Incentives to exporters under various schemes to touch Rs.1.2 lakh crore: Prabhu

The Dollar Business Bureau

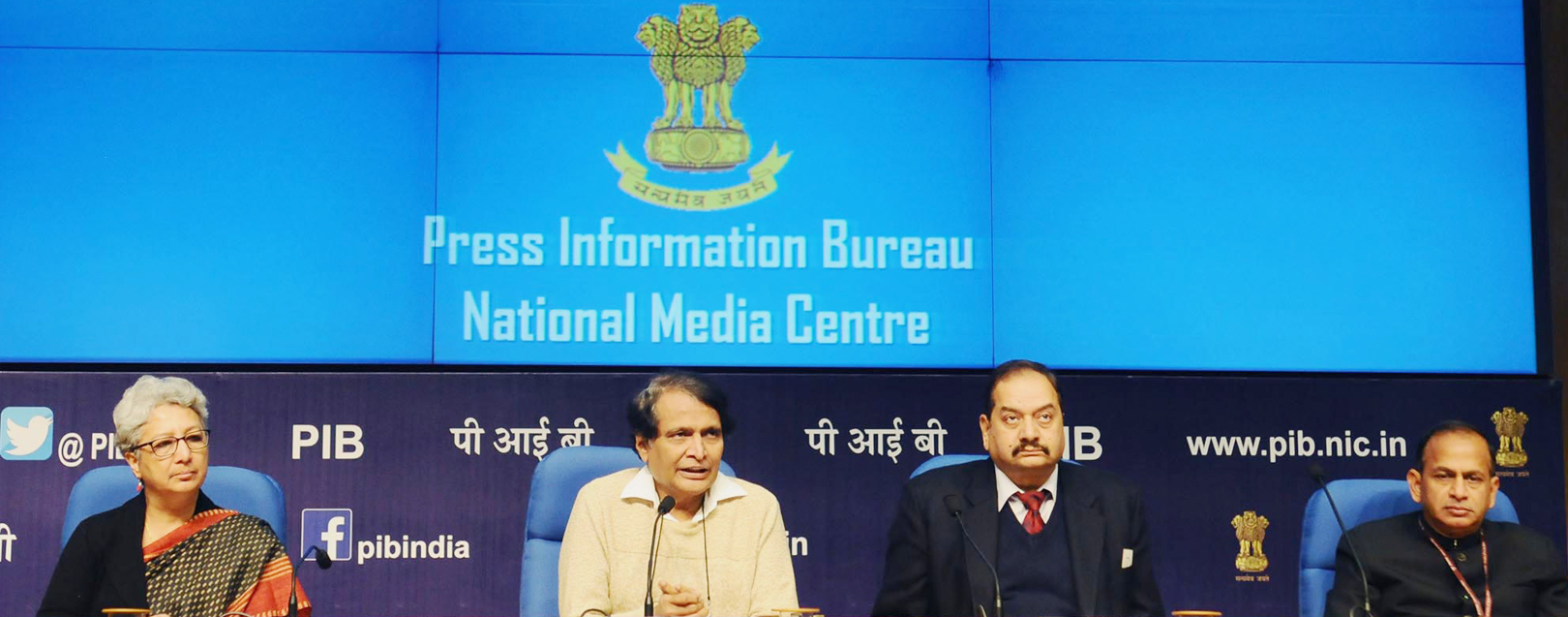

Commerce and Industry Minister Suresh Prabhakar Prabhu said on Thursday that financial incentives for exporters through various export promotion schemes such as Merchandise Exports from India Scheme (MEIS) is expected to cross Rs. 1 lakh crore in the fiscal 2017-18.

“Incentives to exporters under various schemes like the popular MEIS, SEIS, Advance Authorisation and the Export Promotion Capital Goods (EPCG) would cross Rs.1,00,000 crore and touch Rs.1,20,000 crore or even more depending on the performance of exports in the last two months of the fiscal,” Prabhu said while addressing a press conference.

“You heard our Finance Minister say (in his Budget speech) that exports this year could have a growth of 15% over the previous year. A good export performance means more outgo on export promotion schemes,” he added.

In 2016-17, the Director General of Foreign Trade (DGFT) has said that the outgo was Rs.76,980 crore on exports promotion schemes.

The Ministry of Commerce has also asked a hike in rates of support for exporters under the interest subvention scheme to 5% from the current 3%, according to DGFT Alok Chaturvedi.

Interest subvention is the subsidy on interest given by banks to exporters on loans that are in turn compensated by the Government.

Prabhu, while explaining his previous comment on the growth of foreign trade to $1 trillion in the next 7-8 years, said around half of it would come from exports of merchandise and the remaining half from services exports.

“The multi-pronged strategy for export growth will have a strong focus on increase in services exports, which was rising at a rate faster than merchandise exports,” he said.

Prabhu also defended the Government’s measure of increasing the customs duty on various products and added that it doesn’t amount to protectionism and customs duties are a legal tool used in international trade.

“Increasing customs duty is not protectionism... It is an intervention allowed in the World Trade Organisation (WTO),” the minister said.

In the Union Budget, announced last week, the Government has proposed higher customs duty on several products including mobile phones, electronics, some automobile parts, capital goods, imitation jewellery, footwear, edible oils and juices.

to success.

to success.