India’s oilmeal loses major share in Iran market

The Dollar Business Bureau | @TheDollarBiz

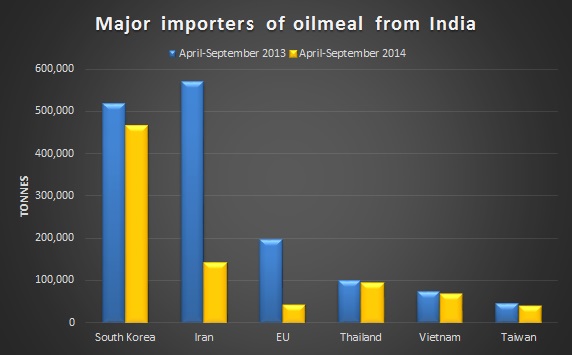

High domestic prices and prospects of a reduced crop this year have virtually knocked India out of key oilmeal destinations in Iran, EU and Southeast Asia. According to the Solvent Extractors Association of India (SEA), India’s oilmeal exports have plunged to 950,599 tonnes during April – September 2014, down 43% from around 1.65 million tonnes exported in the same period last year. In September 2014, total oilmeal exports from India stood at just 82,749 tonnes, down 73% from 301,717 tonnes shipped in September 2013. While domestic prices remain high, conditions have changed dramatically in the international markets in the last few months. Some sanctions on Iran have been lifted by Western countries and talks are on to lift all sanctions. This has freed Iran, a major oilmeal market for India, to buy from other competitively priced sources such as Argentina, Brazil and USA. Together, these three countries account for over 80% of global soybean oilmeal exports compared to India’s share of around 3%, according to USDA. As a result, Iran’s oilmeal imports from India in the first half of FY2014-15 declined over 75% to 142,357 tonnes compared to 571,171 tonnes in the corresponding period last year. SEA’s Executive Director Dr. B.V. Mehta told The Dollar Business that earlier Iran was willing to buy Indian oilmeal at high prices but has now switched to other countries in the Americas after sanctions were lifted. “High prices have made Indian oilmeal uncompetitive in the international market,” Dr. Mehta says. The average FOB price of soybean oilmeal, which constitutes around 50% of India’s exports, surged late last year, from around $510 per tonne in September 2013 to $710 per tonne in May 2014, an increase of almost 40%. However, the spike in prices was during a time when Iran was ready to pay a premium. But now, exports to Iran are down and the reluctance of Indian farmers to lower prices has led to a dip in exports to other key markets as well: EU (down 78.5%), Indonesia (down 24.8%), and South Korea (down 10.35%). Meanwhile, China's oilmeal exports are growing over continued strength against Indian oilmeal in Southeast Asia. Dr. B.V. Mehta expects a turnaround in a couple of months when the kharif and rabi crops will be harvested until February 2015. “Exports will recover once Indian oilmeal prices drop to international prices and become competitive again,” he told The Dollar Business.

This article was published on October 13, 2014.

to success.

to success.