JN Port aims to be among the top 10 global container ports by 2020-21

Bidhu Bhushan Palo | The Dollar Business

Tariff Authority for Major Ports (TAMP) regime inhibited the growth of major ports, says N.N. Kumar, IRS, Chairman, JNPT

Tariff Authority for Major Ports (TAMP) regime inhibited the growth of major ports, says N.N. Kumar, IRS, Chairman, JNPTLocational advantage, growing demand and policy changes will be the fulcrum around which India’s largest container port, the Jawaharlal Nehru Port, aims to transform and grow to one of the top 10 global container ports in the next five years. Recently, the government announced the establishment of the Special Economic Zone (SEZ) at Jawaharlal Nehru Port Trust (JNPT) at a cost of around Rs.4,000 crore in phase 1. The project will develop free trade warehousing zones for engineering goods sector, textile and other sectors, says the government. The SEZ could also play a big role in boosting India’s exports, says JNPT. The proposed SEZ is conceived to have all the integrated facilities and shall be a Port City in itself along the similar lines of other world class Port-based SEZs, N.N. Kumar, IRS, Chairman, JNPT, told The Dollar Business. “It has an excellent connectivity via Mumbai Goa Highway (NH4B) and SH 54(Port Road) with upcoming direct rail connectivity with Dedicated Freight Corridor (DFC) and Delhi Mumbai Industrial Corridor (DMIC). The proposed SEZ, apart from having a huge socio-economic advantage, shall ensure promotion of export-based industries leading to assured throughput for the Port,” he added. Recently, the Cabinet Committee on Economic Affairs (CCEA), chaired by the Prime Minister Narendra Modi, has approved the development of an additional liquid bulk terminal at JNPT at an estimated cost of around Rs.2,496 crore.The project would enhance the liquid bulk cargo handling capacity of JNPT from the existing 5.5 million tonnes per annum (MTPA) to 20.5 MTPA by 2017-18 when Phase-I is expected to be commissioned. Capacity is expected to increase further to 32.1 MTPA with the commissioning of Phase-II by 2025-26. This will facilitate industrial growth in the hinterland and also reduce transaction cost for users who are suffering high waiting time in the existing berths, says the government.

Source – JNPT

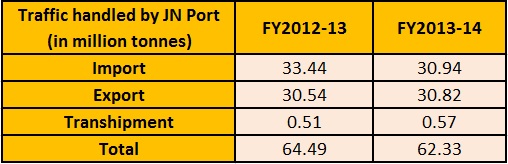

Source – JNPTJN Port is India’s largest major port in container handling with a market share of almost 56%. In FY2013-14, the Port handled 4.16 million TEUs (twenty-foot equivalent units) of container traffic, accounting for around 30.94 million tonnes of imports and 30.82 million tonnes of exports from India. However, JN Port ranks low among global ports. According to the World Shipping Council (WSC), JN Port is ranked 34th in the list of top Container ports when measured in volume handled. The list has seven Chinese ports in the top ten, and the Colombo Port of Sri Lanka is ahead of JN Port at no.33. This is partly because of lack of facilities. “As the busiest gateway and hub in India, it (JNPT) has been constrained in the past by lack of facilities, which has impacted trade,” says Kumar. Due to capacity constraints at JNPT, some containers are being transshipped from China, Singapore, Sri Lanka and even Dubai which have bigger container ports, and the Indian traders have to pay the extra cost of this transshipment. “This is why it is necessary to have a big world-class container port so that we can save on transshipment cost as well as attract mother vessels to India,” says Kumar. In India, container volumes are expected to witness an exponential growth and building new container terminals will help meet the growing global demand as well. “To become an exporting nation with a strong manufacturing base, we need to build port, airport, roads, rail network all of international class and built seamlessly entire through the system,” Kumar says. Building of greater capacity is part of JNPT’s long-term vision. There is a plan to build a fourth container terminal, which according to studies would enable the Port to handle container traffic to the tune of 10 million TEUs by 2020-21. “With this capacity addition and 330 m standalone container terminal, JN Port will be able to handle 10 million TEUs, and place itself among the top 10 global container ports,” Kumar told The Dollar Business. Disbanding the Tariff Authority for Major Ports (TAMP) is also expected to boost the growth of major ports in India. According to sources, the government is likely to revise the TAMP policy aimed at creating a level playing field for all major and non-major ports. “This is a very positive development for the industry. Actually there is no need for regulation of tariff rates at major ports but balanced pricing between major and non-major ports,” says Kumar.

This article was published on January 14, 2015.

to success.

to success.