Tyre manufacturers offer to buy natural rubber from Indian farmers

Average production cost of natural rubber in India stood at around Rs.170 per kg in 2011-12, much higher than prevailing market prices

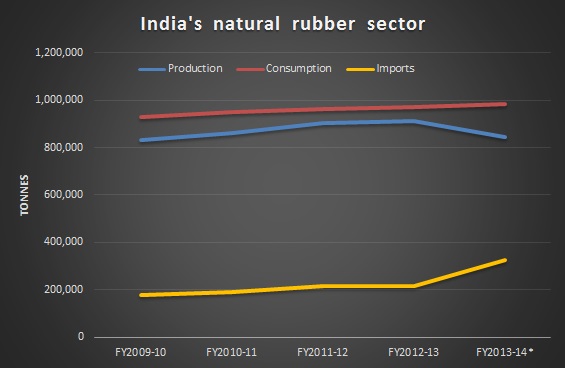

Average production cost of natural rubber in India stood at around Rs.170 per kg in 2011-12, much higher than prevailing market pricesAround 17 tyre companies in India have agreed to buy raw rubber from within India at international prices plus the prevalent import duty to help farmers offload their stock and continue tapping. Rubber prices in India have been on a decline due to influx of imported rubber, which has grown from around 217,364 tonnes in 2012-13 to around 325,190 tonnes in 2013-14, an increase of almost 50%. Meanwhile, rubber production in India has is on a decline, dropping around 8% from about 913,700 tonnes to around 844000 tonnes in FY2013-14, primarily due to higher wages. After the 15% y/y decline in domestic prices seen in 2013-14, the government took several steps to curtail further decline. Measures included increase in import duty on dry forms of rubber from “20 percent or Rs.20 per kg whichever is lower” to“20 percent or Rs.30 per kg whichever is lower” and inclusion of natural rubber in the negative list of Free Trade Agreements (FTAs) with major natural rubber producing countries and under India-ASEAN Free Trade Agreement. However, prices continued to drop, declining by around 6% again y/y to around Rs. 166 per kg in FY2013-14. A sharper decline to close to Rs.100 per kg in international prices this year prompted the intervention of the Chief Minister of Kerala, the largest rubber producing state of India which accounts for around 90% of total natural rubber production in the country. The Kerala CM had urged tyre manufacturing companies to procure rubber from Indian farmers to prevent the crisis faced by farmers. According to ASSOCHAM, around 17 tyre companies have agreed to buy the entire local production available until March 2015 at a price that is equal to the international price of rubber plus the import duty and state taxes.

* Provisional. Source - Rubber Board

* Provisional. Source - Rubber BoardCurrently, international prices stand at around Rs. 106 per kg, compared to domestic prices of around Rs.130 per kg. However, prices are likely to stabilise if companies procure rubber with import duties and taxes. ASSOCHAM has welcomed the move and had said that something similar could be done for other commodities as well. D.S. Rawat, Secretary General, ASSOCHAM, said, “ASSOCHAM considers that this development should set an example particularly for other domestically produced commodities like cotton where the falling price of cotton would benefit the textile industry as well as consumers but would harm the cotton farmers.” He added, “As the tyre industry has demonstrated that there is a national stake in keeping the price above cost to the farmers which the industry leaders must take into their planning.”

This article was published on December 24, 2014.

to success.

to success.