India plans Blue Revolution to boost seafood production, exports

Satyapal Menon | @TheDollarBiz

Fishermen haul in a catch of sardine from wooden boats during deep sea fishing trip in the Arabian Sea near Kannur, Kerala, India

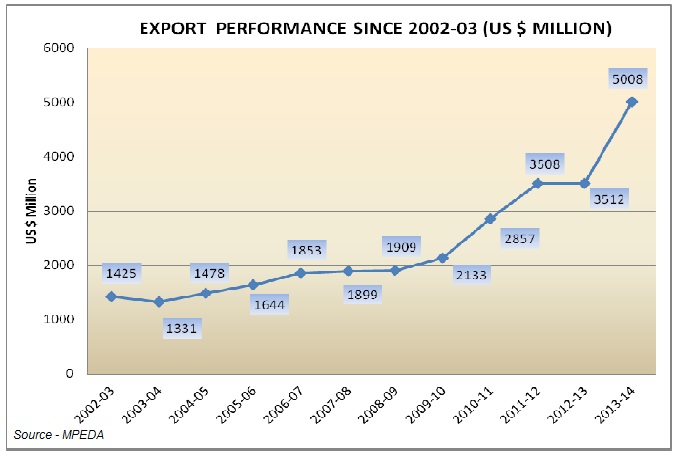

Fishermen haul in a catch of sardine from wooden boats during deep sea fishing trip in the Arabian Sea near Kannur, Kerala, India Beginning from the green revolution, India has had a white revolution with focus on increasing milk production in the country, and here comes the latest - Blue revolution. Even before attempting to figure what exactly this means, the government plans to deploy measures to net in more fish – in terms of not just the catch, but also dollars - than we have done till date. In fact, India has been having quite a considerable haul of seafood over the years. There is always an ocean to be tapped, and this is precisely what India’s Agriculture Minister Radha Mohan Singh meant when he stated that the country is poised to usher in a Blue Revolution to tap the huge potential of aqua resources in the country. Speaking on the occasion of World Fisheries Day on November 21, the minister said, “India has a vast area of unutilised and untapped Inland water resources and is short of for quality fish seed and formulated fish feed and government will focus on filling the critical gaps. Fisheries can be an engine of growth due to high growth rates of 7.9% in Inland fisheries last year.” He added that India ranks world number two in fish production and is also the second highest aquaculture country in the world. “India with a fishermen population of 14.5 million and a coastal line of 8,118 kilometers can rise to be a major player in the world fisheries. India also has a fleet of 200,000 fishing vessels and last year has exported fish worth $5 billion,” he said. According to India’s Marine Products Export Development Authority (MPEDA), India’s seafood exports jumped to a record high in FY2013-14, reaching almost one million tonne and worth over $5 billion, which is almost 43% higher than seafood exports worth $3.5 billion in the previous year. Driven mainly by demand in USA and Southeast Asia, the unit value of India’s overall seafood exports jumped around 34.5% from $3.78 per kg to over $5 per kg. Frozen shrimp recorded the highest increase in value terms, with exports valued at $3.2 billion in FY2013-14, up around 78% from $1.8 billion in the previous year, while the unit value of frozen shrimps surged to $10.65 per kg, up 35% from $7.89 per kg in FY2012-13. Vannamei shrimp exports registered tremendous growth of 92% from around $731 million in FY2012-13 to almost $2 billion in FY2013-14. However, frozen fish exports have declined from $708.63 million in FY2012-13 to $617.6 million in FY2013-14. In terms of quantity, shrimp exports doubled from 9,706.36 tonnes in FY2012-13 to 19,368.30 tonnes in FY2013-14, while frozen fish exports decreased from 3,43,876 tonnes to 3,24,359 tonnes in FY2013-14. USA is the largest market (95,927 tonnes) for frozen shrimp exports in terms of quantity followed by EU (73,487 tonnes), Southeast Asia (52,533 tonnes) and Japan (28,719 tonnes). However, in terms of value of exports, Southeast Asia accounts for the bulk of Indian marine products with a share of around 26.4%, USA is the second largest (around 25.7%), followed by EU (20.24%), Japan (8.2%), China (5.85%) and Middle East (5.45%). India is targeting $6 billion worth seafood exports in FY2014-15, a jump of around 20% y/y. As a part of short term goals, the government plans to impart training to the fishing community to improve productivity. India also plans to double seafood exports to $10 billion by 2020, and the launch of the Blue Revolution is expected to play a key role in it. However, India does not have a consistent Deep Sea Fishing policy and faces increasing phyto-sanitary scrutiny in importing countries. Addressing these gaps and encouraging aquaculture will be crucial to help achieve the targets.

He added that India ranks world number two in fish production and is also the second highest aquaculture country in the world. “India with a fishermen population of 14.5 million and a coastal line of 8,118 kilometers can rise to be a major player in the world fisheries. India also has a fleet of 200,000 fishing vessels and last year has exported fish worth $5 billion,” he said. According to India’s Marine Products Export Development Authority (MPEDA), India’s seafood exports jumped to a record high in FY2013-14, reaching almost one million tonne and worth over $5 billion, which is almost 43% higher than seafood exports worth $3.5 billion in the previous year. Driven mainly by demand in USA and Southeast Asia, the unit value of India’s overall seafood exports jumped around 34.5% from $3.78 per kg to over $5 per kg. Frozen shrimp recorded the highest increase in value terms, with exports valued at $3.2 billion in FY2013-14, up around 78% from $1.8 billion in the previous year, while the unit value of frozen shrimps surged to $10.65 per kg, up 35% from $7.89 per kg in FY2012-13. Vannamei shrimp exports registered tremendous growth of 92% from around $731 million in FY2012-13 to almost $2 billion in FY2013-14. However, frozen fish exports have declined from $708.63 million in FY2012-13 to $617.6 million in FY2013-14. In terms of quantity, shrimp exports doubled from 9,706.36 tonnes in FY2012-13 to 19,368.30 tonnes in FY2013-14, while frozen fish exports decreased from 3,43,876 tonnes to 3,24,359 tonnes in FY2013-14. USA is the largest market (95,927 tonnes) for frozen shrimp exports in terms of quantity followed by EU (73,487 tonnes), Southeast Asia (52,533 tonnes) and Japan (28,719 tonnes). However, in terms of value of exports, Southeast Asia accounts for the bulk of Indian marine products with a share of around 26.4%, USA is the second largest (around 25.7%), followed by EU (20.24%), Japan (8.2%), China (5.85%) and Middle East (5.45%). India is targeting $6 billion worth seafood exports in FY2014-15, a jump of around 20% y/y. As a part of short term goals, the government plans to impart training to the fishing community to improve productivity. India also plans to double seafood exports to $10 billion by 2020, and the launch of the Blue Revolution is expected to play a key role in it. However, India does not have a consistent Deep Sea Fishing policy and faces increasing phyto-sanitary scrutiny in importing countries. Addressing these gaps and encouraging aquaculture will be crucial to help achieve the targets.

This article was published on November 24, 2014.

to success.

to success.