industry increased consistently.

Q. Likelihood of continuation or recurrence of injury

Submissions made by the petitioner and other interested parties

73. Following submissions have been made by the petitioner and other interested parties:

i. Likelihood of continuation or recurrence of dumping and injury’ is a matter of examination of an investigation under Rule 23 (1B) i.e. sunset review and not a subject matter of an MTR. The moot point in an MTR is the satisfaction of the point that the injury to the domestic industry is not likely to continue or recur, if the said anti-dumping duty is removed or varied and is therefore no longer warranted.

ii. There is no continued injury to the domestic industry. Domestic industry is getting undue benefit of AD duties in force. Therefore, the duty should be revoked.

iii. As the injury to the domestic industry is not likely to continue or recur, if the said anti-dumping duty is removed or varied and is therefore no longer warranted.

Submissions made by the Domestic Industry

74. Following submissions have been made by Domestic industry:

i. In a midterm review investigation, the Designated Authority is required to consider the likely situation when an anti-dumping duty is withdrawn. Current performance alone is insufficient to conclude whether the antidumping duty can be withdrawn.

ii. Absence of continued injury does not imply absence of likelihood of recurrence of injury in the event of withdrawal of anti dumping duties. The anti dumping law mandates that the Authority is compulsorily required to examine if there is any likelihood for the continuation or recurrence of injury if the said anti-dumping duty is removed or varied and whether the changed circumstances stated are of lasting nature.

iii. The language of the rules concerning sunset review and midterm review has been deliberately kept different so as to emphasize more on the cautiousness of establishing the need for withdrawal. The emphasis on word “not” likely in Rule 23 (1A) of AD Rules, signifies a higher and stringent obligation while examining premature withdrawal of anti dumping duty.

iv. The Designated Authority is required to consider and determine whether anti dumping duty is required to be extended further in a sunset review, while in a Mid Term Review, the Designated Authority is required to consider and determine whether there is sufficient justification for withdrawal of anti dumping duty at premature stage. Extension of duty is substantially different from withdrawal of duty, the parameters and obligations in Mid Term Review are quite different from parameters and obligations at the time of Sunset Review. The petitioner has practically provided no information to establish “need for withdrawal” of the duty.

v. Even, for modification of anti dumping duty, the applicants have to establish that changes in circumstances are of lasting nature. Perusal of the petition makes it evident that petition does not even deal with likely dumping and injury. Domestic industry submits that this information and claim is grossly insufficient for withdrawal of the anti dumping duty at such a stage. The petitioner must establish that there is no justification for continued imposition of anti dumping duty.

vi. Since the requirement at the stage of Midterm Review is “no likelihood of injury” in the event of withdrawal of anti-dumping duty, mere argument relating to improvement in performance of the domestic industry alone is insufficient ground for withdrawal of anti-dumping duty. If the petitioner has argued no injury to the domestic industry, the petitioner is required to thereafter establish that the injury to the domestic industry is unlikely in the event of withdrawal of anti-dumping duty.

vii. The whole purpose of imposition of Anti-dumping duty is to prevent dumping of the product and injury to the domestic industry. Therefore, no injury to the domestic industry and no dumping of the product is the normal consequence after imposition of Anti-dumping duty. When the objective of imposition of duty is to eliminate dumping and injury, lack of dumping or injury in review period, therefore, cannot become grounds for withdrawal of duty. This is one of the reasons that that the Rule 23 (1A) mandates Authority to examine the effect of the revocation of duty on domestic industry instead of merely focusing on the present situation of domestic industry. The petitioner must establish that there is no justification for continued imposition of anti dumping duty.

viii. In a midterm review investigation, it is insufficient for the exporter to establish that the product was not being dumped in the present review period. The exporter is required to establish that there was no dumping and there was no likelihood of dumping of the product in the event of modification or withdrawn of anti dumping duties.

ix. Similarly, mere non-existence of injury to the domestic industry is grossly insufficient. The exporter is required to establish that there is no likelihood of injury in the event of modification or withdrawn of anti dumping duties.

x. The Designated Authority recommended anti dumping duty ranging from US$ 270/MT to US$ 460/MT. The domestic industry, however, never added the full quantum of anti dumping duty in their prices. In fact, on its part, the domestic industry has charged reasonable price for the product and has not changed its price in tandem with import price. However, should the present anti dumping duty be revoked at a premature stage, the domestic industry is likely to suffer heavily, as the consumers are unlikely to pay a reasonable price to the domestic industry.

xi. The domestic industry submits comparison of cost of production and selling price shows that cost of production has remained at the same level when compared with base year while the selling price of the domestic industry has remained above the levels reflected in the base year. Therefore, it would appear that imports did not cause any price suppression or depression effect. However, withdrawal of anti dumping duty is likely to suppress the domestic industry prices. This gets established by the facts within the POI itself. On a closer month by month analysis of the data within the POI shows that within the period of investigation, there was a steep decline in the selling price without a proportionate decline in cost.

xii. The sole exporter, i.e., Tsaker Chemical Group Ltd who participated in the original investigation has very high export orientation. According to the industry report of Frost Sullivan (the ‘Industry Report’), the Group was the largest DSD Acid producer in the world, accounting for 57.4% of the world’s market share in 2014. By maintaining the gross profit margin of DSD Acid and other dye intermediates at a reasonable level with a slight increase, the Group took the initiative in reducing prices to further expand the Group’s influence in the market. The Group has started to produce new products such as PNT, ONT, MNT and OT since February, 2015. The production of PNT is aimed at achieving the strategic objective of maintaining a stable raw material supply for its key product, which is DSD Acid.

xiii. The above clearly reflects that the exporter is self sufficient and is willing to reduce prices in order to gain hold and maintain its impressive share in the world market as the largest producer of DSD Acid i.e. the product under consideration. Hence, the dumping and injury is likely to recur at aggravated level in case the existing anti-dumping duties are revoked at this stage. Further there are other producers/manufacturers who have a high export percentage and whose operations are spread globally. This indicates a clear likelihood of enhanced dumping of the product under consideration in India and consequent injury to the domestic industry in the event of revocation of existing duties.

xiv. There is indication of expansion of capacities for DASDA in the Tsaker Chemical Group Ltd’s Interim Report 2015. In its relevant part it provides as follows:

We are also preparing to construct a new production plant in Dongying, Shandong Province. Our planned designed annual production capacities, as of the end of 2015, for DSD Acid, DMSS and mononitrotoluene are estimated to be approximately 55,000 tonnes, 4,500 tonnes, and 80,000 tonnes, respectively, upon us leasing certain additional assets to complete the capacity expansion of our Dongao Production Plant.

xv. The above clearly indicates excess capacities, especially in the view of the fact that the demand in Indian is to the tune of 4000-7500 MT only. The capacity with producers in China are far beyond the demand in India, they can easily eat up the entire domestic demand. Therefore, in view of huge capacities and high export orientation, in any event of revocation of anti dumping duty, the volume of imports is bound to increase further.

Examination by the Authority

75. Rule 23 of Anti-dumping Rules requires the Authority to examine the need for continued imposition of the duty from time to time. In a midterm review, the Authority has to determine whether the subject goods are continuing to enter the Indian market, from the subject country, at dumped prices, causing injury to the domestic industry or are likely to be exported at dumped prices from the subject country, indicating likelihood of recurrence of injury to the domestic industry, in the event of withdrawal of the anti-dumping duty. Thus, in a midterm review, likelihood analysis of dumping and injury becomes a necessity when the dumping margin and injury margin are determined as negative during the POI of the investigation. The objective of imposition of the anti-dumping measures is to arrest the injurious effect of dumping of the subject goods. Thus, an effective anti-dumping measure would obviously arrest the injurious effect of dumping. But, in the present case, despite imposition of the anti-dumping duty, the dumping of subject goods from the subject country has continued unabated, causing injury to the domestic industry. This is evidenced by the positive dumping margin and injury margin determined by the Authority. Thus, the present case being a case of continued dumping and injury, the Authority notes that any analysis to establish likelihood of dumping and injury, in a situation of absence of the anti-dumping duty, is not called for. Nevertheless, the Authority has caused the following analysis to establish the likelihood of continuation/intensification of dumping and injury:

Volume of Exports: Post- POI

76. In order to examine, the likelihood of injury to the domestic industry due to dumping of the subject goods from the subject country, the Authority has undertaken analysis of the volume of exports of the subject goods to India during the post-POI period as well. The Authority notes that the volume of the exports from subject country to India during the post POI on the basis of DGCI&S data was 2469 MT (Annualized 4939 MT), showing 24% growth. This trend indicates that there is significant rate of increase of imports into India during post POI despite the ADD in force.

Market share of Subject Country in the Indian market

77. The Authority notes that the market share of the subject country during the POI & Post POI has remained at the same level as that of the base year despite the ADD in force. Moreover, the market share of the subject country has remained significant.

Attractiveness of Indian market

78. The positive dumping margin and injury margin during the POI and increasing imports of subject goods from the subject country with significant market share being held by the subject country’s goods in the Indian market indicate attractiveness of Indian market for the Chinese exporters.